Trouble Ahead: Cash Shortage and Economic Crisis in Afghanistan

How Much CashMoney in physical form such as banknotes and coins. More Fell in Taliban Hands?

When the U.S.-led military coalition took over Afghanistan in 2001, the Taliban looted commercial banks, the branches, and the head office of Da Afghanistan Bank (DAB), the country’s central bank. The Taliban stole about USD6 million in cash reserves from the DAB, press reports indicate.

Reuters and Al Jazeera have analysed the DAB’s 2020 financial statements to assess how much cash might have fallen into Taliban hands. As of December 2020,

- CurrencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation reached 307.29 billion afghanis (AFN), or USD3.98 billion at the then-prevailing exchange rateThe rate at which one currency will be exchanged for another. More of 77 AFN/USD (DAB 2021: 22).

- The DAB had AFN34.16 billion in foreign currency cash reserves, mostly U.S. dollars (DAB 2021: 22).

- The DAB’s vaults also contain 2,000-year-old gold jewellery, ornaments, and coins, known as the Bactrian Treasure, presumed lost until 2003 when they were found in a secret vaultSafe; strong room. A place reinforced with special security measures where high-value objects and documents are safeguarded. In central banks, banknotes and other objects are safeguarded in vaults. More in the DAB’s basement. There were AFN12.57 billion in the DAB’s vault inside the presidential palace, comprising gold bullion (AFN5.86 billion) and bars and silverWhite, shiny, and soft metal used to mint coins or medals. More coins for AFN6.71 billion (DAB 2021: 29).

However, most DAB assets and hard currency claims are deposited in the New York Federal Reserve (USD7 billion, according to former DAB governor Ajmal Ahmady), the Bank of International Settlements, and other international institutions. “We can say the accessible funds to the Taliban are perhaps 0.1-0.2% of Afghanistan’s total international reserves. Not much,” said Ahmady.

Cutting the Taliban Regime Off Global LiquidityDescribes the extent to which assets or rights can be converted into cash without causing a significant decrease in the asset’s price. Accordingly, liquidity is often inversely proportional to the profitability of the asset and involves the trade-off between the selling price and the time needed to convert it to cash. In finance, cash is considered the most liquid asset and cash is sometimes used as a synonym for liquidity (e.g. cash reserves; cash pooling…). More

Soon after the fall of Kabul, Afghanistan started being cut off from the global financial system.

- On August 17, the Biden administration froze nearly USD9.5 billion in DAB assets to prevent the Taliban from accessing them, as the group remains on the U.S. Treasury’s sanctions designation list. As a comparison, in 1999, the Treasury Department froze USD217 million to pressure the Taliban to turn over Osama bin Laden.

- That day, Josep Borrell, the European Union foreign policy chief, said that “no [E.U.] payments are going on to Afghanistan by now. No payments of development assistance,” yet “humanitarian help will continue.”

- The World Bank evacuated its Afghanistan staff to Pakistan last week.

- U.S. money-transfer services Western Union and Moneygram have suspended payments into Afghanistan. In 2020, personal remittancesMoney sent home from emigrants working abroad. More to Afghanistan amounted to USD789 million in 2020, nearly 4% of the country’s GDP.

“The Taliban got rid of the U.S., but not the dollarMonetary unit of the United States of America, and a number of other countries e.g. Australia, Canada and New Zealand. More,” wrote Daniel Moos, a Bloomberg opinion columnist.

IMF: under Taliban rule, Afghanistan “cannot access SDRs”

On August 18, the International Monetary Fund (IMF) announced it would block Afghanistan’s access to international reserve assets. The IMF had recently approved a USD650 billion liquidity injection in the form of special drawing rights (SDRs) that its member countries can exchangeThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More for cash to pay debt or fund pandemic health spending.

Afghanistan would have received about USD460 million in SDRs in proportion to its share of global GDP. However, as there is “a lack of clarity […] regarding recognition of a government in Afghanistan, […] the country cannot access SDRs or other IMF resources,” said Gerry Rice, IMF spokesperson. Afghanistan joins Myanmar and Venezuela as countries receiving but unable to use SDRs.

Cash Shortage, Currency Devaluation, and Rampant Inflation

The sudden stoppage of foreign cash shipments and aid flows and the scarcity of hard currency has resulted in a severe cash shortage, similar to what happened in Myanmar after the military coup. “People who hold savings in the form of the local currency, the afghani, will rush to exchange them for dollars. If they can’t find dollars, they will try to exchange their afghanis for goods. Prices will be pushed up further,” said Ed Dolan of the Niskanen Center.

“The afghani has been defended by literally planeloads of U.S. dollars landing in Kabul on a very regular basis, sometimes weekly. If the Taliban don’t get cash infusions soon to defend the afghani, there’s a real risk of a currency devaluation that makes it hard to buy bread on the streets of Kabul for ordinary people,” said Graeme Smith, a researcher with the Overseas Development Institute.

Moreover, the DAB under the Taliban cannot rapidly source cash and preserve the integrity of the physical moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More supply. According to Ahmady, the “DAB does not print its own currency: DAB typically receives afghanis produced by specialist firms overseas. The bank expected 2 billion afghanis in small-denominated notes from a Polish currency company in August. It had also signed a contract with a French firm for the supply of another 100 billion afghanis for the following year. I am relatively certain that these deliveries cannot be made.”

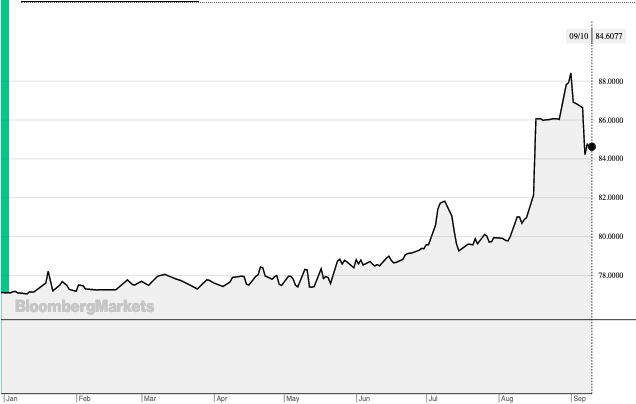

Currency devaluation has accelerated since August 11 (see Graph 1). This will eventually translate into higher inflation given the country’s high imports level (such as in Lebanon). “This will hurt the poor as food prices increase,” tweeted Ahmady.

Graph 1. Afghanistan Afghani Spot Exchange Rate, January-September 2021 (AFN/USD)

Source: Bloomberg (2021).

Financial backing from China or Russia might not be able to assuage Afghanistan’s liquidity problems given the role of the U.S. dollar underpinning global trade and finance. However, “given the agrarian and decentralized basis of economic activity in Afghanistan, [the Talibans’] economic model has shown an ability to weather sanctions and limited access to formal financial markets/resources,” said Robert Kahn, director of global strategy at the Eurasia Group.

“There’s an enormous risk to the Afghan people right now,” said Josh Lipsky, director of the Atlantic Council’s GeoEconomics Center. According to the U.S. Special Inspector General for Afghanistan Reconstruction, nearly half of Afghans required humanitarian assistance in 2021. “In the short term, it’s potentially catastrophic,” said Justin Sandefur, a senior fellow at the Center for Global Development.

Crypto Trading in Afghanistan

“The Afghan people – they’re very complicated. And it’s very hard convincing them that digital currency exists. […] I have plans to teach people about cryptocurrency in the future…but for now, people are just laying low and waiting to see what happens next.” – Farhan Hotak, crypto trader.

Like Turkey and other countries experiencing currency devaluation and accelerating inflation, a small portion of the Afghan public has resorted to crypto trading. According to Chainanalysis, Afghanistan is the 20th out of 154 countries in terms of overall crypto adoption.

Janey Gak, crypto evangelist, holds some of her savings in bitcoinBitcoin is commonly said to be a cryptocurrency, a digital means of exchange developed by a set of anonymous authors under the pseudonym of Satoshi Nakamoto, which began operating in 2009 as a community project (Wikipedia type), without the relationship or dependency of any government, state, company or body, and whose value (formed by a complicated system of mathematical algorithms and cryptography) is not supported by any central bank or authority. Bitcoins are essentially accounting entries i... More: “I don’t trade, I don’t do any of that. I just make some money here and there and save it in bitcoin.” However, “with no electricity and bad internet, crypto trading is near to impossible,” said 22-year old Farhan Hotak, a crypto trader and vlogger.

It remains to be seen whether the Taliban regime can “find itself able to operate solely through cryptocurrency markets,” says Izabella Kaminska, from FT Alphaville. Gak recently tweeted that the Taliban regime must “not join the UN nor allow their agencies to operate in the country, never borrow money, and adopt a bitcoin standard” to be “a truly sovereign state.”