U.S.: Credit Card Debt and Inflation

Highest Increase in U.S. Credit Card Debt Since 1999

During the Covid-19 pandemic, U.S. consumers spent less and paid down their credit cards. Consumers’ credit card debt is increasing as the country returns to normalcy amid a rapid increase in the cost of living. U.S. inflation peaked at 9.1% in June, its highest level since the 1970s.

A recent report from the Federal Reserve BankSee Central bank. More of New York (FRBNY) found that U.S. credit card balances reached $890 billion at the end of June 2022, after a 13% year-over-year increase, the largest since 1999. Aggregate limits on credit card accounts stand at $4.22 trillion, the most significant growth over ten years.

“Some of this just reflects more card usage, more e-commerce, more digital payments, people using cashMoney in physical form such as banknotes and coins. More less. In some respects, higher credit card balances can reflect the growing economy. You just don’t want it to grow so much that people are falling behind [and] carrying expensive debt,” said Matt Schulz, chief credit analyst for Lending Tree.

Credit Card Issuers Nudge Customers to Purchase Mindlessly

While banking officers recommend using credit cards for budget management, customers tend to take on more credit card debt when issuers offer zero-percent interest-rate specials, travel-related bonuses, rewards, loyalty programs, and cashbackA service whereby the customer pays electronically a higher amount to a retailer than the value of the purchase for goods and/or services and receives the difference in cash. It is also a reward system associated with credit card usage, whereby the consumer receives a percentage of the amount spent on the credit card. More on purchases.

- “Things are more expensive. I just had to get my books and wasn’t expecting to spend as much as I had to. […] With everything going on with inflation, I get cashback on a lot of my purchases with the credit card I have. So that’s super beneficial to me right now. […] I’m trying to figure out, you know, how much am I going to have to make?” said Brianna McDonough, a law student at the University of Arkansas in Little Rock.

- Many U.S. banks are targeting “revolvers,” or borrowers who carry a balance from month to month instead of paying their statements off in full.

- In June 2022, 49% of rewards cardholders relied on credit card rewards to offset some of the rising cost of everyday purchases, according to a Wells Fargo survey.

U.S. customers are spending more impulsively now, thanks to online shopping and digital payments. A staggering 70% of respondents to a Slickdeals survey spent more impulsively using their smartphones while lying in bed.

Credit Card Debt: Bingeing and Surviving

Some customers are using credit cards to travel and dine out more.

- “I happen to love theater [and I am trying] to catch up for the time the theater was closed,” said Peter Zangardi, a Philadelphia resident. Zangardi carries a balance on his credit cards from tickets for 21 theater shows in New York, train trips, and meals.

- “I think there’s a lot of folks just trying to do their best to live a normal life and kind of make up the lost ground,” said Brendan Coughlin, head of consumer banking at Citizens Bank, the 13th largest U.S. bank by assets.

Others are relying on credit cards and payday loans to make ends meet.

- “I just started using my credit card for everything. […] That was very stressful. A lot of times, I didn’t sleep […] It was affecting my sleeping, my eating, my psyche,” said Linda Hampton, a property leasing manager in Memphis, Tennessee, whose credit card debt surged to $22,000.

- “My husband and I needed to pay some stuff and credit was the easiest way. And we just let it pile up and pile up. […] The interest rates is what really hurt us because we were making payments, but the bills weren’t going down,” said Mayra Jaramillo, a teacher in her 20s living in a Chicago suburb. Jaramillo now uses cash to treat herself to a night out.

Credit Card Debt Build-Up

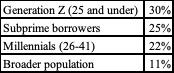

Generation Z consumers, people with low credit scores, and millennials are racking up credit card debt at higher rates than the broader population (see Chart 1 below). FRBNY researchers found that credit card and auto loan delinquency rates are also increasing, particularly in lower-income areas.

Chart 1. United States: Credit Card Balance Increases, 2022Q2 (year-over-year)

Source: VantageScore.

- “There are areas of concern. Number one among them is consumers are adding leverage,” said Silvio Tavares, CEO of credit score company VantageScore.

- “Any new customers –or customers new to credit– are riskier. A lot of that growth [in debt] is replacing balances people paid down in the early part of Covid,” said Moshe Orenbuch, an analyst at Credit Suisse.

- Lower-income consumers “were already living paycheck to paycheck so any little bitIn computers, the basic unit of digital information; contraction of BInary digiT. More of an increase [from inflation] even $50, $100, a month, is overwhelming. Many have maxed out the amount of credit they have,” said Sharita Humphrey, a spokesperson for Self Financial, a fintech company helping customers build credit.

- “If you have credit card debt currently, or you’re taking on debt for a large upcoming purchase, interest rates are high, they are getting higher. It can spiral out of control pretty quickly,” said Sara Rathner, an analyst at NerdWallet, a personal finance website.

#Cashstuffing is Trending on TikTok

Some people, however, are resorting to cash to manage their budget better. “Cash Stuffing,” a trend picking up pace among Gen Z, is a budgeting method where people are stuffing away cash in envelopes for various needs such daily expenses, personal savings, emergency purposes, holiday trips, shopping sprees, and so much more.

With each paycheck, they make separate deposits in these labeled envelopes, making it a unique and innovative way to meet ends.