Webinar: The Future of Cash – Beyond Corona Part III – Register Now!

LET’S BECOME FUTURE LITERATE

According to UNESCO, “Futures literacy is a capability. It is the skill that allows people to better understand the role that the future plays in what they see and do. People can become more skilled at ‘using-the-future’, more ‘futures literate’, because of two facts. One is that the future does not yet exist, it can only be imagined. Two is that humans have the ability to imagine. As a result, humans are able to learn to imagine the future for different reasons and in different ways. Thereby becoming more ‘futures literate’.”

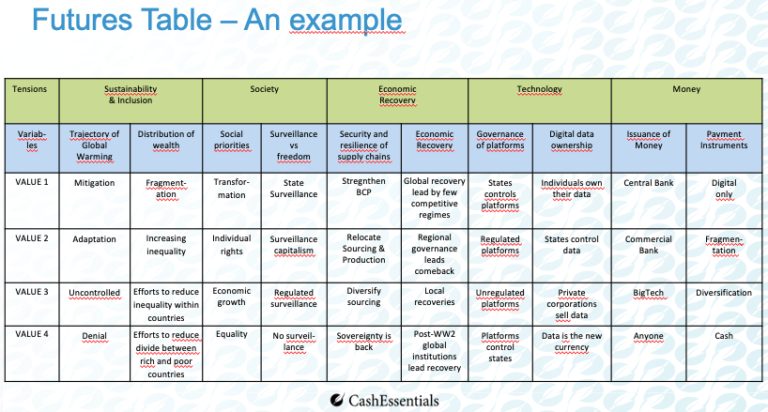

During the first webinar, the group drafted a Futures Table, a tool to support imagining radical futures and exploring the largest uncertainties. It offers a precisely defined framework about the future.

THREE RADICAL SCENARIOS

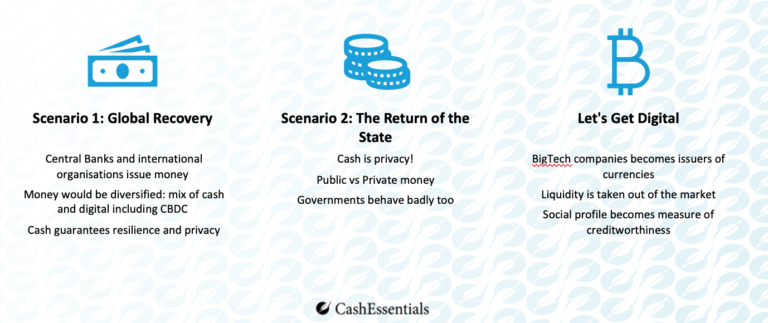

In the second Webinar, the panel presented three scenarios for the future. These scenarios are not forecasts nor do they reflect the panel’s preferences; but they are plausible and polarised to allow meaningful alternative development directions. For each scenario, the panel discussed the monetary ecosystems, payments and cashMoney in physical form such as banknotes and coins. More landscapes.

The first scenario, is based on a globally inclusive economic recovery, driven by post-Word- War II type institutions. Central banks but also potentially international organisations – such as the International Monetary Fund – would become the main issuers of moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More. In terms of the forms of money, we would see further diversification with a mix of cash & digital including Central Bank Digital Currencies. In this scenario, cash is a guarantee of resilience and privacy.

The second scenario envisages a recovery based on a few strong states. In what could be perceived as a shift towards more authoritarian regimes, cash is privacy and guarantees a level of confidentiality of personal data. But cash also provides protection against bad government behavior.

In the third scenario, the pandemic accelerates the shift towards a digital economy and digital capitalism: Big Tech becomes the sole issuers of Money, which would naturally be strictly digital. But this scenarios raises serious questions of liquidityDescribes the extent to which assets or rights can be converted into cash without causing a significant decrease in the asset’s price. Accordingly, liquidity is often inversely proportional to the profitability of the asset and involves the trade-off between the selling price and the time needed to convert it to cash. In finance, cash is considered the most liquid asset and cash is sometimes used as a synonym for liquidity (e.g. cash reserves; cash pooling…). More and access to credit. It also becomes a rather dystopian world where social profiles become a measure of creditworthiness.

The future of cash is often portrayed as somewhat unnatural competition between cash and digital payments and more specifically, during the pandemic between cash and contactless. But this is wrong and misleading. The future of cash has far-reaching societal and policy implications on areas that are far more important than how we pay: financial and social inclusion, privacy, distribution of wealth, economic resilience…

During the third and final webinar, our panel will imagine a desirable future for cash. It will then draft a road map encompassing the decisions which need to be made today in order to achieve this scenario.

To registerSee See-through register. More for the webinar click here.

To review ‘The Future of Cash – Beyond Corona – Part I’ Click here.

To view the recording of ‘The Future of Cash – Beyond Corona – Part II’ Click here.

This post is also available in:

![]()