Australia: Not Dead yet, the Ups and Downs of Cash and other Payments

This article was first published on www.theblondgroup.com and is republished with permission of the author.

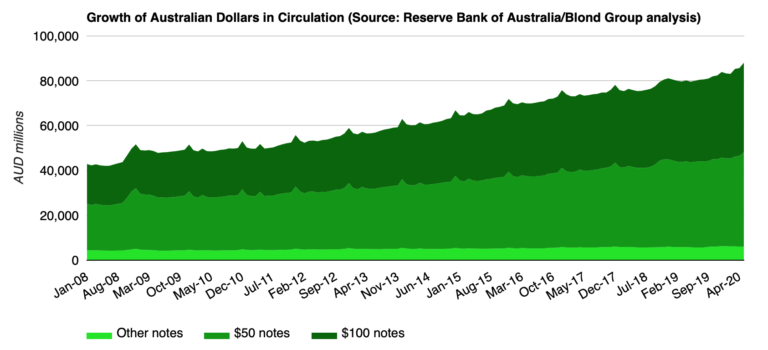

Growth in April was also strong, with a further net increase in notes on issue of $372 million, but news just out shows that, despite a widespread shut down of the Australian economy, banknotes continue to flood out of the Central Bank’s doors with total currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More on issue growing by a further $2,383 million in May to a new record high of just over $88 billion. That’s a 10.6% increase (up $8.5 billion) in the past year.

In an article I previously wrote Cash is not just a dirty word!, I reported that the Reserve BankSee Central bank. More not only publishes detailed banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More by denominationEach individual value in a series of banknotes or coins. More data, but also a comprehensive range of payments use statistics, although given it is gathered from a number of reporting institutions, this information takes a little longer to appear. Data for the month of April 2020 (the first full month of economic and social lockdown) has just been published and provides some fascinating insights into how Australian’s (and in normal times, visitors to Australia) pay for their goods and services.

While an immediate headline grabbing statistic would be to report the dramatic fall in ATM cashMoney in physical form such as banknotes and coins. More withdrawals (total demands in April was $6.4 billion, down 30 percent on the March figure and nearly 40 percent less than a year earlier), the breadth of data provided deserves more detailed analysis.

The value of ATM withdrawals is down, the number of ATM withdrawals have dropped even more

The chart below illustrates the dramatic drop in ATM withdrawals across the board. Total ATM withdrawals in Australia, both from bank and reporting Independent ATM Deployers (IADs), was down from $10.57 billion in April 2019 to just $6.41 billion in April 2020, numbers not seen since the start of the new millennium. The number of withdrawals fell even more sharply from 46.1 million to 21.8 million (down nearly 53%) with a consequent significant increase in the average withdrawal value from around $230 to $294 (USD 204 / EUR 181).

For Independent ATM Deployers, typically with many of their ATMs located in pubs and clubs, the nationwide blanket closure of these venues in late March had a profound effect. The fall in transaction numbers and, as a consequence transaction revenue, which are usually fixed per transaction regardless of withdrawal value, were even more severe. IAD ATM withdrawals in April fell to $688M from $1,498M the previous year, a near 57% drop and the number of withdrawals fell 64% to just under 3.3 million transactions.

Debit card cash out and credit card advances were also significantly lower. When combined with ATM data, total cash out is down from $13.9 billion in April 2019 to $7.9 billion in April 2020, a 43% fall.

The average value of debit card cash out and credit card cash advances held steady at around the $77 and $380 mark, respectively. This suggests that these transactions, while overall far fewer, were largely for the same purpose, typically some cash for transactional use, whereas perhaps the larger ATM withdrawal amounts include an element of ‘rainy day’ cash hoardingThe term refers to the use of cash as a store of value. However, the term has a negative connotation of concealment, and is often used in the context of the war on cash. See Precautionary Holdings. More. Anecdotal evidence also points – especially at the pandemic outbreak – to much larger cash withdrawals across bank branch counters, both for hoarding and perhaps to guard against the uncertainty as to whether or not their bank deposits were safeSecure container for storing money and valuables, with high resistance to breaking and entering. More. The record low interest rates provide little incentive not to hold cash.

Reports of the demise of cash greatly exaggerated?

To paraphrase the quote attributed to American writer Mark Twain on reading his own obituary, reports of the demise of cash are greatly exaggerated, however it’s too early to tell if cash has been mortally wounded.

Although much has been made of the decline in cash use, the truth, at least at point of sale, is that ALL transactions are down. In fact with the Australian Bureau of Statistics reporting a 0.31 percent decline in GDP growth for the March quarter and certainly worse to come in the June quarter, Australia will officially be in recession, something the country has managed to avoid for 29 years – even through the global financial crises!

The April point of sale (contactless and otherwise) purchase statistics reveal a drop in the total value of purchases (by debit, or credit card, or card enabled device) from $35.45 billion a year ago to $26.03 billion in April 2020, a 27% fall. Assuming that some of these transactions were substitutes for cash purchases, the underlying fall is probably comparable to that of cash. Transaction numbers saw a similar contraction, down from almost 680 million purchases in April 2019 to 512 million in April this year, a 25% drop. Average purchase values remained broadly stable at just shy of $51 a time.

A move online or ‘in app’

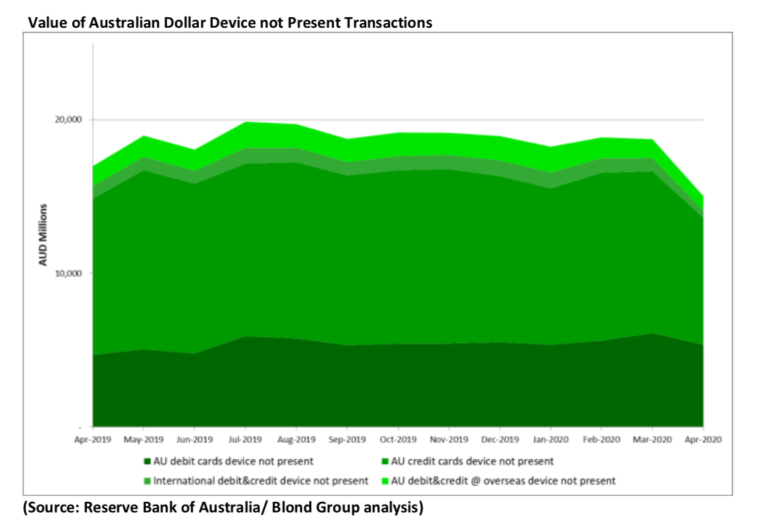

While physical point of sale transactions are substantially down, device not present – online or in app purchases – have been much less impacted. Australian domestic (Australian acquired) purchases have fallen just 8 percent (from $14.87 billion in April 2019 to $13.63 billion this April), while the number of transactions has actually increased 4 percentyear on year. The consequence is a fall in average transaction values from around $130 a year ago, to $114 now.

Looking internationally, the fall in overseas card not present acquired transaction values has been greater, down 26% from $1.28 billion to $0.94 billion, but in a year transaction numbers have increased by a third. This has resulted in the average transaction value falling from $114 to just $63, perhaps bolstered by low value transactions, such as music and entertainment streaming service subscriptions.

While this one area of international payments that has weathered the storm better than most, a closer examination of the numbers reinforce the impact of closed borders and restricted travel.

Both ATM withdrawals within Australia using overseas issued cards and overseas ATM withdrawals by Australian cardholders are sharply lower. Values in Australia are down 54% year on year; abroad the fall is a massive 83%.

Adding in internationally issued debit and credit cards used at Australian point of sale to the ATM withdrawal figures, device present international card use was down 89% in April 2020 to a mere $112 million.

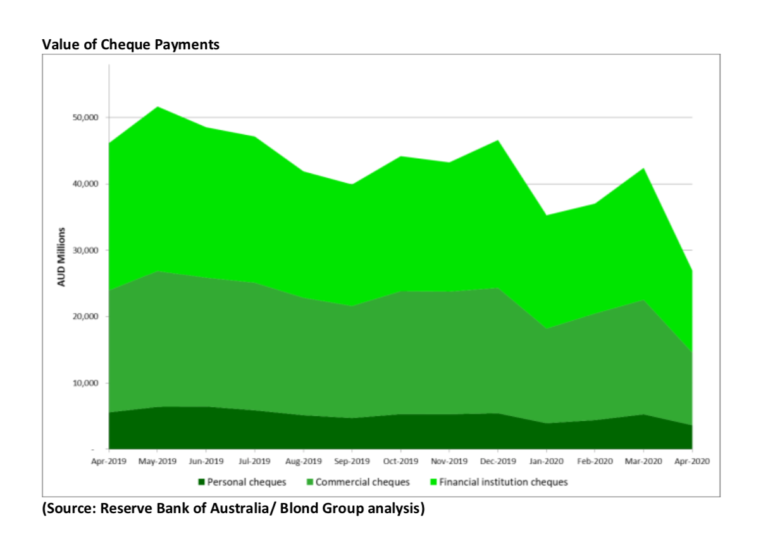

The end for cheques?

Cheque use, already in steep decline, took a battering in April with the total value of cheque payments dropping to $26.9 billion in April 2020 a 42% year on year fall. Australian consumers wrote out less than a million personal cheques in the month, down more than a third (by value and number) on the same time last year.

Faster payments, not immune to the economic contraction

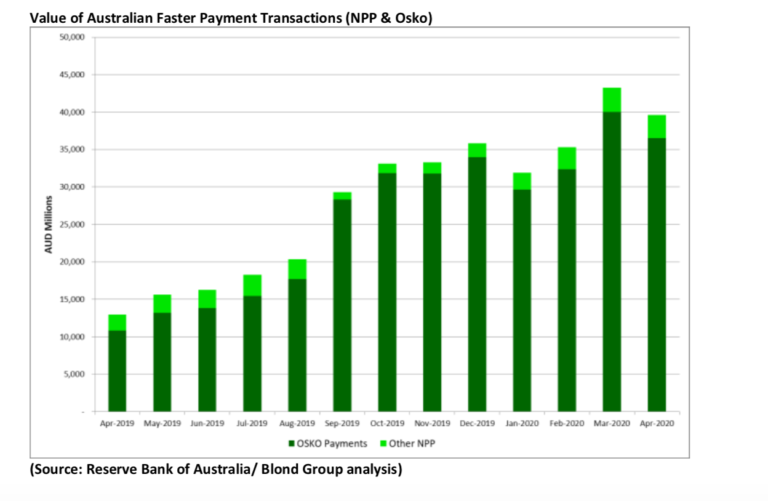

Australia’s faster payments system, the New Payments Platform (NPP), started operating in early 2018 although initially some of the larger banks were slow to offer access to their customers.

More recently, uptake has gathered pace and adoption is now accelerating. To reinforce the point that it’s not just cash that’s taken a battering, even NPP volumes were down in April, albeit by a more modest $3.5 billion, 8%.

The roller coaster continues, more ups and downs ahead!

Late March saw Australia take decisive and to dateThe year in which a medal or coin was minted. On a banknote, the date is usually the year in which the issuance of that banknote - not its printing or entering into circulation - was formally authorised. More largely successful measures to combat the spread of the COVID-19 virus. While the measures have saved many lives, the economic consequences have been profound. The data reported provides a glimpse as to how Australian’s payments behaviours have changed, or indeed in many cases temporarily halted payments altogether. It will be fascinating to track whether the changes have been temporary or are permanent.

We have a rocky road ahead, as the economy recovers, borders domestic and international reopen, but also government financial support measures come to an end and the risk of further infection remains ever present.