Borrowers’ Remorse: U.S. Credit Card Debt

Credit card debt is the most prevalent in the United States. According to the Federal Reserve BankSee Central bank. More of New York (FRBNY), there are more than 500 million open credit card accounts; 191 million Americans have at least one credit card account, and many have multiple accounts.

According to Credit Karma, a credit score tracking company, U.S. cardholders’ average credit card balance is up 20%. Credit scores had fallen 12 points since March 2022, when the Federal Reserve first started raising interest rates.

Rising Credit Card Use during the Cost-of-Living Crisis

U.S. credit card balances reached $930 billion during the third trimester of 2022, per the most recent FRBNY Quarterly Report on Household Debt and Credit.

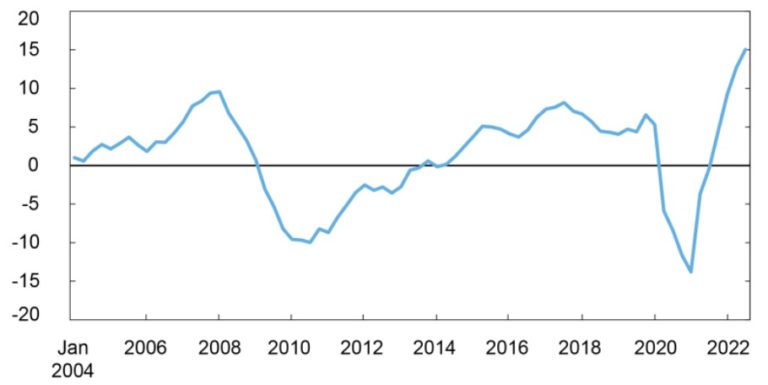

- Credit card balances have increased since 2021 (see Graph 1). Credit card balances increased by $38 billion in 2022Q3, surpassing the June 2022 figure; the 15% year-over-year rate is the largest in more than twenty years.

- Aggregate limits on credit card accounts stand at $4.3 trillion. The delinquency transition rate for credit cards reached 3.69% in 2022Q3, compared to 3.24% in 2021Q3.

Graph 1. United States: Year-Over-Year Percent ChangeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More in Credit Card Balances, 2004-2022

Source: FRBNY (2022).

Credit Card Use by Age and Income

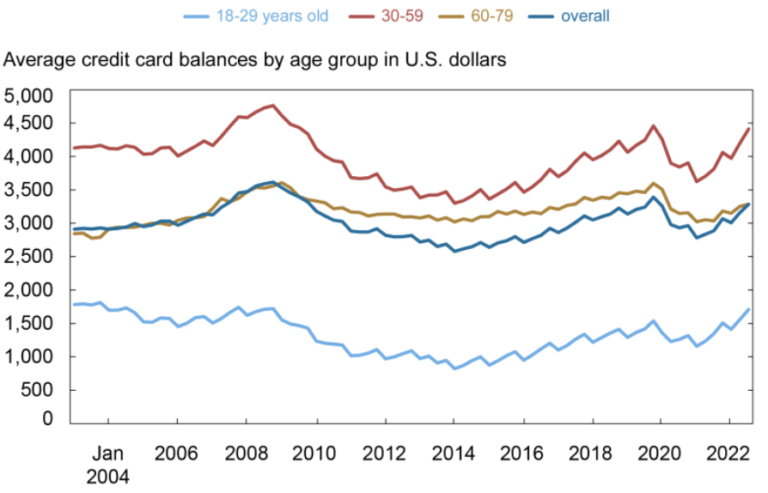

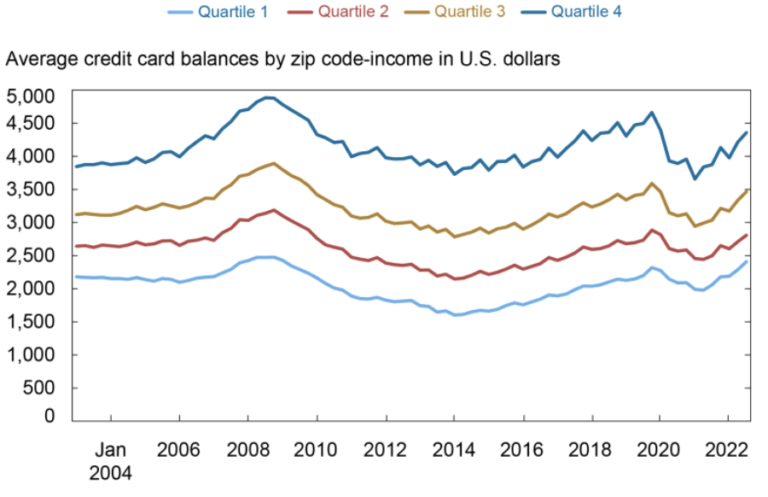

The Report provides data shedding light on how younger and less wealthy cardholders are using credit cards to deal with the cost-of-living crisis. FRBNY researchers analyzed credit card balances by borrower’s age (see Graph 2) and zip code income (see Graph 3).

- Balances for borrowers under 30 are above their pre-pandemic levels.

- Balances for borrowers between 30 and 59 years old are approaching the level reached in 2019Q4.

- Balances for borrowers between 60 and 79 remain below where they stood before the Covid-19 pandemic.

Graph 2. United States: Average Credit Card Balances by Age Group in Nominal U.S. Dollars, 2004-2022

Source: FRBNY (2022).

- Balances for higher-income borrowers were $300 lower in September 2022 than in December 2019.

- Balances for lower-income borrowers have increased since the pandemic and have surpassed the average from December 2019.

Graph 3. United States: Average Credit Card Balances by Zip Code-Income in Nominal U.S. Dollars, 2004-2022

Source: FRBNY (2022).

Targeting Young Adults through Live Concerts

Credit cards are the most common first credit experience for younger borrowers: 73% of Americans have a credit card by age 25, per the FRBNY. Many U.S. young adults are getting their first credit cards lured to see their favorite artists in concert.

Successful artists are partnering with credit card companies to offer fans preferential access to presale tickets, such as Taylor Swift with Capital One and the Coachella Valley Music and Arts Festival with American Express premium cards,

- Shortly after Taylor Swift announced her Eras Tour (her first since 2018), Halie Smith (23, Ross Township, Pennsylvania) got her first credit card to purchase concert tickets. She bought four tickets for $1,103 but had to use her debit card, as the total exceeded her credit card’s limit. “As I signed up, because of the Taylor presale, I realized the importance of financial literacy,” said Smith.

- “I’m worried that people are jumping to utilize a credit card thinking that, with all the glitz and glamour of the marketing that credit card companies do, they’re somehow getting a deal. A credit card isn’t free moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More. A credit card is just a short-term loan that you have to pay back. Your goal should be to be the credit card company’s worst customer,” said Elliot Pepper, a financial literacy teacher and co-founder of Northbrook Financial, a wealth management, and tax planning firm.

Adding Friction to Credit Cards for Mindful Spending

“Whenever you make a purchase that’s unplanned, lots of things can happen. It takes away some of your choices in the future. […] Removing the emotions and the impulses can be very helpful.” – Jamie Wagner, associate professor of economics at the University of Nebraska Omaha.

“Retailers, both online and in brickTen straps are commonly called a brick. In other words, a brick is a thousand notes. See Strap. More and mortar, are really skilled. They make an Olympic sport out of making you want to buy things you don’t need,” said Justin Pritchard, the owner of Approach Financial Planning (a retirement planning firm in Montrose, Colorado). Pritchard had some suggestions to avoid impulse purchases with credit cards, including:

- Stick a Post-it note to your credit card listing your spending priorities, including messages saying “pause” or “slow down.”

- Delete your credit card information from online shopping platforms such as Amazon, creating friction before you check out.

- Use a shopping list for in-person and online purchases.

Some Gen Z consumers stay away from their credit cards and resort to #Cashstuffing to better manage their budgets. “CashMoney in physical form such as banknotes and coins. More envelope stuffing” has been trending on Tik Tok with over 426 million views at the time of writing.