Cash and Cash Infrastructure in Ukraine

A Cyberattack Targeted Banks Spreading Rumors about ATM Malfunctions

On February 12, CashEssentials warned that tensions between Russia and the West increased the likelihood of a cyberattack against Ukraine’s computer systems, including paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More networks. A few days later (February 15), a cyberattack targeted the websites of the Ukrainian army, the Defense Ministry, and the two largest banks in the country, the state-owned PrivatBank and Oschadbank.

The attack disrupted banks’ mobile phone applications and online payments. Fake SMS messages claimed banks had suspended operations and ATMs had stopped working. Customers rushed to withdraw cashMoney in physical form such as banknotes and coins. More and check their banking applications, saturating them. Some PrivatBank ATMs were affected, but not all terminals were shut down. Customers posted tweets saying they could still withdraw cash and use cards. A few customers reported their bank balances had been drained.

Oschadbank confirmed the cyberattack had slowed down its systems. PrivatBank denied it had been targeted at first, asking its “clients and all citizens of Ukraine to remain calm and be guided in their decisions by information from official and verified sources.” Later, “Privat[Bank] assure[d] that there is no threat to depositors’ funds,” according to Ukraine’s Centre for Strategic Communications and Information Security, part of the Ministry of Culture and Information Policy.

- “The key goal of this attack is to destabilize, to sow panic, to do everything to create a certain chaos in the actions of Ukrainians in our country,” said Mykhailo Fedorov, Ukraine’s minister of digital transformation.

- “These are mainly cyberattacks on critical infrastructure and government agencies. The goal of attacking infrastructure is to destabilize. So if let’s say we see that bank services are disabled, and if you can’t pay for fuel and groceries, it will immediately cause some public reaction. And if on top of that there is an attack on government websites, citizens can’t get access to information. That is why a cyber attack, this kind of hybrid attack, can subsequently cause people to get upset, and feel that the state is allegedly not in control of the situation inside the country and its agencies. And this can be a reason to send troops.” said Serhiy Prokopenko, head of Ukraine’s National Center of Cybersecurity.

- “What they want to do is the equivalent of winning the war without firing a single bullet, by causing massive panic here. They want people to start running on the banks. The war is a hybrid the Russians are playing in several domains, the economy included,” said Pavlo Kukhta, an adviser to Ukraine’s minister of energy.

Ukrainian and U.S. officers blamed Moscow.

- “We know today that, unfortunately, the only country that is interested in such strikes on our country, especially against the background of mass panic over a possible military invasion is, unfortunately, the Russian Federation,” said Ilya Vityuk, head of the Ukrainian Intelligence Agency’s Cyber Security Department.

- “We do not know anything. As expected, Ukraine continues blaming Russia for everything. Russia has nothing to do with any DDoS [distributed-denial-of-service] attacks,” said Dmitry S. Peskov, a Kremlin spokesman.

- On February 18, the United States announced it had “technical information that links the Russian Main Intelligence Directorate (GRU)” with the DDoS attack, said Anne Neuberger, the White House’s deputy national security advisor for cyber and emerging technology.

On February 22, another cyberattack disrupted the websites of government agencies and several banks, including PrivatBank. “At about 4 p.m., another mass DDoS attack on our state began. We have relevant data from a number of banks,” said Mykhailo Fedorov, Ukraine’s minister of digital transformation. A day after, the Slovakian cybersecurity firm ESET Research Labs announced it had detected a pieceIn plural, it is commonly used as synonym for units of banknotes and coins. More of destructive malware hit hundreds of computers in Ukraine.

The United States, the United Kingdom and the European Union had imposed some sanctions on Russian banks.

Cash in CirculationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More and ATMs

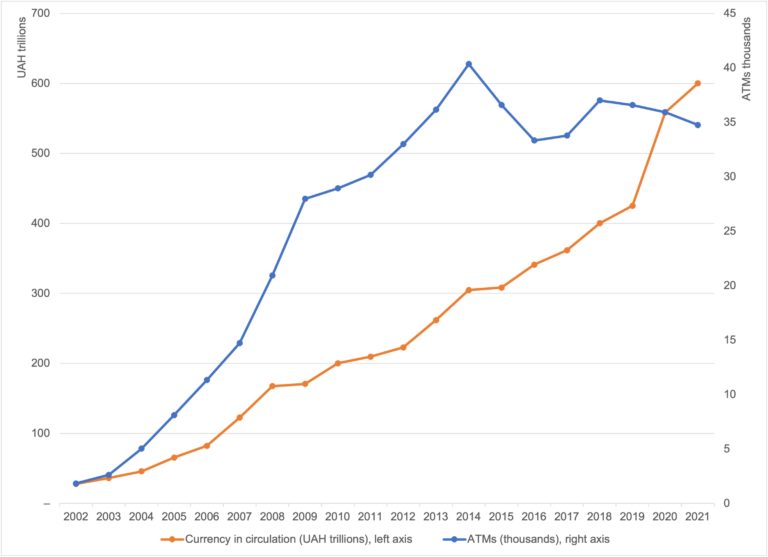

Ukrainian hryvnias (UAH) in circulation grew between 2002 and 2019 and expanded even more rapidly during the Covid-19 pandemic, as Graph 1 shows. Data from the National Bank of Ukraine (NBU) shows that cash in circulation grew 31.4% in 2020.

At the onset of the pandemic, Ukrainians withdrew cash en masse from banks. The NBU provided additional quarantined cash to banks, helping preserve customers’ confidence. CurrencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation grew 4.35% in March 2020 and 6.95% in April 2020.

According to the NBU, as of January 1, 2022, cash in circulation reached UAH627.6 billion, with UAH622.6 billion in 2.95 billion banknotes and UAH4.8 billion in 13.99 billion coins. There were 71 banknotes and 162 coins per capita in Ukraine. The UAH20 banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More had the largest number of pieces in circulation, at 25.1% of banknotes, and the UAH1,000 banknote had the smallest number, at 3% of banknotes.

Graph 1. Ukraine: Currency in Circulation and ATMs, 2002-2021

Note: Figures do not include December 2021. Source: NBU Payment Statistics (2002-2019, 2020-2021); Monetary Statistics (2002-2021); CashEssentials.

The number of ATMs in Ukraine grew at double-digit rates between 2002 and 2009 (see Graph 1). Their number decelerated between 2010 and 2014. The number of cash dispensers declined markedly through 2016, recovered between 2017 and 2018, and slowly declined through 2021. ATM figures include regular ATMs, cash-in ATMs, and self-service kiosks. Self-service kiosks (SSK) allow Ukrainians to deposit funds into their bank accounts, top-up their mobile accounts, and pay for utilities (see NBU 2019: 15).

Cash Withdrawals in Ukraine: 2002-2014

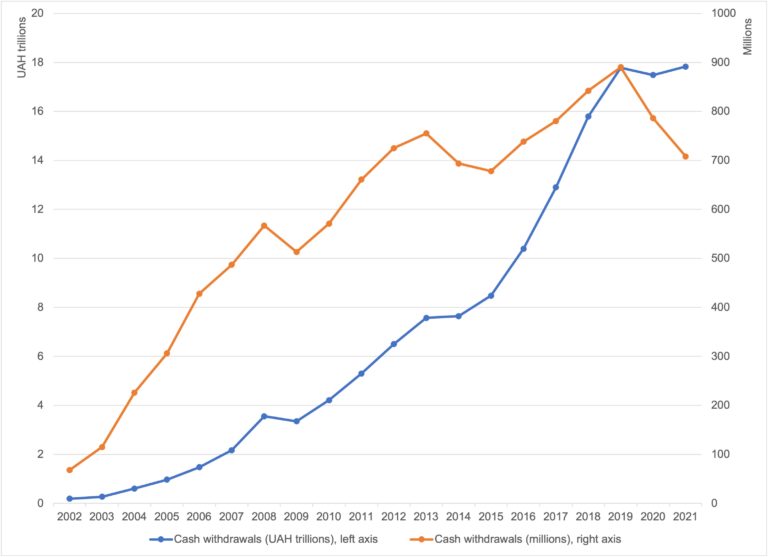

Cash withdrawals grew in value and volume from 2002 to 2008, the year of the global financial crisis (see Graph 2). They declined during the Great Recession and then rose through 2013. In 2014, cash withdrawals declined, but their decrease by value (-6%) was lower than by volume (-10%).

During the Maidan revolution of February 2014, Ukrainians demanded cash in excess out of precaution amid political unrest. Banks had to restrict cash withdrawals in hryvnias (UAH800-2,500) and U.S. dollars ($500-$1,500). “I saw everybody was withdrawing [cash], so I’m withdrawing too. I don’t know,” said a man in eastern Ukraine waiting in line at an ATM (New York Times video, minute 0:44).3

Graph 2. Ukraine: Cash Withdrawals by Value and Volume, 2002-2021

Note: Figures do not include December 2021. Source: NBU Payment Statistics (2002-2019, 2020-2021); CashEssentials.

Payments in Russian-Occupied Territories

Russia confiscated banks’ buildings, equipment, and cash shortly after occupying territories in Eastern Ukraine. Banks closed, and ATMs shut down. Visa and MasterCard cards stopped working due to Western sanctions in territories annexed by Russia and those controlled by pro-Russian rebels.

- “In the evening (our) outlets work. In the morning, a new bank is opened, and just the name is changed to Russian National Commercial Bank. […] To function properly, we need […] access to our branch network, our outlets, our ATMs, to our documents, our files,” said Andriy Pyshnyy, chairman of the management board of Oschadbank. This Ukrainian state-owned bank had 296 branches in Crimea.

- “Unfortunately, due to the fact that there is not enough cash on the peninsula, all transactions with cards, accounts and deposits opened in Crimea are temporarily blocked. This concerns both individuals and companies. Our departments, ATMs and terminals in Crimea are temporarily not operating. We hope that the situation will be settled in the near term,” said PrivatBank, the largest bank in Ukraine. PrivatBank’s losses due to the Russian annexation of Crimea rose to $9 billion.

- Lena Samoilenko, a 36-year-old cultural activist from Antratsyt, now in Russian-occupied territories, wrote on Facebook, “When my town was occupied, the banks were the first to get plundered. […] My mother’s colleague stayed and was killed in her own apartment; they tortured her for a long time, trying to find out where she hid her retirement payments.”

- In Donetsk, people settled all transactions in cash. Customers in Russian-occupied Simferopol faced strict limits to withdraw cash from ATMs.The NBU mandated all banks to suspend all transactions on rebel-controlled territories in Donetsk and Luhansk. ATMs stopped accepting non-Russian cards, and thousands of citizens could not withdraw funds from their bank accounts for months afterward.

- “The living conditions of the local population have been deteriorating in the occupied territories. In particular, there is no cash moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More in banks and ATMs in Luhansk. According to preliminary information, all cash has been withdrawn to the Russian Federation,” said Oleksandr Motuzianyk, a Defense Ministry officer for Anti-Terrorist Operation (ATO) issues.

- International money transfer systems stopped working as well. “A friend in the US needed to transfer me some money, and he had to send it by wire to another friend in Moscow, who withdrew the money and then found someone flying here from Moscow to bring it to me by hand,” said a Simferopol resident.

Cash Withdrawals during the Ukrainian-Russian War (2014-) and the Covid-19 Pandemic (2021-)

From 2015 onwards, cash withdrawals grew and peaked in 2019 (see Graph 2). During the Covid-19 pandemic, cash withdrawals by volume declined in 2020 (-12%) and 2021 (-10%). However, by value, cash withdrawals declined very little in 2020 (-2%) and increased in 2021 (2% through November). This means that although Ukrainians might be using ATMs less, they still withdraw cash in nearly the same or even higher amounts as before the pandemic.

Last year’s increase in cash withdrawals by value coincided with Russia’s military buildup around Ukraine since October 2021. Ukrainians are holding on to more cash due to uncertainty about a potential military conflict.

- The Ukrainian government’s brochure “If There is a State of Emergency of War” advises civilians to prepare an emergency kit with water, food, IDs, cash, bank cards, and phone chargers.

- At the beginning of January, “people [in Kyiv] weren’t lined up at ATMs taking out money or stocking up on groceries,” according to New York Times reporter Michael Schwirtz (The Daily Podcast, February 15, 2022, minute 1:03). Banks provide services without interruptions, according to Matthew Luxmoore and Georgi Kantchev, Wall Street Journal reporters.

- The Ukrainian hryvnia has depreciated heavily against the dollarMonetary unit of the United States of America, and a number of other countries e.g. Australia, Canada and New Zealand. More. Kyiv social media users recommend withdrawing cash and converting it to dollars. Dollars are widely used in territories disputed by Russia, such as Transdniestria. ATMs in Ukraine have dispensed dollars and euros since 2019.

- Ukrainians and visitors such as Utah County Attorney David Leavitt hold extra cash if cyberattacks cripple the internet and ATMs.

- People living in separatist-controlled territories are crossing to Stanytsia Luhanska, a city in Eastern Ukraine, to withdraw cash from ATMs, collect pensions, and buy Ukrainian goods.

- On February 19, the central bank of the self-proclaimed Donetsk republic limited withdrawals to 10,000 roubles per day from ATMs. Card payments functioned without problems.