Cash and Ice Cream in the Big Apple

Unbanked Households in New York City

“Lack of access to banks online and in-person coupled with not being able to afford a bank account because of fees like overdraft are hindering far too many New Yorkers from getting banked. Over the past year, we have seen how vital a bank account is to financial stability. From paychecks to stimulus checks and now the advance Child Tax Credit payments, a bank account is key to getting access to those funds safely and quickly.” – N.Y.C. Department of Consumer and Worker Protection (DCWP) Acting Commissioner Sandra Abeles

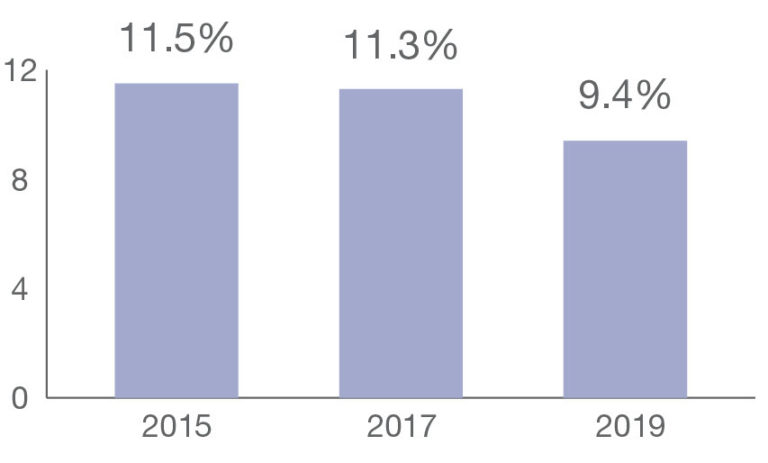

According to the DCWP, an estimated 301,700 households had no bank accounts in 2019 (9.4% of New York City‘s total). That ratio is lower than the share of unbanked households in 2015 (11.5%, see Graph 1). The Bronx has the highest unbanked rates in New York City (see Chart 1).

Figure 1. New York City: Share of Unbanked Households, 2015-2019

Source: DCWP (2021).

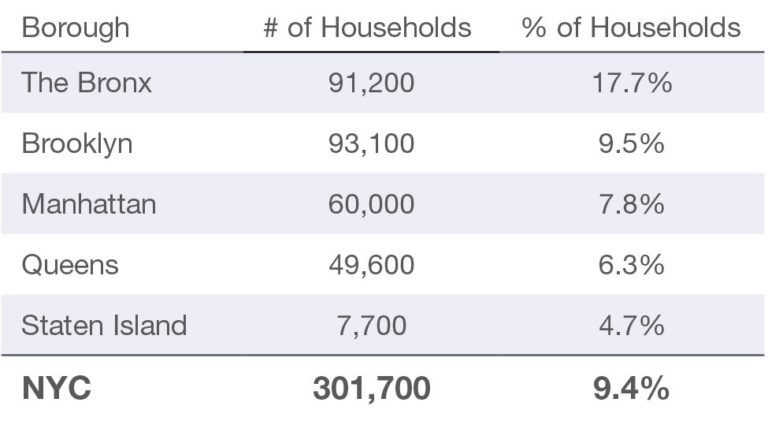

Chart 1. New York City: Estimated Unbanked Households by Borough, 2019

Note: The boroughs’ sum does not match the N.Y.C. total due to rounding. Source: DCWP (2021).

Per the DCWP, most unbanked households are highly concentrated in neighborhoods with:

- higher rates of unemployment,

- predominantly Black and Latino populations,

- lower median household income,

- more inadequate access to bank branches, and

- insufficient or no internet access.

New York City’s 2020 Cashless Ban

Councilmember Ritchie J. Torres first introduced a ban prohibiting food stores and retail establishments from refusing to accept cashMoney in physical form such as banknotes and coins. More payments in 2019. The Torres’ sponsored cashless ban passed on February 23, 2020, and became effective on November 19, 2020. Similar cashless bans exist in Philadelphia, San Francisco, Massachusetts, and New Jersey.

The ban sought to ensure “that all New Yorkers, including those who are unbanked or underbanked, can make retail and food purchases using cash” (City Record, September 8, 2020, 3493):

- The ban on cashless establishments makes it “unlawful for a food store or a retail establishment to refuse to accept paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More in cash from consumers,” per N.Y.C. Administrative Code section 20-840(b)

- Establishments cannot go cashless unless they install reverseThe back of the banknote or coin. See Obverse. More ATMs to “convert cash, without charging a fee or requiring a minimum deposit amount greater than one dollarMonetary unit of the United States of America, and a number of other countries e.g. Australia, Canada and New Zealand. More, into a prepaid card that allows a consumer to complete a transaction,” per N.Y.C. Administrative Code 20-840(e).

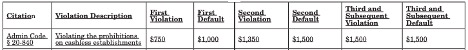

- The ban also set up penalties to induce compliance (see Chart 2).

Chart 2. New York City: Penalties for Violating Prohibitions on Cashless Establishments, 2020

Source: City Record (September 8, 2020, 3493).

A New York City Retailer Refuses U.S. Legal TenderMoney that is legally valid for the payment of debts and must be accepted for that purpose when offered. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered (“tendered”) in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. More

Despite the cashless ban, the upscale Van Leeuwen Ice Cream chain (founded in 2008) refused to take cash at its 19 locations.

- Van Leeuwen is known for expensive ice cream scoops and exotic flavors like organic Oregon peppermint, biodynamic single-estate Ceylon cinnamon, and vanilla with organic beans from Papua New Guinea.

- The chain grew from yellow food trucks in New York City to 33 stores across the United States, including Texas, Pennsylvania, and California.

You Can’t Pay for your Scoop of Royal Wedding Cake Ice Cream with a $10 Bill

Dozens of consumers filed complaints about Van Leeuwen with the DCWP. The city’s Office of Administrative Trials and Hearings (OATH) found Van Leeuwen violated the cashless ban over 90 times, incurring more than $112,000 in penalties.

Van Leeuwen’s “brazenness felt almost ideological,” wrote Pamela Paul, a New York Times opinion columnist. Paul mentioned some costs of cashless payments.

- On the consumer side, digital payments require customers to have bank accounts, make transactions traceable, and are subject to identity theft and other risks. In addition, cashless payment systems automatically ask consumers to tip for services that traditionally go without tips.

- On the retailers’ side, merchants increase their prices to offset credit card companies’ interchange fees.

SettlementThe discharge of an obligation in accordance with the terms of the underlying contract. In e-transfers the settlement may take days, whereas cash settlements are instantaneous and irreversible. More

In October, Van Leeuwen entered a settlement agreement with the city’s DCWP:

- Van Leeuwen started accepting cash at all its N.Y.C. locations and planned to install reverse ATMs in some stores.

- The chain said it had “removed all signage, stickers, and placards indicating that they do not accept cash and/or that they only accept credit and debit [card payments].”

- The ice cream seller would have to pay $33,500 in civil penalties.

“Cash is king, which is why the Cashless Ban Law was passed to protect the unbanked and underbanked in our city. We will not allow any business to take advantage of this vulnerable population or penalize customers just for wanting to use cash to pay for things. This agreement will not only ensure that those who patronize Van Leeuwen will now have the option of paying in cash, but, more importantly, it sends a clear message that those who repeatedly violate this law will be held accountable.” – N.Y.C. Mayor Eric Adams.

“No New Yorker should be discriminated against because they can only—or want to— pay with cash. While DCWP takes an education-first approach to enforcing the city’s laws, systemic and flagrant defiance will not be tolerated. This is more than just an issue of compliance with the law, it’s also an issue of equity and treating all New Yorkers fairly.” – N.Y.C. DCWP Commissioner Vilda Vera Mayuga