Cash or Gifts for the Holidays?

Gifts Generate Deadweight Loss

In December 1993, economist Joel Waldfogel, from Yale University, measured the “deadweight loss” of Christmas by studying the difference between the cost of Christmas gifts and how much their recipients valued them after they had accounted for exchanges and put sentimental value aside. A deadweight loss is a societal cost created by market inefficiency, which occurs when supply and demand are out of equilibrium.

Waldfogel’s key argument is that the best gift-giver will replicate the recipient’s choice. While the recipient may value the gift more than its actual price, it is more likely that the recipient will be left worse off than if he had made his own consumption choice with the same amount of moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More. To support his thesis, Waldfogel ran a survey among Yale undergraduate students and estimated that gift-giving destroyed between 10% and 30% of the value of gifts.

By applying these ratios to the value of Christmas expenditure in 1992, Waldfogel estimated that giving gifts instead of cashMoney in physical form such as banknotes and coins. More amounted to a deadweight loss between $4 and 13 billion in the US alone. These figures would naturally be far higher today. Finder.com estimates that in 2022, 32 million Brits (62% of the population) will receive at least one unwanted gift worth some £1.2 billion combined.

Gifts Are Not Limited to Monetary Value

However, François Levêque, an economist at Mines Paris, states in The Conversation that “economic reasoning is erroneous and absurd”.

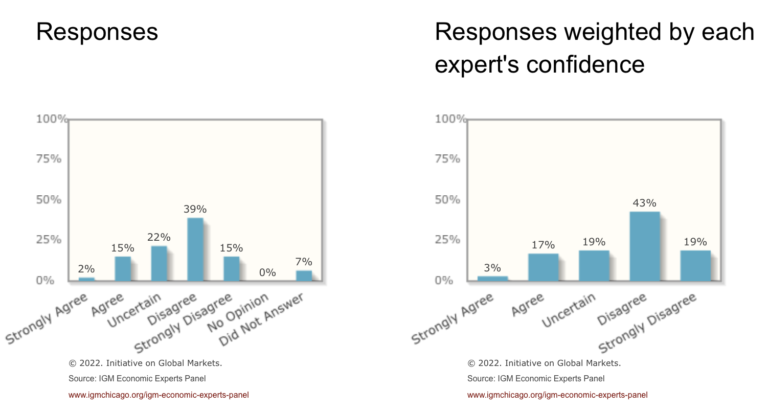

Levêque quotes a poll of economists ran in 2013 on Chicago Booth’s IGM Forum, most of them teaching at Chicago Harvard, MIT or Berkeley, who were asked to react to the following question: “Giving specific gifts as festive gifts is ineffective because beneficiaries could much better satisfy their preferences with cash.”

The results illustrate the absence of consensus, with 54% disagreeing and 17% agreeing. The comments are well worth the read.

Instead of proposing to your wife w/diamond ring, you offer a gift card of equal value. Efficient–if you don’t count your hospital bills. – Austan Goolsbee

This is the sort of narrow view that rightly gives economics bad name. – Angus Deaton

For Levêque, the value of the gift is not limited to its monetary value. Waldfogel’s students should not be asked to estimate the price of the gift received, leaving aside the sentimental value, but should estimate the total value, understood as its material value plus its sentimental value. In this case, it becomes a gain, not a loss. The donor’s satisfaction should also be included in the calculation. As the saying goes, the pleasure of giving is greater than that of receiving.

Economists Alex Tabarrok and Tyler Cowen also debate the economics of gift-giving in this video while wearing Christmas sweaters, which makes a strong point.

Yanis Varoufakis, former Finance Minister of Greece and economist at the University of Athens, analyses in Project Syndicate how different schools of economic thinking, from neoclassical and Keynesian to Libertarian and Marxist, view Christmas gifting. He concludes, “Levity aside, the answer reveals the pompousness and vacuity of each economic theory.”

Cash Etiquette, Beyond Economics

For some, giving cash may be perceived as unimaginative, unthoughtful or even downright lazy. As always, the internet provides solutions to problems most people never had.

- Across the world, cash is an ideal instrument to give donations, tips, and gifts.

- This blog offers fascinating advice on the subtle etiquette of giving and receiving cash. One essential takeaway: “Generally, it’s not cool to give financial gifts to your significant other for any occasion.”

- For those who lack creativity, there are countless ideas online for inventive ways to give cash; you can find tutorials for anything from banknotes frozen inside giant ice cubes to cash-filled chocolate boxes.

- This tutorial will teach you how to make a notepad out of banknotes.

Happy Holidays!