ChatGPT and the Case For (and Against) Cash

ChatGPT is a chatbot launched in November 2022 by OpenAI, a San Francisco artificial intelligence (A.I.) company. ChatGPT generates text based on a statistical model trained on content from all over the internet before 2021. Social media users marvel at ChatGPT’s capabilities to code and write essays, poems, and jokes.

Microsoft has incorporated an A.I. chatbot into its Bing search engine; Google will follow soon. A.I. will most likely disrupt many industries, “potentially reducing the need for some knowledge workers,” wrote Paul Krugman, the NYT columnist and 2008 Nobel laureate in Economics.

ChatGPT’s Case For CashMoney in physical form such as banknotes and coins. More

What does ChatGPT have to say about the relevance of cash? ChatGPT wrote an essay in a minute based on the following prompt:

Write an essay on why contemporary societies need cash (coins and banknotes)

Contemporary societies are facing an ongoing debate on the need for cash in the current digital age. Some argue that cash is becoming obsolete and that digital forms of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More, such as debit cards and mobile wallets, are the future of financial transactions. However, despite the growth of digital payment methods, there are still several compelling reasons why cash continues to be an essential component of contemporary societies.

One of the main reasons for the continued need for cash is that it provides a reliable and accessible means of payment for individuals who may not have access to other forms of payment. This is particularly true for older generations, those who live in rural areas with limited access to banking services, and those who have limited access to technology. Cash is a universally accepted form of payment, and it can be used anywhere, at any time, making it an ideal option for those who may not have access to digital payment methods.

Another important reason for the continued need for cash is that it provides individuals with greater privacy and security in their financial transactions. Digital forms of payment leave a permanent and public record of transactions, which can be vulnerable to cyberattacks and data breaches. In contrast, cash transactions do not leave a digital trail and are not linked to personal information, making them a more secure and private form of payment.

Cash also plays a crucial role in supporting small businesses and local economies. In many parts of the world, small businesses are reliant on cash transactions to pay suppliers, employees, and taxes. Furthermore, cash is often preferred by consumers who wish to support local businesses, as it provides them with greater control over their spending and helps to keep moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More circulating in the local economy.

In times of crisis, such as natural disasters or financial downturns, cash is a critical component of ensuring economic stability. When banks are closed or digital payment systems are down, cash remains a viable form of payment that individuals can rely on. This is particularly important for individuals who are unable to access their digital accounts or who may be in need of immediate access to funds in a crisis situation.

In conclusion, despite the growth of digital payment methods, cash continues to play an important role in contemporary societies. It provides individuals with greater accessibility, privacy, security, and is an essential component of supporting small businesses and local economies, particularly in times of crisis. Until these needs are fully met by digital alternatives, cash will remain a crucial component of our financial system.

ChatGPT’s Case Against Cash

We asked ChatGPT to write an essay against cash with the prompt below:

Write an essay on why contemporary societies do not need cash (coins and banknotes)

Contemporary societies are undergoing a major shift towards digital payment methods, and this has led to discussions about the need for cash in the current digital age. While cash has been an essential component of financial transactions for centuries, there are several reasons why contemporary societies do not need it.

First and foremost, digital payment methods offer greater convenience and efficiency compared to cash. Digital transactions can be completed instantly, regardless of location or time, and they eliminate the need for individuals to carry large amounts of cash, reducing the risk of theft or loss. Furthermore, digital payment methods provide a detailed record of transactions, making it easier for individuals to manage their finances and track their spending.

Another significant reason why cash is becoming less necessary in contemporary societies is the increasing prevalence of financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More initiatives. These initiatives aim to provide access to financial services, including digital payment methods, to populations who were previously excluded from the financial system. This is particularly important in developing countries, where access to banking services is limited, and many individuals rely on cash transactions.

The growth of e-commerce and online shopping is also contributing to the decline of cash. Digital payment methods make it easier for consumers to purchase goods and services online, without the need for cash. This has increased the accessibility of online shopping and has made it easier for individuals to purchase goods from other countries.

In addition, digital payment methods are more secure and offer greater protection against fraud compared to cash. Digital transactions are encrypted and can be monitored in real-time, reducing the risk of fraud and cybercrime. Furthermore, digital payment methods are often linked to a personal account, providing individuals with greater control over their finances and making it easier to report and resolve any fraudulent activity.

In conclusion, contemporary societies do not need cash because digital payment methods offer greater convenience, efficiency, security, and accessibility. As digital payment methods become more widespread, the need for cash will continue to decline, and individuals will increasingly rely on digital transactions for their financial needs. The shift towards digital payments is an important step towards a more inclusive, efficient, and secure financial system, and it represents a significant opportunity for individuals and businesses alike

Nothing New Under the (Digital) Sun

While we marveled at ChatGPT’s speed in writing the two essays, we were relieved to see that the chatbot did not encounter any arguments CashEssentials or the cash community missed. ChatGPT missed several ideas, including

- Cash is universal: cash covers a broad range of transactions, and cash is also a store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More.

- Cash is trust: cash is a public good.

- Cash is efficient: cash is the most widely used payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More, cash is easy to use, costs of cash versus costs of electronic payment instruments, innovation contributes to the efficiency of cash, and cash ensures competition among payment instruments.

- Cash connects people: cash is the most widely used product, cash is a symbol of national sovereignty, and cash contributes to education.

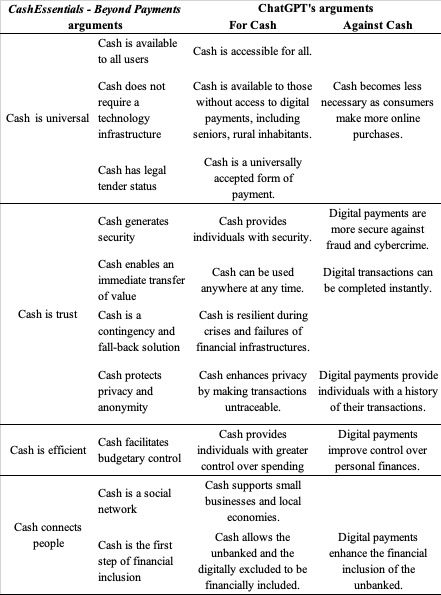

Table 1 compares ChatGPT’s arguments for and against cash to those in the CashEssentials white paperSee Banknote paper. More Cash Essentials – Beyond Payments.

Table 1. ChatGPT’s Arguments For (and Against) Cash

Source: CashEssentials (2015), ChatGPT essays.

An Unbeatable Poem for Cash

ChatGPT’s capabilities for writing poems did surprise us, however.

Write a poem on why contemporary societies need cash (coins and banknotes)

In this age of plastic and screens,

Where digital transactions reign supreme,

Many may wonder what it all means,

But the need for cash remains supreme.

For some, cash is all they’ve got,

No access to banks or digital slots,

It’s the only way to pay their lot,

And for this reason, it cannot be forgot.

With cash, there’s a sense of security,

A physical form that’s tangible, sturdy,

It’s not just numbers on a screen, flimsy,

But something real, that’s trustworthy.

Cash can be used anywhere, anytime,

From corner shops to market stalls so prime,

It’s universally accepted, not confined,

A reliable means of payment so divine.

For small businesses, cash is key,

To pay suppliers, employees, and fees,

It supports local economies, you see,

And keeps money flowing, helps them succeed.

In times of crisis, cash saves the day,

When digital payments fail, banks in dismay,

Cash remains a viable means to pay,

And helps us all get through, come what may.

So let us not forget the value of cash,

Amidst the glitz and glamour of the digital bash,

For it plays a vital role, never to be rash,

In contemporary societies, it’s a necessary stash.

A.I. is Not Prescient

ChatGPT’s capabilities and speed are impressive but do not manifest intelligence or creativity. The chatbot replicated arguments based on its extensive textual training without the capacity to sort them. This A.I. model cannot “think” beyond the data, anticipate or predict the future of cash and payments.