Colombians’ use of cash grows despite Covid-19 pandemic

In December 2020, the National Federation of Retailers (Fenalco), the most influential association of retail trade and services firms in Colombia, and the Colombian Federation of Private Surveillance and Security Firms (FedeSeguridad) released preliminary results from a study about the use of cashMoney in physical form such as banknotes and coins. More and alternate means of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More in Colombia during the Covid-19 pandemic. The report aimed to measure whether cash use had declined with the pandemic.

In the virtual press conference releasing the study’s preliminary results, Jaime Alberto Cabal, president of Fenalco, said that Colombian consumers showed “a remarkable preference for cash.” Nicolás Botero Páramo, executive director of Fedeseguridad, said that cash is “a secure means of payment, widely accepted in all establishments, which allows sellers and consumers to have immediate control of its movements.” The final version of the report, titled “Convenience of the use of cash,” was released in January 2021.

Cash is still king, despite the Covid-19 pandemic

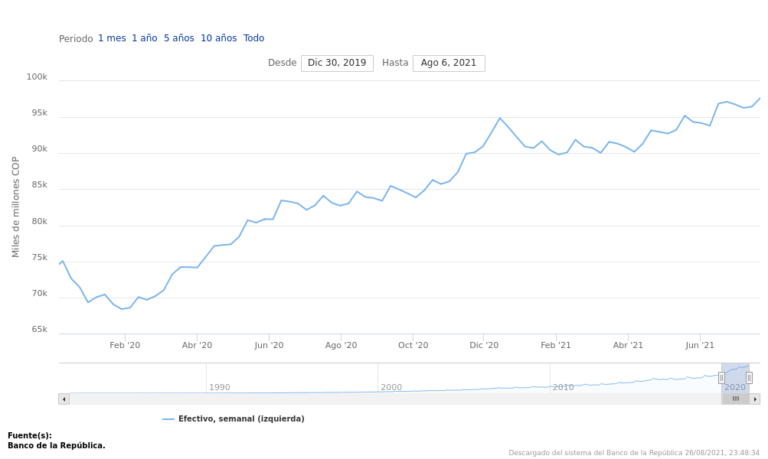

According to data on coins and banknotes held by the public from Banco de la República (the country’s central bank), the demand for cash in Colombia during the first week of November 2020 grew nearly 31% yearly compared to the same week of 2019 (see Graph 1). The comparable figure for the first week of November 2019 was 7.7%. Moreover, in November 2018, Colombian consumers held COP$120 in cash per COP$100 saved in their bank deposit accounts. After the Covid-19 pandemic, in November 2020 Colombians held more cash (COP$138) per COP$100 in their bank accounts.

Graph 1. Colombia: CurrencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in Circulation, January 2020-June 2021

Source: Banco de la República (2021); CashEssentials.

The document asserts that in Colombia, cash and digital payments do not exclude each other, nor are they perfect substitutes or competitors. Cash and other means of payment cater to different users and retailers, reflecting income and wealth inequalities and lack of access to financial products and services. According to the 2019 payment systems report from the Colombian central bank, 37.5% of Colombians had savings accounts, 7.19% had checking accounts, 29.6% had debit cards, and 20.2% had credit cards (Banco de la República 2019: 100-101). The same report stated that the public used cash in 87.7% of all transactions, followed from afar by debit cards and credit cards, with 8.2% and 3.3%, respectively (Banco de la República 2019: 101).

Colombian big and small retailers alike prefer cash due to high commissions on card payments

The Fenalco/Fedeseguridad report surveyed big retailers (supermarkets and department stores) and small retailers (tenderos) about the public’s use of cash and alternate means of payment. Both big and small retailers signaled their preference for cash due to the commissions on card payments, which lessen already diminished margins during the pandemic (Fenalco 2020: 62, 64-65). The report indicates the potential for fintech entrepreneurs to “conquer the juicy world of tenderos with financial solutions made to their image and likeness” (Fenalco 2020: 65).

Responding to the Fenalco/Fedeseguridad report’s publication, the Colombian Banking and Financial Entities Association (Asobancaria), stated that the use of cash sustains “the shadow economy (both the informal and the illegal) since cash transactions are anonymous and facilitate tax evasion and illegal activities.” Recently, Asobancaria’s president Hernando José Gómez stated that the “overuse of cash” is a “blockade for the economic development” of Colombia.