Cuba: Cash and Electronic Payments

“The increase in the use of cashMoney in physical form such as banknotes and coins. More in transactions has led to a decline in financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More. In addition, [there are] high costs associated with its issuance, transportation, processing and storage, and the increasing demand for ATMs to withdraw cash.” – Resolution 111/2023, Central Bank of Cuba (BCC).

Cuba’s economic troubles have worsened since the Covid-19 pandemic. Inflation exceeded 70% in 2021 and reached 39% in 2022. Cubans have long used cash to settle transactions and hold sizable holdings at home.

On August 3, the Central Bank of Cuba (BCC, presided by Che Guevara from 1959 to 1961) issued rules limiting cash transactions to 5,000 pesos ($20 at black market rates) between individuals and companies and curtailing ATM withdrawals. The Cuban government seeks to promote digital payments by forcing the public to deposit their cash holdings in bank accounts.

“Today there is a significant level of cash that is outside the banking system. That moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More does not circulate through the logical paths of the economy and is only traded between people.” – Joaquín Alonso Vázquez, BCC president.

Run for Cash and Long Lines at ATMs

“In the times we are living in, 5,000 pesos is nothing. If I had a lot of money, I would not put it in the bank, because if I need it tomorrow and I go to the bank, they will not be able to give it to me, so I will have to wait three days, or until the bank has enough money” said mechanical engineer Lisandra Pupo, 30 on France24.

Cubans have scrambled to withdraw cash from ATMs.

- “You go to any ATM and there is no money. And tremendous cristóbal colón [huge line or cola in Spanish],” said announcer Yunior Morales in Havana.

- “Not even the employees of a bank know when there will be cash at the ATMs,” said a teacher in Holguín.

Cash in CirculationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More and Bank Deposits

“We are going to have to pay with cocoa seeds, because paperSee Banknote paper. More cash is an illusion. The entire country could be paralyzed at any time.” – Roberto.

Most Cubans use cash and have not adopted digital payments. CurrencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation in Cuba grew 48.3% between 2015 and 2018 (see Graph 1). Current accounts grew 31.7%, sight savings grew 44.5%, and fixed-term deposits grew 22.3% in the same period. The BCC has not published monetary or financial statistics for the years after 2018.

Graph 1. Cuba: Cash in Circulation and Bank Deposits, 2015-2018.

Source: BCC (2023).

Cash and Banking Infrastructure in Cuba

“I couldn’t help but wonder how it was possible the ATM ran out of cash after only an hour of being in service. Isn’t it protocol to fill them up before the bank branch closes? Isn’t it the bank’s responsibility?” – Esther Zoza.

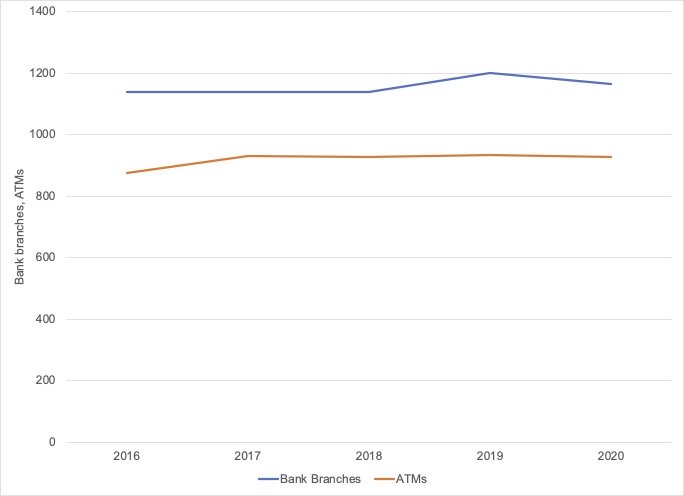

Cuba had barely 100 ATMs in 2001. Between 2016 and 2020, the number of bank branches grew by 2.2%, and the number of ATMs grew by 5.9%. By 2020, Cuba had 1,164 bank branches and 918 ATMs (see Graph 2).

- As Map 1 shows, La Havana concentrates most bank branches (527) and ATMs (195). Many ATMs are technologically obsolete or faulty, and the country lacks spare parts or replacements. (Mora Silvera 2021: 49; Millán Sardiña 2022: 125).

- As of 2020, Cuba had 13 bank branches and 10 ATMs per 100,000 inhabitants, well below the averages for Latin America (19.5 bank branches and 58.3 ATMs per 100,000 people, see Mora Silvera 2021: 51-52).

Graph 2: Cuba: Bank Branches and ATMs, 2016-2020

Source: BCC’s Reporte informativo de inclusión financiera (RIIF, 2020) in Mora Silvera (2021: 50).

Map 1. Cuba: Banking Infrastructure, 2020 (Access Points per 100 km2 in La Havana and 1,000 km2 by Province)

Source: BCC’s RIIF (2020) in Mora Silvera (2021: 98).

Between 2019 and 2020, ATM withdrawals grew by 25.5% by volume and 81.6% by value (Millán Sardiña 2022: 125, see Graph 3). Service payments and card transfers represent a small share of ATM operations. ATM operations grew 30.8% between 2017 and 2020 (Mora Silvera 2021: 55).

Graph 3. Cuba: ATM Operations, 2019-2020

Note: Extracción de efectivo – ATM withdrawals; Pagos de servicios – Service payments; Transferencia entre tarjetas – card transfers.

Source: Millán Sardiña (2022: 121).

Electronic Payments

“To install point-of-sale terminals, a communication line is required. Now imagine how much investment we would need to put terminals in all points of sale.” – Joaquín Alonso Vázquez, CC president.

The BCC has long sought to promote and consolidate electronic payments by modernizing the wholesale and retail payments infrastructure. However, Cuba has made little inroads toward this goal.

- Cellphone and internet connectivity are unreliable. Many Cubans lack smartphones. Per the BCC, 7.6 million Cubans have cell phones, 83% of Cuba has digital coverage, 73% has 3G connectivity, and 50% has 4G coverage.

- Cuba had 550,000 RED debit cards in 2001; there were 8.91 million debit cards and 1,846 point-of-sale (POSAbbreviation for “point of sale”. See Point-of-Sale terminal. More) terminals in 2020. According to BCC director Julio A. Pérez Álvarez, Cubans currently have 15 million cards.

- Due to inefficiencies in manufacture and distribution, it takes up to 21 days for Cubans to obtain a RED card and PIN (Millán Sardiña 2022: 119).

- The country has few POS terminals: they declined 74.5% between 2016 and 2020, while RED debit cards grew 86.3% between 2018 and 2020 (see Graph 4). Most POS terminals are in La Habana (463). Most retailers refuse to adopt POS terminals due to a lack of incentives, high operation costs, and a lack of telephone lines (Millán Sardiña 2022: 49).

Graph 4: Cuba: POS Terminals and Debit Cards, 2016-2020

“All payments between economic actors must be based on the paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More methods established by the BCC, prioritizing electronic channels.” – Alberto Quiñones Betancourt, BCC vice president.

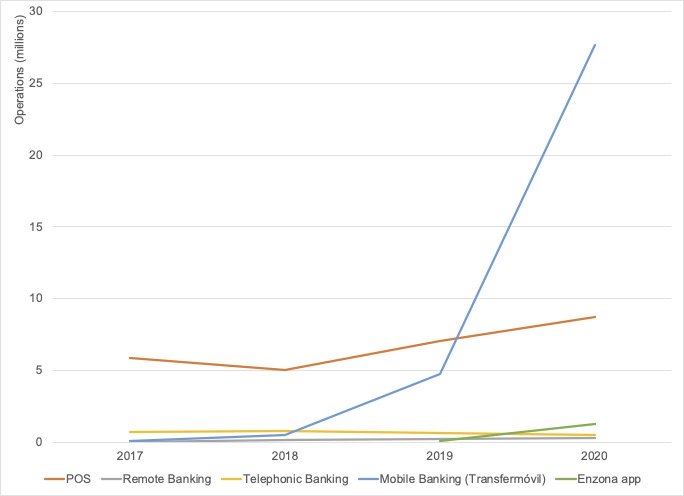

Between 2017 and 2020, POS transactions grew by 48% (see Graph 5). Mobile and remote banking operations have increased by 58,722% and 637% in the same period; telephonic banking declined by 33.1%. Operations through the Enzona payment app grew by 2,399.2% between 2019 and 2020.

Graph 5. Cuba: Individuals’ Operations by Digital Payment Channels, 2017-2020

Source: BCC’s RIIF (2020) in Mora Silvera (2021: 55).