ECB calls for Greece to drop Cash Payment Limitations. But what about the other Countries?

On 19 November 2019, the European Central Bank (ECB) received a request from the Greek Ministry of Finance for an opinion on certain amendments to the draft Tax Law seeking to further expand already existing tax restrictions on the use of cashMoney in physical form such as banknotes and coins. More. According to the government, the measure is designed to combat tax evasion and broaden the tax base. The draft bill tightens measures already adopted in 2016 that promote the broader use of electronic paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More instruments in Greece.

The first measure requires taxpayers to settle a certain amount of their expenses by means of electronic payments. If this minimum quota is not reached, an additional 22% tax is charged on the difference, and taxpayers are no longer eligible to benefit from currently applicable income tax credits. The quotas are based on existing income brackets and range from 10% to 20%. The draft law proposes to raise the quota to 30%.

The second measure provides that any single cash payment for the acquisition of goods and services exceeding EUR 500 for consumer-to-business transactions is prohibited and that such payment may only be made via electronic means. The draft proposes to lower this to €300.

For the ECB “there should be clear evidence that such limitations are likely, in fact, to achieve the stated public goal of combating tax evasion.” In 2018, after a two-year consultation, the European Commission decided not to impose EU wide limitations on cash payments and concluded that “While tax fraud and the use of cash are often associated, the study demonstrates that the relationship between the two is not always clear-cut.” The European Commission Recommendation 2010/191/EU states that the acceptance of payments in cash should be the rule, but acknowledges that cash may be refused for reasons related to the ‘good faith principle’, without this constituting a breach of the legal tenderMoney that is legally valid for the payment of debts and must be accepted for that purpose when offered. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered (“tendered”) in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. More status of cash.

The ECB considers that “the existing limit on cash payments of EUR 500 for consumer-to-business transactions, and the new tax incentives discouraging companies from spending cash in excess of EUR 300, are disproportionate in light of the potentially adverse impact on the cash payment system.” Cash transactions above the defined thresholds should be permitted as long as the parties are able to ensure that the payment is traceable by identifying the amount, the reason for the transaction and the parties involved.

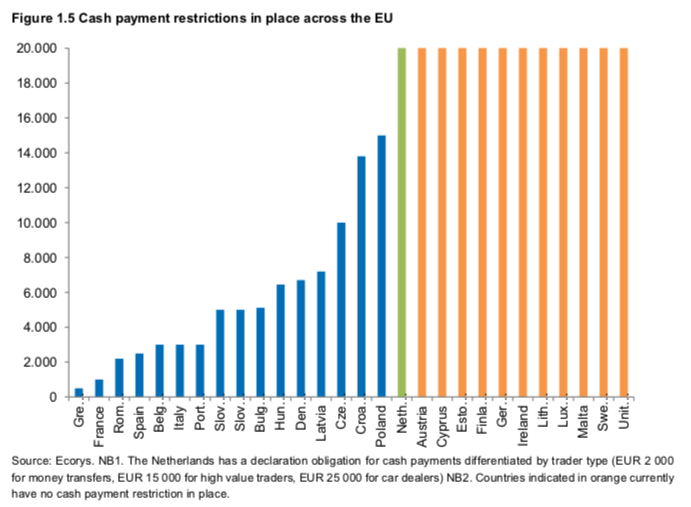

It is noteworthy that 17 out of 28 Members States of the European Union have introduced cash payment limitations. Thresholds vary significantly as illustrated by the chart below published in the Ecorys-CEPS Study on an EU initiative for a restriction on payments in cash, ranging from €500 in Greece to over €14,000 in Poland.

In her recent address on the occasion of the signing of the euro banknotes, Christine Lagarde, President of the ECB declared: “But the euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More is one thing we all have in common. It serves as the most tangible symbol of European integration, a process which has brought peace, freedom and prosperity to our continent.” Perhaps it is time to drop restrictions on the use of the euro.