Germany: Only Cash is Real

CashMoney in physical form such as banknotes and coins. More is King in Germany

In Germany, 62% of point-of-sale transactions and 87% of person-to-person transactions are paid in cash; according to the European Central Bank, Germans withdraw an average of €6,600 yearly from ATMs. Cash usage has declined in the last decade, as it accounted for 77% of payments in 2019. However, a majority of Germans still prefer cash over digital payments:

- In a YouGov survey of 2,069 adults (2021), 36% preferred to use cash in payments; 45% said they had wanted to pay with cards at establishments that only accepted cash, and 29% said cash gave them more control over their spending.

- In a Deutsche Bundesbank survey of 2,718 respondents (2021), 77% said they had never heard of the digital euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More, and just 13% supported introducing a digital euro (Deutsche Bundesbank Monthly Report October 2021: 71-72).

Cash and the Covid-19 Pandemic

In 2019, the Bundesbank’s net issuanceThe value or units of banknotes (or coins) issued by a central bank over a period, minus the equivalent withdrawn from circulation during the same period. A positive net issuance expresses an increase in circulation during the period. More reached €60 billion; in 2020, it increased to nearly €70 billion (Deutsche Bundesbank Monthly Report October 2021: 69-70). The demand for banknotes peaked at €21 billion in March 2020, beginning the Covid-19 pandemic (see Graph 1).

Graph 1. Germany: Bundesbank’s Monthly Net BanknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More Issuance, 2019-2021

Source: Deutsche Bundesbank (Monthly Report October 2021: 69).

Younger people had backup emergency cash to finance consumption. In a Bundesbank survey (Monthly Report October 2021: 69-70), 44% of participants said they held cash reserves, but holdings vary depending on age:

- 51% of respondents under 30 owned cash reserves, while only 38% of those aged 65 and older did so.

- 37% of respondents under 30 and 65% with net household incomes of more than €6,000 said they had increased their cash reserves since March 2020.

Nur Bares ist Wahres: Only Cash is Real

Several news items illustrate the dominance of cash in Germany.

- Cash and public transit: The Berlin public transport company (BVG) refused to accept cash since March 2020 due to the Covid-19 pandemic. Users could only pay with BVG cards, credit cards and contactless payments. The passenger association IGEB and members from the red-green-red coalition (SPD, the Greens, and Die Linke) pushed to revert this decision. BVG restarted cash payments for bus tickets in January 2023.

- Card discounts: In June 2020, the bakery chain Kamps started offering a 3% “innovation discount” to customers who paid by card. The chain provided subsidised paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More terminals to franchise partners with high cash managementManagement and control of cash in circulation. More costs. The chain said card and mobile payments were more “hygienic, more flexible and faster.”

- Cash is a “tyrant”: 74% of 1,007 respondents to a 2021 Bitkom survey said they wanted to be able to make digital payments everywhere. “We need real freedom of choice when paying. It’s not about getting rid of cash, but leaving customers free to decide how they want to pay at any location. Nobody should be forced to carry cash with them all the time,” said Bernhard Rohleder, the Bitkom digital association director.

- Banks preserve the cash infrastructure: In June 2022, Deutsche Bank announced it would stop allowing customers to pick up cash at its counters as part of measures to increase profitability. “In the future, I don’t want to offer cash in the branches anymore, because holding cash incurs costs,” said Lars Stoy, Deutsche Bank’s head of domestic retail banking operations. The entity did not annountoit would implement the policy and said it would preserve its existing ATM infrastructure.

Blowing-Up ATMs

Germany has 53,000 ATMs, reflecting the public’s preference for cash. Cases of data theft (skimming) at ATMs have been declining, from €34 million in 2011 to €1.06 million in 2020. But machine blow-ups are on the rise: in the last years, burglars have targeted ATMs, using explosives to access their safes and escape speeding to Autobahns.

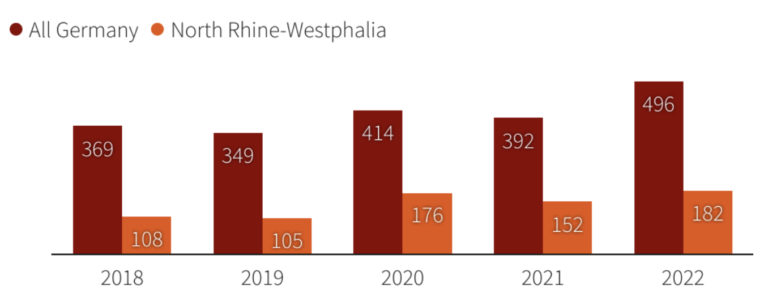

- ATM thefts have increased by 40% since 2019, with 496 attacks in 2022, most in western Germany, such as North-Rhine Westphalia, a state with 11,000 ATMs (see Graph 1).

- In 2020, perpetrators captured €1 million; in 2021, they stole €20 million.

- According to Boris Pistorius, then interior minister of Lower Saxony, criminals target German ATMs as they lack security measures. Belgian, Dutch and French ATMs use ink staining technology (IBNS) to protect cash held in ATMs.

Graph 1. Germany and North-Rhine Westphalia: ATM Thefts, 2018-2022

Source: German interior ministry, North-Rhine Westphalia police in Reuters (2023).

Die Welt reported the culprits are part of a “700-member network” of Dutch-Moroccan criminals. German police estimate Dutch ATMs raiders have carried out 70% to 80% of attacks in Germany.

- “ATM robbers can also be added to the list of Dutch export products such as cheese and tulips. In Germany, ATMs are often still easy to crack, as if they were biscuit tins,” said Marc Wösten, a Dutch forensic expert.

- In October 2021, the Dutch and German authorities arrested nine suspects who had ordered ATMs and recorded step-by-step tutorials on how to blow them up.

- In February, the Dutch police arrested four men suspected of blowing up an ATM in a shopping centre in Mülheim an der Ruhr. Their vehicle had large quantities of stained banknotes.

- In March, German police detained 42 people suspected of blowing up ATMs to steal cash during the night.

Explosions have injured pedestrians and damaged homes, according to Oliver Huth, chairman of the state branch of the German Criminal Police Association (BDK) in North-Rhine Westphalia.

- “Anyone who blows up cash machines risks the life of people who aren’t involved,” said Interior Minister Nancy Faeser.

Many banks are closing cash machines to customers overnight and are reluctant to adopt blanket measures, advocating for a case-by-case approach. “Different locations come with different risks. There is currently no one-size-fits-all solution,” said a spokesperson for Deutsche Kreditwirtschaft, an industry group.