Italian Government Subsidizes Non-Cash Payments

Cash Accounts for 82% of Transactions

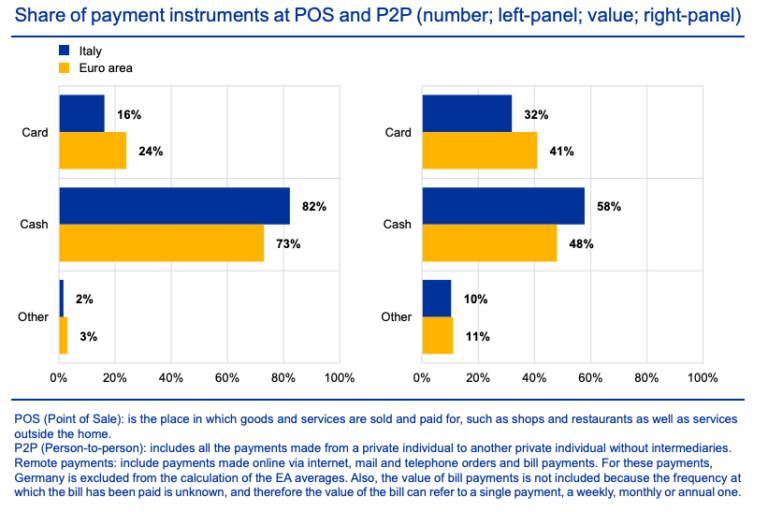

Italy is often considered as a cash-intensive country. According to the recent ECB Study on the PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More Attitudes of Consumers in the EuroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More Area (SPACE), in 2019, 82% of the volume and 58% of the value of Point-of-Sale and Person-to-Person transactions were settled in cashMoney in physical form such as banknotes and coins. More in Italy compared to euro-area averages of respectively 73% and 48%.

Source: ECB SPACE study

A new so-called cashback initiative, launched on 8 December, offers an automatic refund from the state to citizens making in-store purchases with a payment card or smartphone app, as long as they first registerSee See-through register. More on the national IO app. 7.6 million people downloaded the app on the day of the scheme’s launch. This resulted in technical glitches, with many people complaining they could not activate the IO app. Blaming the huge volume of requests to access the system, the operators admitted some “inefficiencies” but said they were being addressed.

A 10% Refund on Non-Cash Payments

The cashbackA service whereby the customer pays electronically a higher amount to a retailer than the value of the purchase for goods and/or services and receives the difference in cash. It is also a reward system associated with credit card usage, whereby the consumer receives a percentage of the amount spent on the credit card. More programme includes purchases made in shops, bars, restaurants as well as from craftsmen, and professionals.” says the website. Online transactions are excluded. Prime Minister Giuseppe Conte said that bringing forward the cashback scheme – originally slated to begin on January 1 – aimed to direct pre-Christmas spending towards brick-and-mortar shops that suffered during the lockdown.

Between 8 and 31 December 2020, with the Christmas Extra Cashback programme, consumers will receive a 10% refund up to a maximum of 150 euros on the condition that they make a minimum of 10 purchases with a payment card. January 2021.

After January 1, 2021, shoppers will receive a 10% refund on the amount of purchases they make with cards or payment apps. There is no minimum amount of expenditure and it is possible to obtain reimbursements of up to 300 euros per year. Every 6 months, consumers who make a minimum of 50 payments, will receive 10% of the amount spent, up to a maximum of 150 euros in total reimbursement.

The “Italia Cashless” programme also includes a lottery mechanism with prizes for shoppers who total the highest number of transactions.

A Subsidy of €3 billion per Year for Digital Payments

The government has earmarked 1.75 billion euros for the scheme for 2021, and three billion for the following year. It hopes that encouraging people to pay digitally will reduce the chronic tax evasion that costs the public up to 100 billion euros per year according to official estimates.

The programme does not support those who are financially excluded. The ECB Space survey shows that 10% of the population do not have access to cards. And it is still common in Italy for shops to refuse card payments. In addition, the government plans to lower the ceiling for cash payments from €2,000 to €1,000 from January 2022.

The initiative also appears rather countercyclical as many countries have experienced a shift towards digital payments during the pandemic. The combined sales of Alphabet, Amazon, Apple and Facebook grew by 18% year on year while after-tax profits increased by 31% to $39 billion. It is not certain they required an additional boost from the Italian taxpayer.