BIS Bolsters Trust in Cash

An unprecedented public debate

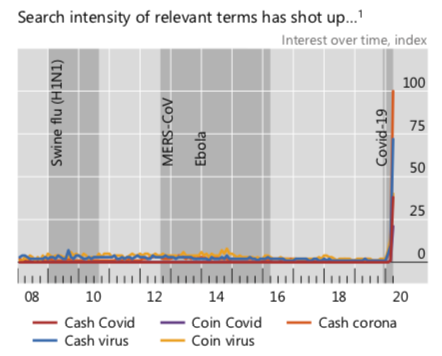

According to the report, the Covid-19 pandemic has generated an unprecedented public debate on the risk of transmission of the virus by banknotes and coins. The number of internet searches associated with cashMoney in physical form such as banknotes and coins. More and Covid are skyrocketing as illustrated by the chart below.

Source: Covid-19, cash, and the future of payments; Bis Bulletin n°3; 3 April 2020

Promoting Trust in Cash

A number of central banks – Austria, Canada, Finland, Germany, Luxembourg, New Zealand, Sweden – have actively communicated to promote trust and acceptance of cash and emphasise that there is no evidence they play a role in spreading coronavirus. Several central banks – Austria, Germany, Morocco, New Zealand – have emphasised that the supply of cash is secure during the crisis. Some central banks – China, Hungary, Kuwait, South Korea, Russia, the US – have taken measures to sterilise or quarantine banknotes. Some central are promoting contactless payments.

Source: Covid-19, cash, and the future of payments; Bis Bulletin n°3; 3 April 2020

The key take-aways from the report are:

- The Covid-19 pandemic has fanned public concerns that the coronavirus could be transmitted by cash.

- Scientific evidence suggests that the probability of transmission via banknotes is low when compared with other frequently-touched objects, such as credit card terminals or PIN pads.

- To bolster trust in cash, central banks are actively communicating, urging continued acceptance of cash and, in some instances, sterilising or quarantining banknotes. Some encourage contactless payments.

- Looking ahead, developments could speed up the shift toward digital payments. This could open a divide in access to payments instruments, which could negatively impact unbanked and older consumers. The pandemic may amplify calls to defend the role of cash – but also calls for central bank digital currencies.

Strengthening the role of cash

The authors also stress that “If cash is not generally accepted as a means of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More, this could open a ‘payments divide’ between those with access to digital payments and those without. This in turn could have an especially severe impact on unbanked and older consumers. In London, one reporter (Hearing (2020)) has already noted the difficulties of paying with cash, and the consequences for the 1.3 million unbanked consumers in the United Kingdom. In many of the emerging market and developing economies where authorities have recently called for greater use of digital payments, access to such alternatives is far from universal. This could remain an important debate going forward, potentially asking for a strengthening of the role of cash.”

This post is also available in:

![]()