CBDC and Cash in the Euro Area: Crowding Out or Co-Circulation?

Gerhard Rösl and Franz Seitz investigate how the digital euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More could coexist alongside banknotes and coins.

Demand for Cash Remains Strong

CashMoney in physical form such as banknotes and coins. More usage at the point of sale decreased perceptibly in the past years. This is partly due to the ongoing trend towards digitalization. Still, there are indications that consumers were nudged towards digital payments by government regulations and supply-side restrictions by commercial banks. Nonetheless, overall demand for euro cash remained strong and even increased relative to GDP since the financial crisis in 2008.

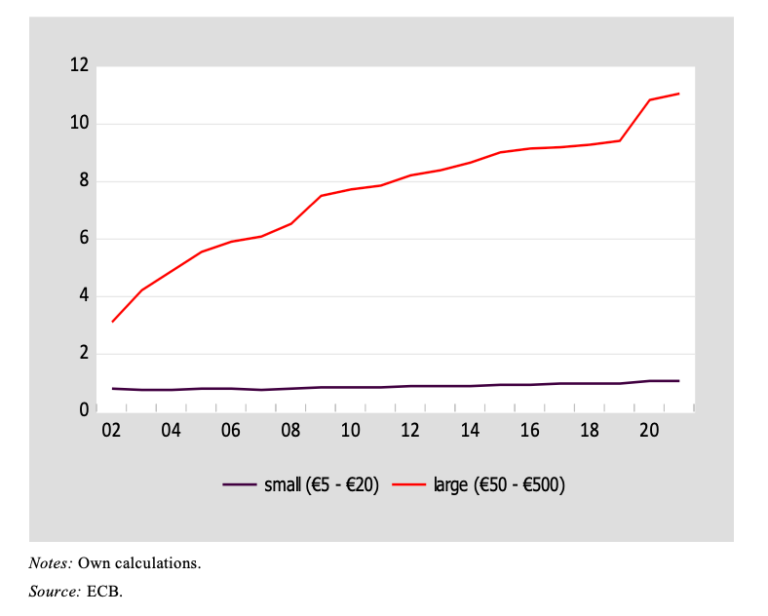

However, Figure 1 illustrates that small denominations (€ 5- € 20) have been remarkably stable in GDP terms, at around 0.9%, indicating steady transactional demand for cash. By contrast, large denominations have increased approximately four times faster than GDP and have reacted positively to crises such as the Global Financial Crisis or the Covid-19 pandemic.

Fig. 1. Small (€5 – €20) and large (€50 – €500) euro banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More denominations in circulation in % of nominal GDP (2002 – 2021)

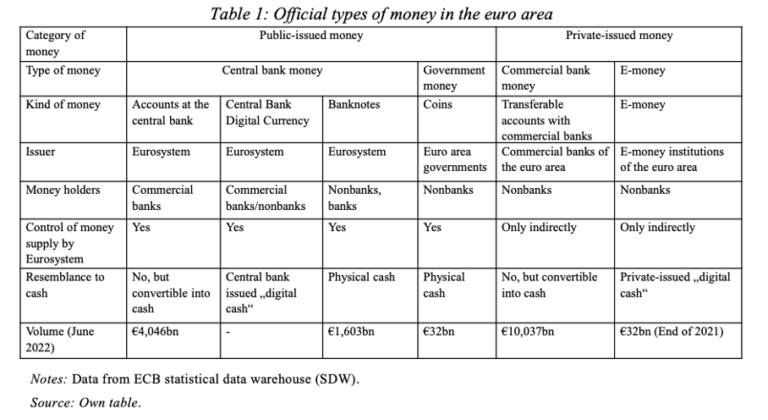

Central banks worldwide are considering the potential issue of a Central Bank Digital CurrencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More as a substitute or complement to cash. Although the characteristics of a possible digital euro have become more perceptible, its fundamental design properties remain unknown. Rösl and Seitz categorise different types of moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More (Table 1) currently circulating in the euro area and look at how a CBDC would fit.

A Digital Euro Will Not Match the Attributes of a Cash

According to the latest survey by the Bank for International SettlementThe discharge of an obligation in accordance with the terms of the underlying contract. In e-transfers the settlement may take days, whereas cash settlements are instantaneous and irreversible. More, 90% of 80 surveyed central banks are currently engaged in CBDC work, mainly focusing on retail CBDC as a cash-like claim on the central bank, but where the private sector handles all customer-facing activities (Kosse/Mattei 2022). Rösl and Seitz emphasize that although the ECB explicitly keeps all design options open, there are signals that a digital euro will not match some of the critical attributes of cash.

Firstly, it should not be used as a saving instrument (Panetta 2022b). For that reason and to avoid systemic risks from a possible flight into CBDC in times of financial crisis, individual holdings of digital euros will be either limited or indirectly restricted by tiered remuneration.

Secondly, the digital euro will not offer the same complete anonymity as cash. Money holders will be required to identify themselves when they purchase digital euros, preferably at a supervised intermediary such as a commercial bank.

Thirdly, it is unclear whether there will be sufficient demand for the digital euro. But given the information currently available, there seems to be little interest in the new digital money by consumers who want to pay anonymously. These people will likely continue using cash for at least as long as supply-side restrictions by commercial banks and government limitations on cash usage will not intensify. A 2022 survey by the Austrian central bank showed that two-thirds of respondents had never heard of a digital euro. Most respondents wanted cash to keep an essential role in the future.

In conclusion, Rösl and Seitz stress that cash is far from being outdated as domestic and foreign residents continuously seek euro banknotes as a highly liquid store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More. Around 80% of total euro cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More is not used for domestic transactional purposes.

“It is very hard to predict what role a digital euro will play in the future paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More markets. Our guess, however, is that there will be a co-circulation with cash in the coming decades.” Gerhard Rösl and Franz Seitz

The final decision to introduce or not the digital euro will not be taken before autumn 2023.

This post is also available in:

![]()