New study finds that cash is cheapest payment instrument

The paperSee Banknote paper. More was authored by Santiago Carbo-Valverde and Francisco Rodriguez-Fernandez. Santiago Carbo-Valverde is a Professor of Economics and Finance at the Bangor Business School in the United Kingdom and of CUNEF Business School in Madrid. Francisco Rodriguez-Fernandez is a Professor of Economics at the University of Granada in Spain. He is a senior economist at Funcas and the Funcas Observatory of Financial Digitalization, the main research centre on financial digitalization studies in Spain.

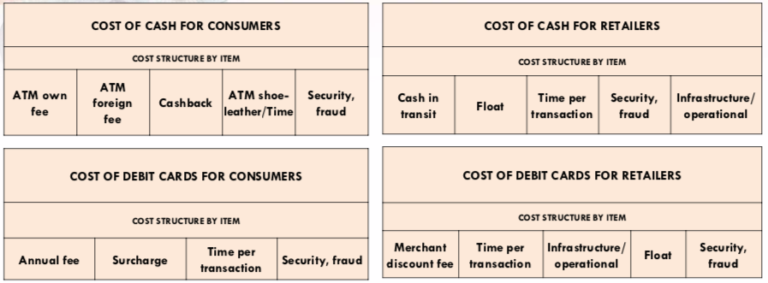

The study identifies and measures the main cost items of cashMoney in physical form such as banknotes and coins. More and debit cards for consumers and retailers. 19 different cost components were identified.

The unit cost of debit cards is 2.8 times larger than the cost of cashAlthough banknotes are delivered to the citizens free of charge and their use does not involve a specific fee, costs are generated during their manufacturing, storage and circulation process, which are covered by different social agents (central banks, commercial banks, retailers etc). More

The report concludes that globally, the unit cost of debit cards is 2.8 times larger than the cost of cash. For an average retail transaction of $59, this would imply:

- A transaction cost of $0.54 for a cash paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More

- A transaction cost of $1.52 for a debit card

There are significant variations across geographic areas but cash is cheaper than debit cards in all.

Cash persistence is not only related to (old) habits but also to a number of convenience and cost advantages

In the case of cash, ATM fees are by far the main cost item for consumers and represents 92% of costs. For retailers, cash-in-transit represents the two thirds of cost the transaction time represents 23%.

In the case of debit cards, annual fees represent 70% of consumers’ costs while transaction time represents 23%. For merchants, the merchant discount fee represents 82% of costs.

Most of the cost is borne by retailers. In the case of cash, they assume 56.14% of the cost and 54.7% in the case of debit cards.

Measured in relation to GDP, cash represents 0.114% versus 0.252% in the case of debit cards.

The report also concludes that banks generate a profit margin when they distribute cash. The average costs of cash distribution including cash-in-transit and ATM operating costs are lower than ATM revenue.

Bundesbank study also finds cash is cheapest payment option

In February, the Deutsche Bundesbank also concluded that cash is quick and cheap. The study found that cash payments costs 24 cents on average compared with 34 cents for a debit card transaction.

Download the report below:

This post is also available in:

![]()