U.S.: Consumer Payment Behaviour Consistent with Early Pandemic

CashMoney in physical form such as banknotes and coins. More is the Third Most Used Payment InstrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More

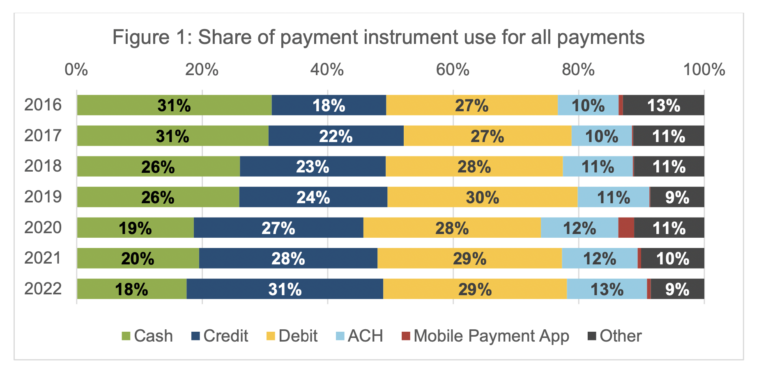

The 2023 Findings from the Diary of Consumer Payment Choice show that the share of payments in cash declined slightly from 20% in 2021 to 18% in 2022. However, the authors, Emily Cubides and Shaun O’Brien, emphasize that this is driven by increased non-cash payments rather than decreased cash payments. Cash remains the third most-used paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More instrument. Credit cards are the primary winner and have seen their share increase from 18% in 2016 to 31% in 2022. Debit cards have remained roughly stable. Mobile payments peaked in 2020 and have not increased and are barely visible on the chart, with a share of less than 1%.

Four factors explain the decline in cash payments, according to the report:

Four factors explain the decline in cash payments, according to the report:

- A higher share of online transactions, compared to before the pandemic, resulting in fewer cash payments

- A lower number of low-value transactions (under $25) for which cash is widely used compared to pre-pandemic levels.

- Lower usage of cash for in-person payments

- A declining preference for cash as consumers enjoy the rewards provided by credit cards.

Payment Choice is Increasingly Fragmenting Society

Before the pandemic, household income was a discriminating factor regarding cash usage, with lower-income households using cash more frequently than higher-income households. On average, families making less than $25,000 per year used cash at a rate over three times greater (36%) than those from households earning more than $150,000 (10%).

Similarly, unbanked people use cash four times more frequently than those with a bank account. To a large degree, the unbanked consumers belong to lower-income households. Since the beginning of the pandemic, their reliance on cash has increased, representing 55% of all payments in 2019 to 73% in 2022 and 66% in 2022.

However, since the pandemic, age has also become a discriminating factor, with older consumers more likely to use cash than younger ones, who tend to use debit cards. This means that the use of cash has fallen by 20 percentage points between 2019 and 2022 for the 18-24 year-olds, whereas it has dropped by only 7 and 11 percentage points, respectively, for the 35-44 year-olds and the 45-54 year-olds.

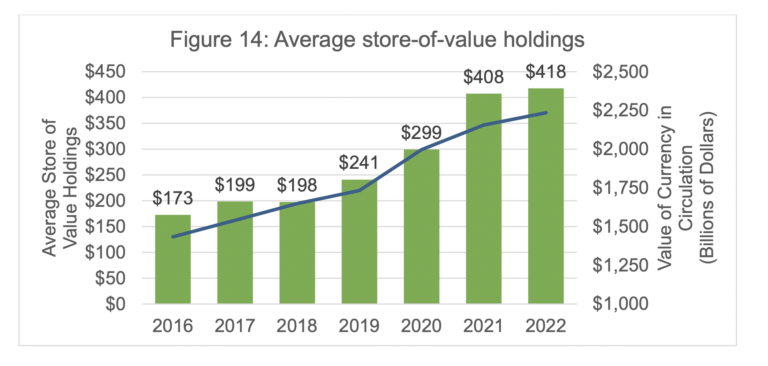

Increasing Demand for Cash as a Store-of-Value

The report shows that in parallel to the declining use of cash for payments, consumer cash holdings have continued to increase in 2022. In value, currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation grew by 3.3% in 2022 compared to 7.4% in 2021 and 22.8% in 2020, clearly showing that cash demand increases in times of uncertainty.

The Fed distinguished between “on-person holdings” (cash in one’s pocket, purse, or wallet) typically used for transactions and “store-of-value holdings” (cash held in one’s home, car, or elsewhere).

On average, in 2022, consumers carried $73 compared to $60 in 2019. Since the pandemic, the share of consumers holding cash remained steady at 79%, while the figure decreased between 2016 and 2019. Somewhat counterintuitively, the younger age groups have increased their cash holdings the most.

Store-of-value holdings have grown far more spectacularly since 2019, from an average of $241 per person 2019 to $418 in 2022 (+73%). The growth rate slowed in 2022 but remained positive, in line with the growth of the currency in circulation.

93% of Consumers Have no Plans to Drop Cash

Finally, 93% of respondents have indicated they have no plans to stop using cash. In addition, when asked if an utterly cashless society would be problematic, only 30 per centFraction of a currency representing the hundredth of the unit of account. More of consumers answered ‘no’. In contrast, the remaining consumers believed it would be inappropriate or were uncertain if it would be problematic.

This post is also available in:

![]()