Russia: Digital Payments and Western Sanctions

Cash v. Digital Payments, 2010-2021

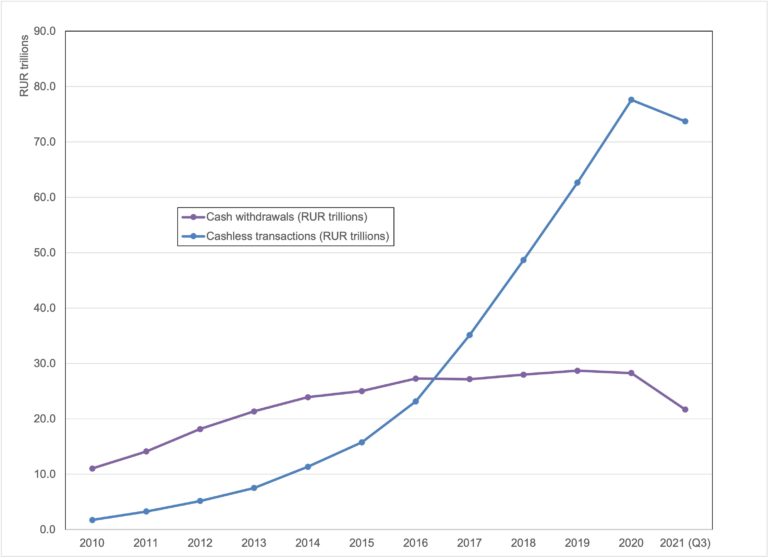

According to the Bank of Russia (CBR), card payments thrived from the mid-2010s through 2020. Cash withdrawals surpassed digital transactions by volume until 2012 (Graph 1, panel A). By value, cash withdrawals were bigger than digital transactions until 2016 (Graph 1, panel B). Digital transactions increased in 2020 during the Covid-19 pandemic but fell by volume (-7.2%) and value (-5%) in 2021.

Graph 1. Russia: Cash Withdrawals and Digital Transactions by Volume (billions of transactions) and Value (RUR trillions), 2010-2021

|

A. Volume |

B. Value |

|

|

Note: Figures include cash withdrawals and digital (“cashless”) transactions with cards issued by Russian and foreign banks. Figures for 2021 exclude Q4. Source: CBR National Payment System statistics (“Key Indicators of the National Payment System (NPS) development”); CashEssentials.

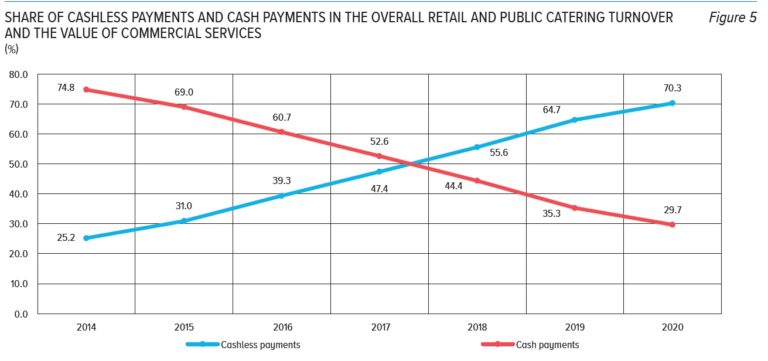

According to the CBR, digital payments surpassed cash in Russia’s retail turnover in 2018 (see Graph 2).

Graph 2. Russia: Digital Payments (blue) and Cash (red) in Retail Turnover (percentages), 2014-2020

Source: CBR 2021: 9.

Debit cards dominate payment cards in Russia. Their number doubled between 2011 and 2021. (see Graph 3). Credit cards numbers increased until 2015 and have been stable since. Electronic point-of-sale terminals (POS) experienced double-digit growth rates between 2010 and 2020, but their number declined in 2021.

Graph 3. Russia: Payment Cards and Electronic Terminals (millions), 2011-2021

Source: CBR National Payment System statistics (“Key Indicators of the National Payment System (NPS) development”); CashEssentials.

Financial Inclusion in Russia

According to the World Bank’s Global Findex Database, in 2017,

- 75% of Russians (age 15 and older) had an account at a financial institution.

- 57% of Russians owned a debit card, and 20.08% had a credit card.

- 52% of Russians had made or received digital payments.

- 24% of Russians used a mobile phone or the internet to access a financial account.

According to the World Bank’s World Development Indicators, in 2020,

- There were 163.58 mobile cellphone subscriptions per 100 Russians.

- 85% of the Russian population used the internet.

Digital Payments and the Covid-19 Pandemic

The CBR promoted digital payments during the Covid-19 pandemic:

- The CBR recommended creditors “to communicate with borrowers remotely (by telephone).”

- The central bank reduced banks’ commissions for electronic transfers between individuals.

- It also said it was considering setting maximum commissions for online payments made with cards “to enable citizens to make uninterrupted online purchases of food and medicines without visiting stores, as well as to support online commerce.”

In 2020, there were 56 billion digital transactions in Russia, totalling 914.2 trillion roubles (RUR) and 27.2 billion contactless transactions, at RUR22.7 trillion (CBR 2021: 6, 7). The share of digital payments in retail turnover increased from 64.7% in 2019 to 70.3% in 2020.

Cyber thefts have increased too, rising to nearly RUR9.8 billion.

- During the pandemic, criminals sent phishing e-mails.

- Fraudsters also called Russians by phone to offer “deferrals for loan repayment, various compensations, benefits, refunds for air tickets, services to diagnose contamination [sic] with the coronavirus infection, and volunteer services” to get customers’ personal information, according to the CBR.

Do you Take Mir?

In April 2014, Visa and Mastercard suspended operations in Russian-annexed territories in Ukraine. Shortly after, the CBR established the National Payment Card System (NPCS) and the Mir (“World”) card scheme, an alternative to Visa and Mastercard. Mir cards have grown in Russia, totalling 108.6 million in 2021. However, Mir cards are not accepted worldwide.

The CBR also launched the NPCS-based Faster Payments System in 2019 to enable Russians to “transfer funds to each other using mobile phone numbers, pay for purchases, pay utility bills,” among other transactions. The FPS slowed down on March 5 due to intensive DDoS attacks on telecom providers.

Western Sanctions Disrupt Card and Mobile Payments

Mobile and card payments operate with glitches since Western countries imposed sanctions against Russia following the invasion of Ukraine.

- At first, the CBR said that sanctioned bank cards could still be used “all over Russia to facilitate payments for goods and services, money transfers, and transactions in ATMs without limitations.” The central bank acknowledged those cards cannot be used “outside Russia.”

- The Singaporean student in Moscow, Jeremy Lim, 32, said he could use his Visa card until Sunday, February 27. A barista at a coffee shop in Moscow noted that Apple Pay, Google Pay, and MasterCard were not working, but customers could still use Visa. Domestic and foreign credit cards occasionally failed in Moscow, said Masha Gessen, a New Yorker staff writer.

- Moscow commuters can no longer pay their subway fare with their phones. “I always pay with my phone but it simply didn’t work. There were some other people with the same problem. It turned out that the barriers are operated by VTB Bank which is under sanctions and cannot accept Google Pay and Apple Pay. I had to buy a metro card instead. I also couldn’t pay in a shop today – for the same reason,” said Daria, 35, a project manager in Moscow.

- “I’m used to living in the 21st century, without carrying plastic cards around. Everything is installed on my smartphone. I’m definitely against it,” said Sergei, a Moscow resident who has not used cash or cards for five years.

- “I want to have a month worth of cash in case there are technical glitches with cards. I already had problems paying for a taxi with Google Pay yesterday,” said Ekaterina, a Moscow resident.

On March 5, payment networks Visa, Mastercard, and American Express announced they would suspend operations in Russia. According to the Nilson Report, Visa and Mastercard cards accounted for 74% of payment transactions in Russia in 2020.

- President Volodymyr Zelensky reached out to VISA CEO Alfred Kelly on February 27. “That was the initial sign to me about the pressure we would feel […] to put pressure on the Russian government,” said Kelly. On March 5, President Zelensky told U.S. lawmakers Visa and Mastercard should stop handling transactions in Russia. That evening, Visa and Mastercard announced they would suspend operations.

International money transfer firms including Western Union, Remitly Global, Wise, and WorldRemit Group have also suspended service, further isolating Russia’s financial system.

- Russian cardholders “will be able to carry out transactions in ATMs and make payments with these cards and card-to-card transfers,” said the CBR.

- The CBR said that “cross-border transactions with MasterCard and Visa cards will be unavailable” for “foreign online stores and transactions abroad.” Only countries connected to the Mir network (Turkey, Vietnam, Armenia, and Belarus) accept Russian cards.

- Resister to the Putin regime fleeing Russia have trouble accessing their bank accounts. Lika Kremer, a forty-four-year-old media executive from Moscow in Tbilisi (Georgia), withdrew several thousand dollars in cash before her bank cards stopped working.

- Russian banks will reissue Mir cards for their customers. Banks might also issue cards using China’s UnionPay or Japan’s JCB networks. There are shortages of UnionPay plastic cards, however.

- Russian cards no longer work in Apple Pay and Google Pay.

- Foreign-issued cards will no longer work in Russia.