The Forever War and a Pandemic: Cash and Payments in Afghanistan

CashMoney in physical form such as banknotes and coins. More in Afghanistan during the “Forever War” and the Covid-19 Pandemic

Da Afghanistan Bank (DAB), the country’s central bank, did not issue new banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More issues during the first Taliban regime (1996-2001). People accepted DAB notes from the Islamic State of Afghanistan (1992-1996) in daily payments.

Inflation rendered small denominationEach individual value in a series of banknotes or coins. More notes nearly worthless. People carried la However, old DAB cash recovered some of its value after the U.S.-led invasion of Afghanistan in 2001. After the first Taliban regime fell, the DAB removed three zeros from the currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More (van Rooden, Dicks-Mireaux 2005).

The DAB started issuing banknotes of 1, 2, 5, 10, 20, 50, 100, 500, and 1,000 afghanis (AFN) and minted coins of AFN1, 2, and 5. The DAB notes found wide acceptance in daily payments across Afghanistan (see Graph 1). According to DAB data, currency in circulation grew 23.3% between May 2019 and May 2020.

Graph 1. Afghanistan: Currency in Circulation, December 2006-April 2021

Source: DAB Monetary and Financial Statistics (2021), CashEssentials.

The Afghan Cash and Payments Infrastructure

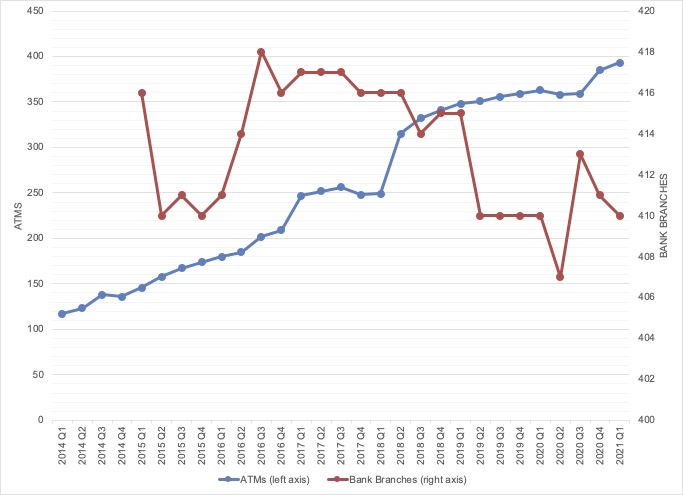

In 2019, Afghanistan had 2.2 commercial bank branches, 1.6 ATMs, and 1.1 point-of-sale (POSAbbreviation for “point of sale”. See Point-of-Sale terminal. More) terminals per 100,000 adults. According to the Afghanistan Banking Association (ABA), as of 2021Q1, the country had 393 ATMs, 736 POS terminals, and 410 bank branches (see Graph 2).

Graph 2. Afghanistan: ATMs and Bank Branches, 2014-2021

Source: ABA quarterly statistics (2021), CashEssentials.

Financial InclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More and Exclusion in Afghanistan

The DAB made financial inclusion one of its key policy objectives in 2016. In September 2019, the DAB and the World Bank launched the country’s National Financial Inclusion Strategy. The task ahead was nothing short of gigantic, as can be seen with some indicators.

- According to the World Bank Global Financial Inclusion database (2017), only 14.5% of Afghans had a financial institution account. PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More cards’ usage was exceptional, as only 2.7% of Afghans had debit cards and 1.1% had credit cards. Digital and mobile payments were tiny, as 3.8% had made digital payments, and only 0.9% reported having a mobile moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More account.

- As of 2019, nearly 85% of Afghan adults were unbanked, according to Abdul Matin Ghafori, then-deputy director-general of DAB’s Financial Inclusion Department.

- As of 2020, 59.4 out of every hundred Afghans had mobile cellular subscriptions, and only 11.4% of the 38.93 million Afghans used the internet, according to the World Bank. Whereas most Afghan banks are located in major cities, as of 2020, 73.97% of Afghans live in rural areas, also per the World Bank.

- As of 2021Q1, Afghanistan had 4.37 million depositors, according to ABA. Bank deposits reached AFN292.6 billion in December 2020, equivalent to 19.9% of the country’s GDP (World Bank 2021: 10-11). Deposits had grown 10.9% since December 2019 due to the public’s reluctance to hold cash with increased political instability and requirements by neighbouring immigration authorities for arrivals from Afghanistan to maintain bank accounts with a minimum amount of funds, according to the World Bank.

The DAB and the Payments Infrastructure: Interoperability, Branchless Banking, and a Mobile Payments Solution

In the past years, the DAB advanced towards integrating all banks and payment institutions within the Afghanistan Payments System (APS), the national e-payments switch funded by the World Bank and a part of the DAB since 2019 (World Bank 2021: 13). By February 2020, “all government and private banks and revenue and custom systems of the Ministry of Finance, and around four thousand markets and shops” had been connected to the APS.

The DAB expected that “conducting transactions with physical money [would] decrease.” The fully interoperable APS had connected 11 banks and 390 ATMs as of May 2021. “Everybody relies 100% on cash, and this was about to changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More. [APS] finally succeeded bringing digital banking to Afghanistan, but as soon as they launched and began to start walking from crawling, the Taliban came and everything basically turned into dust,” said Sher Shah Rahim, CEO of WasalPay, an online payment system for utility bills.

In September 2020, the DAB signed a memorandum of understanding with the Afghan Post and the Afghanistan Banking Association to promote branchless banking. The directive allowed banks to provide banking services through the Afghan Post branches.

The DAB also launched a domestic card scheme called AfPay to lower commissions for banked Afghans and promote the financial inclusion of the unbanked. The DAB also implemented a mobile payment solution through APS, modeled after M-Pesa.

The Afghan Public’s Mistrust in Banking

In 2010, the Kabul Bank, the country’s then-largest financial organization, nearly went into bankruptcy after corrupt elites pilfered USD861 million in bogus loans to shareholders. Some stolen funds were taken away from Afghanistan in airplane food trays.

Kabul Bank customers withdrew more than USD200 million, or about 60% of their deposits in a bank run. The government, the DAB, and Afghan banks had to step in and bailed out Kabul Bank. Its near-collapse diminished the public’s trust in banking organizations in the country.

Afghan banks have long operated in the shadows of the Islamic hawalaA popular and informal value transfer system based not on the movement of cash, or on a telegraph or computer network or wire transfers between banks, but instead on the performance and honour of a huge network of money brokers (known as hawaladars). Today, hawala is used mostly for migrant workers’ remittances to their countries of origin. More (transfer in Arabic) or hundi (trust in Hindi and Urdu). Afghanistan’s “banking system is fragile. The formal financial system is a very small part of the economy,” according to former U.S. Treasury attaché in Kabul Alex Zerden. “The political and economic power of the hawala industry dramatically overshadows the formal banking industry,” said Zerden.

The hawala system has been used in the Middle East and South Asia for centuries to transfer funds domestically and internationally without any movement of physical money. The system employs an informal network of money dealers and changers (hawaladars).

Hawala is “literally the lifeblood of the rural economy [… Hawaladars] know how to work with or avoid the Taliban,” said Paul Vaaler, professor at the University of Minnesota’s Carlson School of Management. “The informal economy is the only source for the Taliban to survive,” said Ahmad Javed Wafa, chief executive of Pashtany Bank.

Banking in the Shadow of Hawala

“Importantly, the international community must not be alarmed over any increased reliance on informal exchangers, which it may associate with the illicit movement of funds or the descent of the financial system. On the contrary, that reliance may be an indication that the Afghan economy has a fighting chance.” – Nafay Choudhury, research fellow at the University of Cambridge

After a revolution deposed king Mohammad Zahir Shah in 1973, business people and the wealthy deposited their cash with Afghan money changers, who had replaced the dominant Indian and Pakistani hawaladars. The hawala system survived the Soviet invasion, civil war, the first Taliban regime, and the U.S.-led war and will most likely continue having an essential role under the second Taliban regime (see more in Munzele Maimbo 2003; Jost & Sandhu 2003; Choudhury 2021).

In the early 2000s, a World Bank officer had suggested encouraging “the larger money exchangeThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More dealers to make the transition into the formal banking sector” (Munzele Maimbo 2003: 20). In 2020, the DAB attempted to convert hawaladars to “monetary service companies” by cancelling the distribution and renewal of individual licenses to induce money exchangers to obtain “corporate licenses.”

Exchangers went on strike. According to Nafay Choudhury, a research fellow at Cambridge, the protest was early evidence of “multiple centers of authority” that would “exist throughout the country” after the departure of Western troops.

During the fall of Kabul on Sunday, August 15, hawaladars closed, as they could no longer exchange their afghani holdings for U.S. dollars sourced from the U.S. Treasury in DAB auctions. The Taliban secured the Sarai Shahzada money exchange market by 5:30 pm of that day.

Hawala dealers have since resumed operations, albeit in stringent conditions. Enayatullah, a money changer, said he had to increase his commission to 4% per transaction, eight times his usual rate, as cash and hard currency are scarce and “The demand is too much.”