The Future of Cash – Beyond Corona Part III – Key Take-aways

LET’S BECOME FUTURE LITERATE

According to UNESCO, “Futures literacy is a capability. It is the skill that allows people to better understand the role that the future plays in what they see and do. People can become more skilled at ‘using-the-future’, more ‘futures literate’, because of two facts: One is that the future does not yet exist, it can only be imagined. Two is that humans have the ability to imagine. As a result, humans are able to learn to imagine the future for different reasons and in different ways. Thereby becoming more ‘futures literate’.”

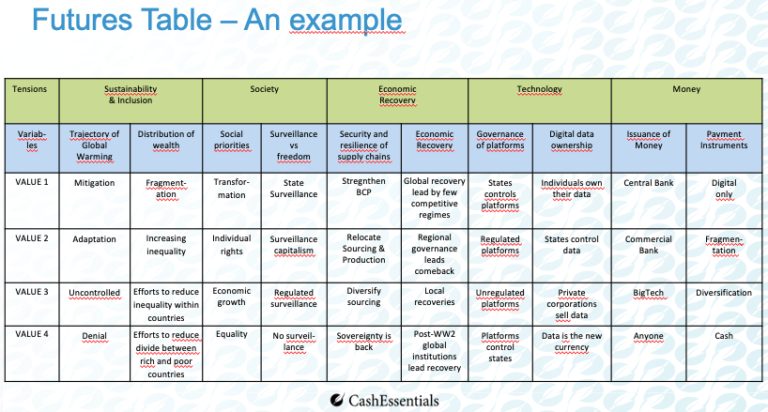

During the first webinar, the group drafted a Futures Table, a tool to support imagining radical futures and exploring the largest uncertainties. It offers a precisely defined framework about the future.

THREE RADICAL SCENARIOS

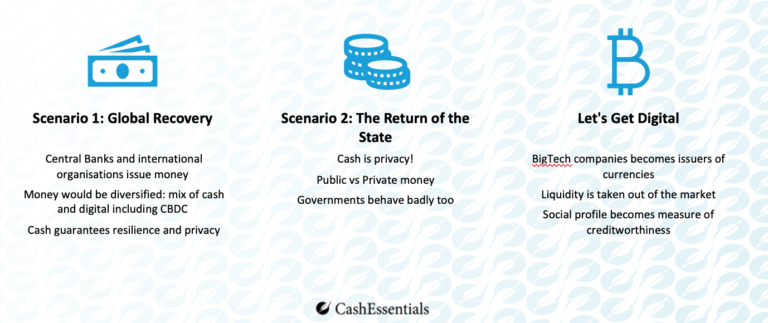

In the second Webinar, the panel designed three scenarios for the future. These scenarios are not forecasts nor do they reflect the panel’s preferences; but they are plausible and polarised to allow meaningful alternative development directions. For each scenario, the panel discussed the monetary ecosystems, payments and cashMoney in physical form such as banknotes and coins. More landscapes.

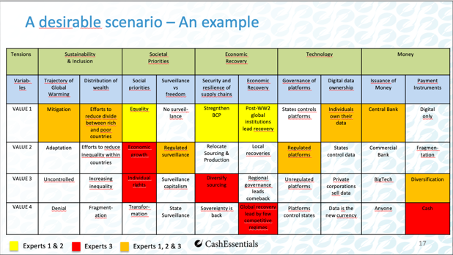

During the third and final webinar, our panel imagined a desirable future for cash. The experts were invited to highlight the preferred values for each of the variables in the future Table. Each expert was given a colour but two experts picked exact matching scenarios in yellow. The third used red. The orange boxes represent the common choices between the red and yellow. In summary, the orange boxes represent the consensus between our three experts and the yellow and red are areas of divergence.

In the second part of the webinar, the experts discussed what actions and what policy decisions were required today to ensure that the scenario becomes a reality. The actions discussed can be grouped in 4 key areas:

- Infrastructure: we need an efficient and resilient infrastructure to ensure access to and acceptance. All stakeholders including banks and retailers need to fully understand the implications of a changing landscape in terms of competition, or in terms of financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More. If cash were to disappear, it would be very difficult to rebuild the infrastructure.

- Cash CycleRepresents the various stages of the lifecycle of cash, from issuance by the central bank, circulation in the economy, to destruction by the central bank. More Models: if market forces fail to guarantee the infrastructure, central banks should consider alternatives including increasing their direct involvement, increasing subsidies to stakeholders and/or regulation. New business models should be sustainable and profitable for all stakeholders, whether they are value-based or utility-based.

- Communication: we need to explain why cash is an important part of public infrastructure. Governments and central banks should consider giving up their neutral position towards cash and develop a positive argumentation in favour of cash.

- Research: research starts with improving the level and quality of statistical information to better understand cash usage. Research is required on paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More behaviour, on the resilience of cash in disaster recovery. The pandemic has demonstrated the need to better understand the role of cash in the transmission of viruses and pathogens. The research needs to be published and shared with the scientific community.

CashTech: when cash meets Fintech

CashEssentials will be holding a new webinar on 8 July 2020, entitled ‘Is CashTech the Future of Cash?’. We will discuss how new players can impact the cash cycle. Will they challenge traditional players, or will they partner with them to improve the cash distribution network? Will they compete with existing branches and ATMs or will they offer an alternative channel Can they disrupt the trend towards increasing use of digital payments? Or can they turn cash into a digital payment? Can they establish a new cash lifestyle?

RegisterSee See-through register. More for the CashTechThe expression was first coined by CashEssentials and is the encounter of cash and technology. It brings together innovative companies who leverage software and modern communications technology to improve cash services: access to cash; acceptance of cash; and the efficiency of the cash cycle for all stakeholders. More webinar here.

To review ‘The Future of Cash – Beyond Corona – Part I’ Click here.

To view the recording of ‘The Future of Cash – Beyond Corona – Part II’ Click here.

To view the recording of the The Future of Cash – Beyond Corona – Part III’ Click here

This post is also available in:

![]()