You don’t need to Like your Payment Instrument

Lies, damned lies and Statistics

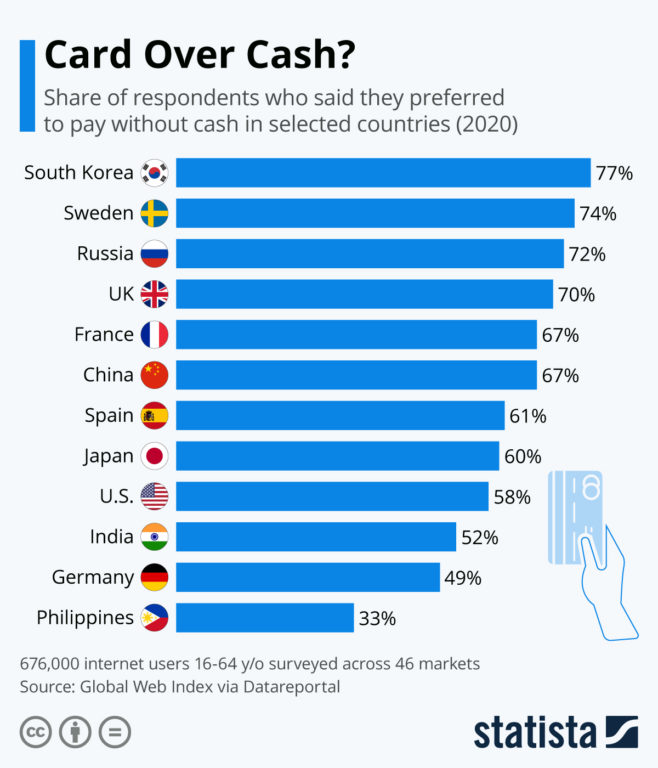

A recent Statista article analyses paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More preferences around the globe and presents the results of an international survey. Unsurprisingly, Sweden and South Korea are ranked first amongst the countries where people prefer cards over cashMoney in physical form such as banknotes and coins. More. At the bottom end of the chart, the Philippines and Germany are the only two countries where a majority of people prefer to pay in cash. The article is also posted on the World Economic Forum website.

In my opinion, the article contains several inaccuracies and biases.

- The article references twice data supposingly collected by CashEssentials and this is simply wrong. The references link to the 2018 World Cash Report by G4S, not CashEssentials.

- But beyond the source of the information, there is also the question of how old the data is. The article mixes 2019 central bank data on the number of people holding a bank account in the Philippines with 2016 data on the number of card-accepting terminals. This is misleading particularly when, as highlighted by G4S, the number of POSAbbreviation for “point of sale”. See Point-of-Sale terminal. More terminals grew by 54% between 2012 and 2016.

- The presentation of the data is also misleading. The chart shows 12 countries and in 10 of those, people prefer to pay without cash. However, the survey covers 46 countries. In two countries cited in the article but not represented on the chart, Egypt and Morocco, a majority of those surveyed preferred cash. The complete dataset is not available.

- The wording of the question appears to introduce a social desirability bias, i.e. respondents tend to answer in a way that they believe will be interpreted favourably rather than truthfully. Respondents were asked whether they preferred to pay without cash rather than a more neutral formulation such as ‘How do you prefer to pay?’.

- Last but not least, the survey presents a rather obvious statistical bias due to the fact that the respondents are internet users, thus excluding those who don’t use the internet and likely do not have access to non-cash payment instruments. It is a bitIn computers, the basic unit of digital information; contraction of BInary digiT. More like running a survey on veganism at a McDonald’s restaurant.

But besides these inaccuracies, the article raises the interesting question of the relevance of payment preferences and highlights how they differ from country to country. But does this matter and particularly in terms of policy. If people prefer to pay with a card or with a phone, should policy aim to help or should it aim to guarantee a diversity of choice?

Some cannot afford Payment Preference

Some people simply cannot afford a payment preference. Approximately 31% of the world population or 1.7 billion adults remain unbanked in 2017 —without an account at a financial institution or through a mobile moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More provider, according to the World Bank. Moreover, only 52% of adults around the world reported making or receiving at least one digital payment in the past year.

Cash is a Vital Back-up when Technology Fails – even for those who Prefer to use Digital Payments

Furthermore, cash serves as a contingency when systems break down. Last week in the UK, supermarket chains Morrrison’s and The Co-Op suffered payment glitches that left customers unable to pay by card and others were charged d twice. Gareth Shaw, from head of money at consumer association Which? said: “This was a concerning situation for shoppers and reinforces why cash is such a vital back-up when technology fails – even for those who prefer to use digital payments.”

From Payment Gamification to the Pain to Pay

One emerging trend in payments over the past decade has been gamification. With more and more payment methods to choose from, payment service providers have borrowed from the gaming industry and offer users points and rewards when they complete certain tasks and objectives. Monzo has introduced achievements which unlock badges and rewards; PayTM offers cashbackA service whereby the customer pays electronically a higher amount to a retailer than the value of the purchase for goods and/or services and receives the difference in cash. It is also a reward system associated with credit card usage, whereby the consumer receives a percentage of the amount spent on the credit card. More using a lottery-based system. This certainly makes it fun for users. Cash, on the other hand, generates what behavioural economists have called the pain to pay, i.e. the physical discomfort of parting with one’s money. The pain to pay plays an important role in helping consumers control their spending and avoid impulsive purchases.

Payment preferences matter as they influence individual consumer choices. However, cash also fulfils important social functions – including financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More, resilience and financial literacy – which are often not tailored into individual choices.