Australia: Covid-19 could be the Ultimate Disrupter in Retail Payments

In Australia, the pandemic has accelerated a trend that had started long before the pandemic. CashMoney in physical form such as banknotes and coins. More demand has been increasing steadily, measured by cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More, largely due to store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More demand but transactional demand or the share of cash in retail payments, has been declining.

Increasing Cash Demand

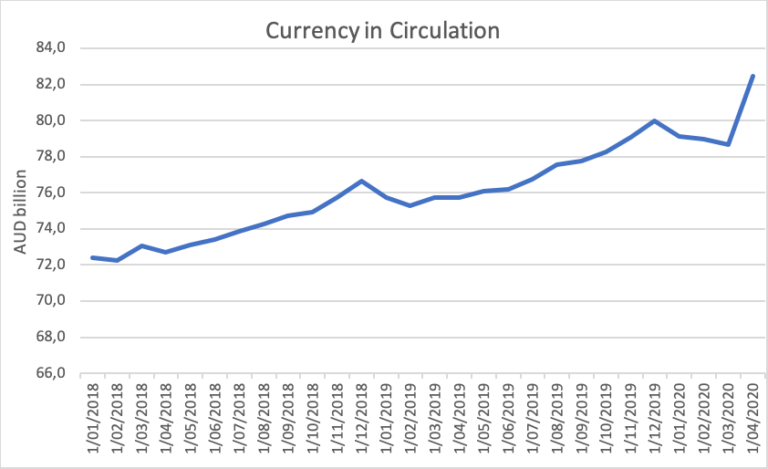

Between end February and end of April 2020, currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation grew by AUD 3.5 billion representing year on year increase of 8.9%. This is comparable to surges in demand observed in other countries. The Reserve Bank of Australia (RBA) revealed in its April financial stability report that cash withdrawals from banks increased in the second half of March.“This included a small number of customers making very large withdrawals – more than $100,000, and in some cases into the millions of dollars,” it said, adding that the elevated demand had since abated.

Source: Reserve BankSee Central bank. More of Australia

Less Cash Payments

During the pandemic, paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More behaviour has changed rapidly. In a recent speech, Michele Bullock, Assistant Governor of the Reserve Bank stated “Both merchants and consumers appear to have been keen to reduce their use of cash. Many merchants made it clear through signage that they preferred contactless card payment, even for low-value payments. Some even went as far as to indicate that they would not accept cash. Maybe partly in response to this, and their own concerns about hygiene, many people reduced their use of cash in stores. In addition, there was a significant shift to online shopping, where cash is simply not a payment option. As a result of these changes, ATM withdrawals in April were down 30 per centFraction of a currency representing the hundredth of the unit of account. More from the month before and over 40 per cent lower than twelve months earlier.”

A fundamental question around the globe is whether this behavioural changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More will survive the crisis. The Reserve Bank seems to think it could; Michele Bullock said “All of these changes are likely to result in permanent shifts in behaviour as some people maintain the new ways of doing things.” On the other hand, the Royal Australian MintAn industrial facility manufacturing coins. More said in a statement “We believe that Australians using contactless payments may increase post COVID-19 but this will not lead to a permanent shift to a cashless society, at least not in the near future”.

The Reserve Bank stresses that the change could have far-reaching policy implications, on the costs of electronic payments, on the resilience of the payments system and on the ATM network.

Keeping the cost of electronic payments low

Michelle Bullock said that the RBA will consider reducing the cost of electronic payments for both merchants and consumers as the declining use of cash in payments is reducing competition in the payments market. Two options are on the table: one is to mandate that acquirers explicitly offer least-cost routing to all their merchants; the other is to lower the benchmarks that serve as a cap on average interchange fees. As shown in the chart below, the total cost of merchant fees can vary by a factor of 7 between the domestic eftpos system and international credit schemes. From a commercial bank perspective, this raises an interesting paradox: the decline in cash usage could lead to less profitable electronic payments markets.

Increasing Resilience of the Payments System

Cash has often been viewed as a back-up in case of outages and this was clearly the case during the violent bushfires that swept across the country a few months ago. But if people carry less cash, the resilience of the retail payments system must be strengthened. The Reserve Bank is working with the industry to develop a set of standard operational performance indicators to be disclosed by individual institutions. The work is complemented by efforts to identify and mitigate risks of reliance on supporting infrastructure that can be ‘single points of failure, such as the telecommunications and energy sectors. These measures will likely lead to an increase in costs for electronic payments providers and could counterAutomatic device for the counting of banknotes or coins. More the previous objective of reducing costs for merchants.

One option that does not seem to be considered by the Reserve Bank is to actually encourage consumers and merchants to increase the use of cash at the point of sale. This would effectively increase competition between suppliers and would reduce the marginal cost of cashAlthough banknotes are delivered to the citizens free of charge and their use does not involve a specific fee, costs are generated during their manufacturing, storage and circulation process, which are covered by different social agents (central banks, commercial banks, retailers etc). More. It would also guarantee a tried and tested back-up system in case of outages.