Australia scraps Legislation restricting Cash Payments

The Currency (Restrictions on the Use of Cash) Bill 2019 was submitted to the Federal Parliament in September last year, and would would have introduced fines of up to AUD25,000 or jail terms of up to two years for people or entities that made or accepted payments over AUD10,000. The rationale was to stop criminals laundering moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More by spending their cash but the bill faced was fierce backlash and privacy concerns.

At the time Mark McGovern, Visiting Fellow, QUT Business School, Economics and Finance, Queensland University of Technology wrote: “CashMoney in physical form such as banknotes and coins. More has been one of the few things we can absolutely rely on, whatever our status, situation or access to other paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More means. Removing (and dishonouring) that guarantee, while criminalising reliance on it, should not be done lightly in a mad rush to an arbitrary dateThe year in which a medal or coin was minted. On a banknote, the date is usually the year in which the issuance of that banknote - not its printing or entering into circulation - was formally authorised. More.”

ABC News reported in February that the draft bill received 2,659 submissions by early December, with the majority opposing the bill, and many arguing the Government should not interfere with their legal right to spend cash how they wish. Many submissions also raised concerns that the proposed law may leave people’s bank deposits vulnerable to negative interest rates — a situation whereby, instead of receiving money on deposits, depositors would be charged interest by the banks to hold their money.

The draft law was dropped after fears that it would face rejection in the Upper House. The Government declared that the delay in bringing the law forward was due to them prioritising the emergency economic response to the COVID-19 pandemic.

In December, ABC news said the law could be revived in the future, once the pandemic has passed.

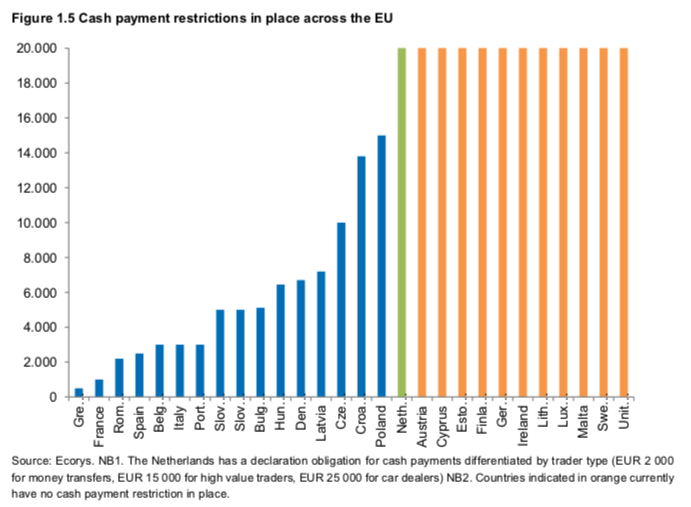

A number of countries throughout the world impose cash payment limitations, particularly in Europe where 16 countries have adopted restrictions, which range from €500 in Greece to approximately €15,000 in Poland. There is no evidence that cash payment limitations have contributed to curb tax evasion, money launderingThe operation of attempting to disguise a set of fraudulently or criminally obtained funds as legal, in operations undeclared to tax authorities, and therefore not subjected to taxation. Money laundering activities are strongly pursued by authorities and in most countries, there are strict rules for credit institutions to cooperate in the fight against money laundering operations, to declare and report any transactions that could be considered suspicious. More or the fight against terrorism. In 2018, after a two-year consultation, the European Commission decided not to impose EU wide limitations on cash payments and concluded that “While tax fraud and the use of cash are often associated, the study demonstrates that the relationship between the two is not always clear-cut.” In 2019, the ECB reacted to a Greek government proposal to lower the cash limit from €500 to €300 and wrote “the existing limit on cash payments of EUR 500 for consumer-to-business transactions, and the new tax incentives discouraging companies from spending cash in excess of EUR 300, are disproportionate in light of the potentially adverse impact on the cash payment system.”