Can Sweden Save Cash?

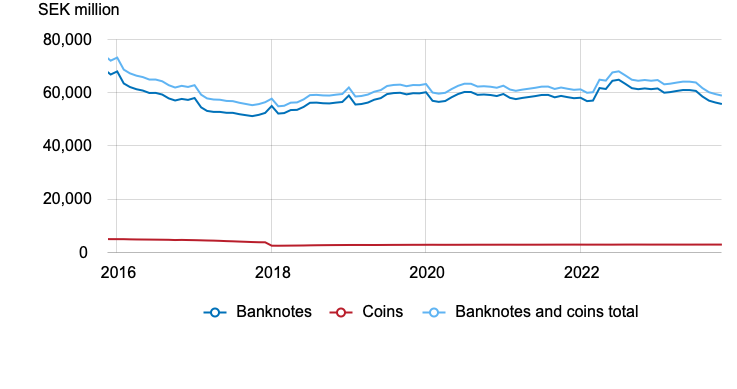

For decades, Sweden has been one of the few countries that have seen a sharp decline in cashMoney in physical form such as banknotes and coins. More demand. The value of the currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation peaked in 2007 at just over SEK 110 billion and then dropped to SEK 56 billion in 2017. It has rebounded modestly since, but unlike most countries, Sweden did not see a substantial increase in demand during the Covid-19 pandemic. It did spike, however, following the Russian invasion of Ukraine in February 2022 but has been trending downwards since (see Graph 1).

Graph 1. Sweden: Cash in CirculationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More, 2016-2018

An Early Mover to Ensure Cash Access

Sweden has been among the first countries to adopt regulations to ensure the access to and acceptance of cash. A law took effect in 2021, requiring banks to provide adequate cash services. The law was designed to protect the people at risk, such as the elderly, migrants, those with disabilities, the rural, and those who do not have access to digital payments.

An inquiry into the state’s role in the paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More market was carried out between 2020 and 2023. On 31 March 2023, the Payments Inquiry presented a report, ‘The State and the Payments,’ which recommends that the government review cash position and access to cash services by 2025 at the latest. The review should at least cover the options for making cash payments, particularly for essential goods such as medicine, food, and fuel, access to cash services, and the development of the cash infrastructure, including distributing banknotes and coins. Should such a review show that the possibility of paying for essential goods in cash is impaired, legislative measures should be considered.

State Intervention Is Required to Correct Market Failures

On 27 October, the Sveriges Riksbank submitted its consultation response to the Payment Inquiry’s report. The response outlines the Riksbank’s perspective on the current state of the payments market and provides feedback on the Payment Inquiry’s proposals. The Riksbank emphasizes the crucial role of the state in ensuring the stability and efficiency of the financial system, especially in facilitating public payments during both every day and crises. While recognizing the responsibility of private actors in payment infrastructure, the Riksbank contends that state intervention is necessary when market solutions fail to meet competition objectives, efficiency, safety, and accessibility.

Too Little, Too Late

The Payment Inquiry conducted a comprehensive survey, revealing deficiencies in access to both digital and cash payments. The Riksbank acknowledges some of the proposed measures to address these challenges but contends that more decisive actions are needed. Concerning cash, here are the critical viewpoints highlighted in the response.

Preservation of cash: The Riksbank urges immediate legislative amendments to safeguard cash status and access to cash services. Emphasizing the importance of cash for digitally excluded consumers and its role in emergency preparedness, the Riksbank proposes measures such as the obligation for banks to accept cash deposits and the possibility of paying cash for essential goods.

«There is a considerable risk that cash will be further marginalised and that in the near future it can no longer be used for essential purchases. The Riksbank therefore proposes legislative amendments regarding the possibility of paying cash for essential goods and an obligation for banks to accept cash deposits from consumers.”

Riskbank response to the Payments Inquiry report

Enhanced access to payment services: the Riksbank stresses the need for payment accounts with limited functionality to improve inclusion. It suggests that credit institutions should provide services adapted to those who struggle with digital transactions and that the state may need to offer payment services to those unwilling or unable to pay digitally at citizen’s centres.

The State’s role in the payments market: While supporting a more active state role in the payment market, the Riksbank contends that the Inquiry’s proposals fall short, especially in preserving the status of cash and preparing for a future e-krona. It emphasizes the state’s responsibility for long-term planning and the use of various tools, including regulation, coordination, dialogue, and direct provision of services if necessary.

Financial InclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More: The Riksbank supports initiatives to broaden the state’s efforts for essential payment services but insists on clarity in objectives to ensure access to payment services for everyone, including those unwilling or unable to use digital services.

Civil preparedness in the payments ecosystem: The Riksbank agrees that retailers who provide vital goods and services should, as a starting point, accept several payment methods, including those that work in the event of significant disruptions to the electricity supply or electronic communications, as this means increased resilience.

Legal tenderMoney that is legally valid for the payment of debts and must be accepted for that purpose when offered. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered (“tendered”) in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. More in Sweden: Disagreeing with the Inquiry’s assessment, the Riksbank argues for immediate legislative proposals to strengthen cash’s position. Concerned about the decline in cash usage, it believes waiting for a review could risk irrelevance. The Riksbank suggests a broader obligation for retailers providing essential goods and services to accept cash. It points to international examples, such as Denmark and Norway, where legislation mandates acceptance of cash with certain exceptions, and the euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More area, where a draft regulation proposes to require the acceptance of cash.

“For cash to be a real alternative for making payments if society is exposed to challenges and elevated preparedness, a basic infrastructure must be in place even in normal times.”

Riskbank response to the Payments Inquiry report

Need for a Central Bank Digital Currency (CBDC)A digital payment instrument, denominated in the national unit of account, and a direct liability of the central bank, like banknotes. A general purpose CBDC can be used by the public for day-to-day payments like cash. More: The Riksbank concurs with preparing for an e-krona, critical of the lack of legislative proposals in the Inquiry. It emphasizes the importance of an e-krona for maintaining confidence in the national currency amid digitalization. The Riksbank stresses the need for transparency and public trust in introducing an e-krona.

Strengthening the Position of Cash

In summary, the Riksbank acknowledges the state’s role in shaping a well-functioning, secure, and inclusive payment market and calls for the immediate strengthening of the position of cash in legislation.

“For cash to be used in the future, both under normal conditions and in crisis and war situations, the Riksdag needs to regulate where and how it can be used,” said Ms. Aino Bunge, Deputy Governor of the Riksbank, pointing out that stores should be obliged to accept cash for socially essential goods such as food, fuel, and pharmaceuticals. Banks should also be obliged to accept deposits from consumers.