Canada: Grocery Stores Refusing Cash Are Discriminatory

A new study from Dalhousie University, “Cashed Out: How a Cashless Economy Impacts Your Grocery Experience, a Canadian Perspective,” shows how Canadians pay and their perception of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More methods. The study is based on a survey of 1,503 Canadians conducted in January 2023 in partnership with Angus Reid.

CashMoney in physical form such as banknotes and coins. More Payments Are Low

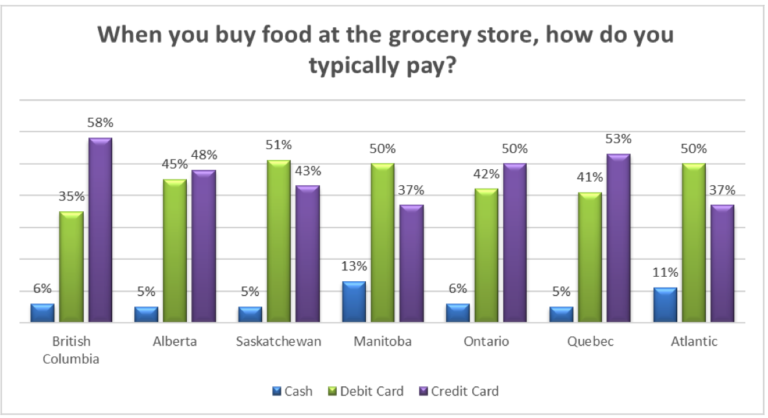

Unsurprisingly, both credit and debit are most popular with Canadians. On average, 6% of Canadians pay exclusively with cash. Of the groups that pay with cash, Manitoba has the highest percentage at 13%, followed by the Atlantic region at 11%.

Source: Agrifood Analytics Lab

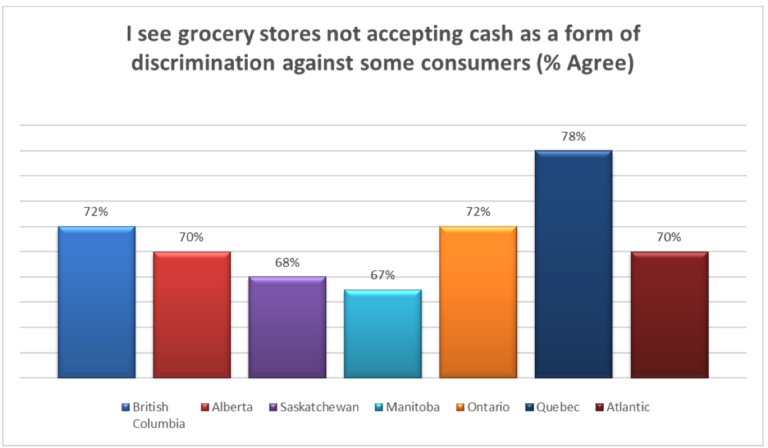

Source: Agrifood Analytics Lab

Cash Protects Consumer Privacy

The survey finds that 53% of Canadians consider a cashless economy to threaten privacy. Digital transactions collect personal information, such as names, addresses, and credit card numbers. This information can be vulnerable to wrongdoers and cyber-criminals. Grocers may also use payments, browsing, location and other personal data to profile individuals and target them for advertising or other purposes.

Cash also helps consumers manage their budgets, with 28% of respondents believing that cash helps them track the cost of food. Only 17% consider cash a health threat, spreading germs and viruses.

The Cash Utility Paradox

On the one hand, cash is not viewed as very popular as a payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More. 27% believe using cash is outdated; 74% believe not using cash is convenient. 26% of grocery stores will not accept cash within five years.

On the other hand, cash plays an essential role in social inclusion. 73% believe a cashless grocery store is discriminatory. 60% believe cash is critical since it is the only way to support some charities collecting donations at the grocery store.

Source: Agrifood Analytics Labs

Source: Agrifood Analytics Labs

“Results show that Canadians not only see the economic convenience of not having cash but also perceive the socioeconomic downsides of an economy which excludes cash. Individuals who are unbanked or underbanked, such as those experiencing homelessness or living in poverty, could not purchase goods and services at these stores, as they may not have access to electronic forms of payment,” concludes the report.

“For grocers, not having moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More to handle and manage certainly has its upside, but Canadians clearly see cash as a social enabling tool more so than an economic one.” said Dr. Sylvain Charlebois, Director of the Agri-Food Analytics Lab at Dalhousie University.

An estimated 6% of Canadian households, or 1.5 million homes, were unbanked in 2022, meaning they had no account at a financial institution. Furthermore, around 15% of Canadian households were considered underbanked, meaning they had an account at a financial institution but still used alternative financial services such as payday loans or cheque-cashing services. Factors contributing to being unbanked or underbanked include low income, lack of education, and immigration status.

“There’s certainly a push for a cashless grocery store, but our study shows Canadians expect more of an inclusionary approach when paying for groceries,” said Janet Music, Research Associate at the Agri-Food Analytics Lab.

It could also become a problem for those living in remote areas where internet connectivity is unreliable and electronic transactions might not be possible. A 2022 Bank of Canada report evaluates access to cash amongst remote First Nations reserves. It shows that white-label ATMs (or ABMs as they are known in Canada) are the most common closest source of cash, primarily in retail stores, gas stations and grocery stores.