Cash Access in Australia

Australian Senate Launches Inquiry on Bank Closures

The Australian Senate Standing Committee on Rural and Regional Affairs and Transport launched an inquiry on bank closures in regional Australia on February 8. Senators conducting the investigation have threatened to mandate community consultation when banks consider a branch closure or to require banks to maintain a rural presence as part of their licence obligations. The Committee will deliver a report in May 2024.

On February 10, Senator Matthew Canavan requested Australian banks “to postpone closures of regional branches” until the inquiry’s conclusion. Among the big four banks (Commonwealth Bank, Westpac, National Australia Bank and Australia New Zealand Bank), National Australia Bank (NAB) is the only one that has not promised to pause closures while the inquiry is being undertaken.

Commonwealth Bank CEO Matt Comyn claimed that the cost of running its 728 branches – for $1bn a year – to sell loans and manage cashMoney in physical form such as banknotes and coins. More transactions is increasingly unsustainable as customer demand diminished. Comyn said:

“Transporting and making cash available around our vast country involves the considerable expense of logisticsThe term originates from military language and refers to the movement and provisioning of troops at war. In today’s business vocabulary, it refers to the management in particular, the transportation, storage and distribution of finished goods. More and security. We estimate that continuing to support distribution and availability of cash costs CBA approximately $400 million each year – which works out to roughly $40 for every one of our 10 million customers. Many of our customers don’t use cash though – and these customers cross-subsidise those that do.”

Australian Government Supports Cash Access

In June 2023, the Australian Government released “A Strategic Plan for Australia’s Payments System. Building a Modern and Resilient Payments System.” The Treasury plan says:

“The Government understands the important role cash still plays in our payments system and supports Australians having continued access to cash. The Government will work with the relevant agencies across the public sector and with industry to ensure that Australia has a sustainable cash distribution network that maintains adequate access to cash.” – Australian Government (2023: 23)

Cash and Banking Guarantee Petition

“Going cashless is privatization of a public asset: moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More. Transactions moved out of the public sphere and into privately held banking infrastructures and someone is making money off your transactions.” – Dr. Chris Vasantkumar, Macquarie University.

In 2020, Jason Bryce noticed he was spending more by paying with cards and phones. “I was tap, tap, tapping my card to buy everything, and I lost control of my budget so I just decided not to do it anymore.”

Last March, Bryce launched a Change.org petition calling for “An Australian Cash and Banking Guarantee” to preserve the role of cash as a critical payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More for consumers and businesses. The petition has gained 128,973 signatures as of October 16.

- A cash and banking guarantee should include “reasonable local access to cash and full banking services” and freedom “to choose cash when paying for food and essentials at physical retailers.”

- The petition emphasizes how “banks are deserting towns and suburbs, leaving Australians without ready access to cash and banking services.”

Distance to Cash

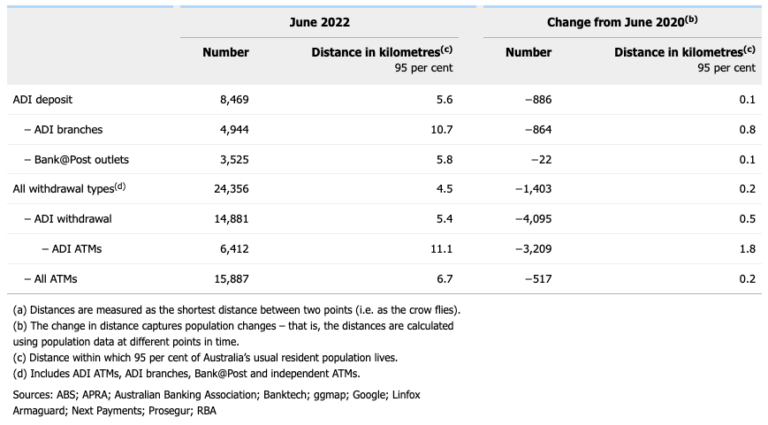

As of June 2020, 95% of the Australian population lived within 4.3 km of a cash withdrawal point and 4.9 km of a cash deposit point in accepting-deposit institutions, ADIs (Caddy and Zhang 2021: 12). Those distances increased to 4.5 km and 5.6 km respectively as of June 2022 (Guttmann, Livermore, Zhang (2023: 43). Chart 1 shows the changes by withdrawal and deposit types.

Chart 1. Australia: Cash Access Points and Distance to Cash Services, 2020-2022

Source: Guttmann, Livermore, Zhang (2023: 43).

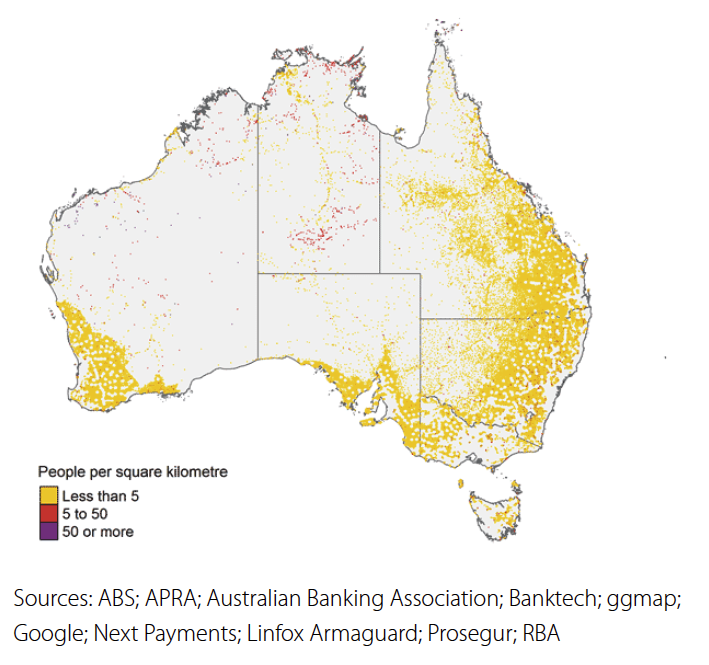

As of June 2020, close to 1% of Australians (250,000 people) lived more than 15 kilometers away from cash access points (Caddy and Zhang 2021: 13). Most lived in areas with lower incomes, higher proportions of Indigenous people, and regions lacking reliable internet access.

Map 1. Australia: Population with Least Access to Cash (People per km2 Needing to Travel More than 15 km to Access a Cash Point)

Source: Caddy and Zhang (2021: 13).

People in remote areas have fewer alternatives when a cash access point does not operate due to temporary unavailability or removal. Close to 100 (0.5%) access points had no option within 50 kilometers (see Map 2).

Map 2. Australia: Most Remote Cash Access Points (Cash Withdrawal Points More than 50 km from Nearest Alternatives)

Source: Caddy and Zhang (2021: 15).

Median distances to bank branches and ATMs in remote locations have increased by 3.4 km (12%) and 6.5 km (18%) since 2020 (Guttmann, Livermore, Zhang 2023: 44).