The Cash-Use Cycle in Australia

The Cash-Use Cycle

Rochelle Gutman, Tanya Livermore, and Zhan Zhang (Note Issue Department, Reserve BankSee Central bank. More of Australia, RBA) examined the decline of cashMoney in physical form such as banknotes and coins. More usage in retail transactions through a cash-use cycle framework in an article published in the RBA’s Bulletin of March 2023.

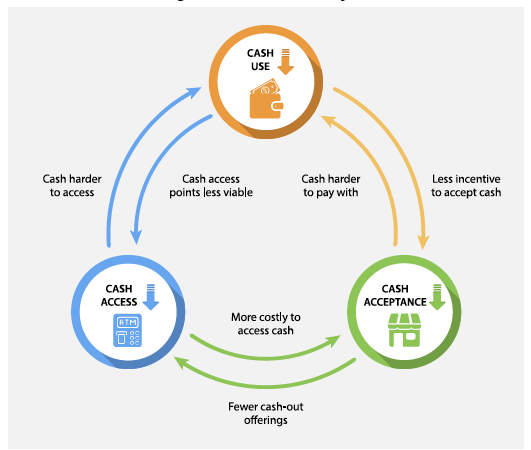

The cash-use cycle is the set of “interdependencies between consumers’ use of cash, access to cash, and merchants’ acceptance of cash” (Guttmann, Livermore, Zhang 2023: 40). The authors’ emphasis on the interdependences between cash use, cash access, and cash acceptance allows to understand how the decline in cash usage is accumulative and self-reinforcing (see Chart 1 and Diagram 1).

Chart 1. Cash-Use Cycle Framework

- Cash use: Consumers’ enduring use of cash in retail transactions

- Cash access: Ease in accessing cash through ATMs, bank branches, Bank@Post outlets, and retailers

- Cash acceptance: Retailers’ acceptance of cash payments in physical locations.

Source: Guttmann, Livermore, Zhang (2023: 40).

Diagram 1. Examining the Decline in Cash Usage through a Cash-Use Cycle Framework

Source: Guttmann, Livermore, Zhang (2023: 41).

Cash Use

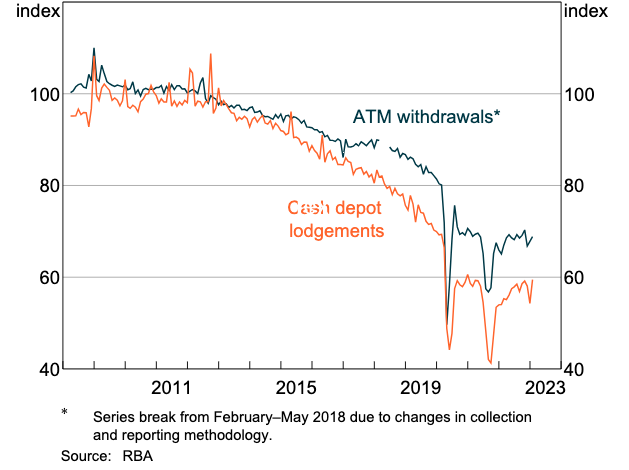

The authors employ ATM withdrawals and cash lodgments in cash-in-transit (CIT)Describes the logistical handling of banknotes, coins, and items of value. This can include the transportation, storage, counting and processing, and packaging. Cash-in-transit companies are often responsible for the replenishment and servicing of ATMs. Many cash-in-transit companies are private security companies. See Cash Management Companies. More companies’ depots as proxy variables to shed light on the declining transactional demand for cash in Australia. ATM withdrawals have reduced by 60% in volume and 40% in value since 2008 (see Graph 1). Cash depot lodgments are 50% lower than at their peaks both in volume and value.

Graph 1. Australia: ATM Withdrawals and Cash Depot Lodgments, 2008-2022 (Seasonally Adjusted Values, 2012 = 100)

Source: Guttmann, Livermore, Zhang (2023: 42).

Most Australians employ debit and credit cards to make payments, per the RBA’s Online Banknotes Survey (OBS). However, the share of respondents who reported using cash in their most recent in-person transaction has remained stable since 2020, at 25% in 2022 (see Graph 2).

Graph 2. Australia: Payment MethodSee Payment instrument. More Used in Most Recent In-Person Transaction, 2020-2021 (Shares)

Source: Guttmann, Livermore, Zhang (2023: 42).

Regarding banknotes in circulation, low-denomination banknotes ($5, $10, and $20) have grown relatively slowly since 2006. However, high-denomination banknotes ($50 and $100) have thrived and spiked during the Covid-19 pandemic, evidencing a robust precautionary demand for cash as a store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More during the crisis.

Graph 3. Australia: Value of Banknotes in Circulation, 2006-2021 (Shares)

Source: Guttmann, Livermore, Zhang (2023: 43).

Cash Access

Over 70% of Australians obtain cash through ATM withdrawals (see Graph 4). Around 20% get cash through retailers, and close to 15% obtain it through bank branches. Australians also receive cash in payments or gifts.

Graph 4. Australia: Sources of Cash, 2022 (Share of Respondents)

Source: Guttmann, Livermore, Zhang (2023: 43).

Australia’s cash infrastructure has declined markedly since the mid-2000s (see Graph 5). Since their peak in 2016, 8,000 ATMs (25%) have closed, most owned by accepting-deposit institutions (ADIs, banks). There were 30% fewer bank branches in 2022 compared to 2017. Most closures have been in cities (60%) or inner regional parts of Australia (20%).

Graph 5. Australia: Cash Access Points, June 2004-June 2022

Source: Guttmann, Livermore, Zhang (2023: 43).

The cash-in-transit industry has also experienced consolidation because of this trend. In June, the Australian Competition and Consumer Commission (ACCC) approved the merger that created a single CIT provider, Armaguard, with more than 90% market share.

Cash Acceptance

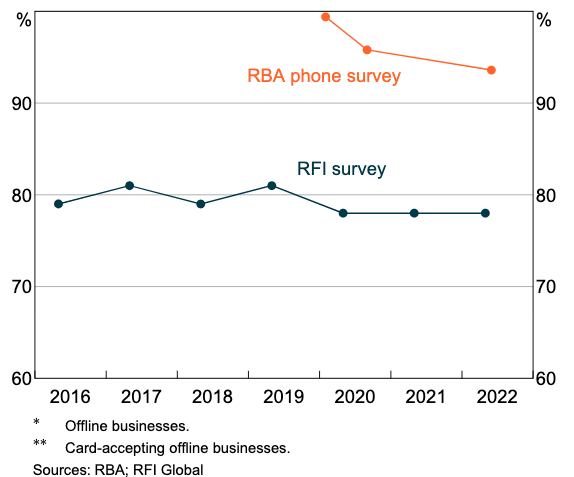

Regarding merchants’ cash acceptance, 78% of card-accepting physical retailers accept cash payments, per an RFI Global survey. The RBA’s survey for cash and card-accepting retailers indicates that 94% of businesses accept cash payments (Graph 6). Per this survey, the share of merchants accepting cash has declined from 99% to 94% in June 2022.

Graph 6. Australia: Cash Access Points, June 2004-June 2022

Source: Guttmann, Livermore, Zhang (2023: 43).

Nearly half of the merchants surveyed by RFI in April 2022 planned on actively discouraging cash payments in the future, citing hygienic reasons (erroneously) linked to the Covid-19 pandemic and consumer habits (Graph 7). Retailers not planning to dissuade cash saw no reason to changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More the status quo or cited strong consumer preferences for cash.

Graph 7. Australia: Retailers’ Reasons for Cash Acceptance and Refusal, April 2022

Source: Guttmann, Livermore, Zhang (2023: 47).

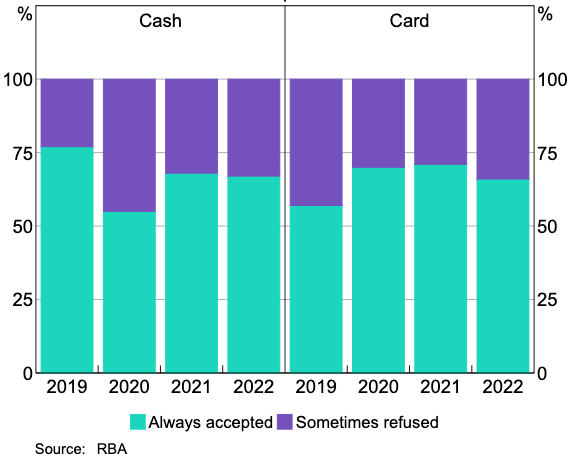

Regarding consumers’ cash acceptance, half of the RBA’s Online Banknotes Survey respondents said a merchant had refused a cash paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More in 2020, the first year of the Covid-19 pandemic (see Graph 8). The situation has improved somewhat, as only a third noticed the same in 2022. Cash acceptance in retail transactions remains high despite the proliferation of digital payments.

Graph 8. Australia: Consumers’ Payment Acceptance Experience Within the Past Month, 2022

Source: Guttmann, Livermore, Zhang (2023: 47).

Towards an Evaluation

In their conclusion, the authors assert that while the cash-use cycle in Australia functions adequately:

“The data point to some vulnerabilities in the cash system. Some communities, particularly in non-metropolitan areas, are increasingly susceptible to a decline in cash access if there were to be further removal of cash access points. Furthermore, a substantial share of merchants indicated plans to discourage cash payments at some point in the future. The Bank will continue to monitor these trends.” – Guttmann, Livermore, Zhang (2023: 47).