Australia: Competition Authority Approves Armaguard-Prosegur Merger

The complex nine-month-long review saw the competition authority gather over 80 submissions, 13 witness statements and four expert reports, forcing them to extend their decision-making deadline several times.

Industry in decline, cashMoney in physical form such as banknotes and coins. More remains crucial.

The review concluded that the Australian cash-in-transit industry is in structural decline due to the decreasing use of cash as a payment methodSee Payment instrument. More. Still, it noted that cash continues to be crucial to some parts of the economy.

Regarding the decision, ACCC Commissioner Liza Carver said, “We accepted that, without the proposed merger, it was highly probable that either Armaguard or Prosegur would withdraw from the declining cash-in-transit market soon and this exit could occur very quickly. We were concerned that the rapid withdrawal by either of these two major suppliers could cause significant disruption, including by reducing the availability of cash to their customers, and therefore the public.”

While the speed at which either company might exit the market is debatable, the threat appears to have swayed the ACCC’s decision. What is undisputed is the considerable losses that both companies have sustained under current trading conditions. Ms Carver acknowledged that the proposed merger could substantially reduce competition. Several competitors and customers had raised this concern along with the threat of potential price rises, which it could cause.

To address these fears, the ACCC will impose a series of obligations on the combined business that will be effective for the next three years.

Three-year competition undertaking

The undertaking, which went through three iterations incorporating a range of feedback, sets out several obligations for the combined business. The company must continue offering cash-in-transit services to all locations currently serviced. Current pricing must be honoured for existing and new or renewed customer contracts. Contract price rises must be capped at not more than the increase in the Australian Consumer Price Index (CPI) plus 7.5% annually. In their response to these obligations, the applicants claimed that even with this level of price increase, the combined business would not breakeven over the three-year term of the agreement, reinforcing the challenging state of the cash logisticsThe term originates from military language and refers to the movement and provisioning of troops at war. In today’s business vocabulary, it refers to the management in particular, the transportation, storage and distribution of finished goods. More business and the need for longer-term solutions to secure cash distribution, access and acceptance.

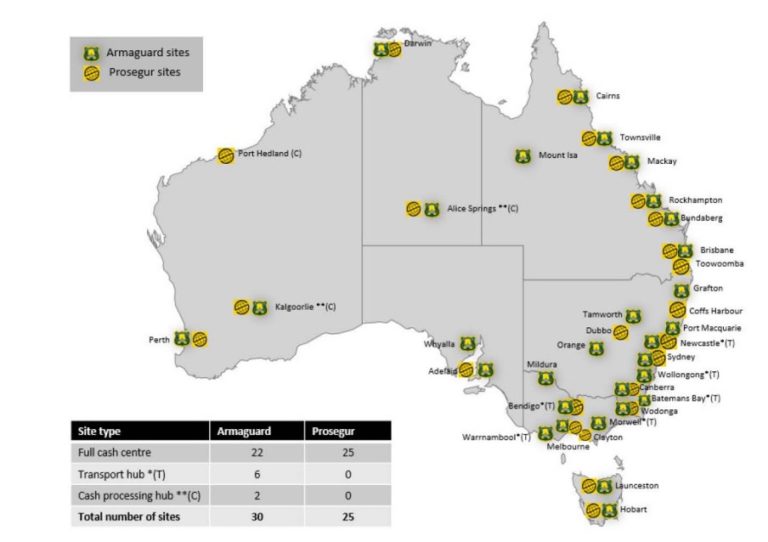

Map illustrating the degree of cash centreProcessing centre for large volumes of cash, often in facilities that have special security and logistic characteristics. Cash centres can be operated by a central bank or a commercial entity (usually bank or a cash-in-transit company). More duplication across Australia (taking from the applicant’s merger submission in September 2022 but with some changes in numbers since the application was lodged)

Additionally, the company must establish a registerSee See-through register. More of assets that includes surplus Approved Cash Centres, surplus equipment and a record of former personnel to assist other companies seeking to acquire these assets to grow their businesses.

The undertaking also sets out various requirements for third parties, including independent ATM deployers, to access approved cash centres and provide a range of ATM-specific cash Processing services. The company must follow a formal complaint-handling process to support the agreement, appoint an Independent Expert to adjudicate disputes and set Approved Independent Auditors. It will be interesting to see how these obligations play out over time, whether they facilitate greater market competition and if they contribute to the safeguarding of cash.

ATMX and Precinct – more than just ATMs?

A feature of the declining transactional use of cash and the growth of digital paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More and banking alternatives has been the widespread closure of bank branches and ATMs. Armaguard and Prosegur have developed their ATM networks, with Armaguard acquiring ATMs from ANZ and Commonwealth banks and incorporating the Cuscal-owned rediATM network under their ATMX brand.

At Prosegur, the company has rebranded the offsite ATMs they acquired from Westpac Group in 2019 as Precinct, an offering styled as more than just an ATM network but a multi-bank solution. Prosegur is also starting to offer Courier and Access Hubs from their cash centres under the Precinct banner this year.

With Westpac Group recently extending the existing fee-free access for its banking customers at Precinct ATMs to ATMX ATMs, it will be interesting to see if the merger will result in a single ATM network or whether the two brands can co-exist.

Indeed, in addition to ATMs for cash access (and acceptance), there are opportunities to develop shared banking hubs and provide cash centre access to the many smaller cash couriers that form an essential part of the Australian cash ecosystem and who are finding it harder and harder to access traditional bank branches for business cash deposit and withdrawals.

Time flies

While the cash industry has primarily been in a holding pattern while awaiting the outcome of the merger decision, Australian payment behaviours continue to evolve.

According to the Reserve Bank’s Consumer Payments Survey, just 13% of payments were made using cash in 2022, whereas in 2019 this share was 27 per centFraction of a currency representing the hundredth of the unit of account. More. At the same time, financial institutions are reducing the number of branches and ATMs they operate nationwide.

The Australian Prudential Regulation Authority (APRA) reports that over the five years to June 2022, bank branches have declined by 30% in major cities and 29% in regional and remote areas. The number of ATMs in Australia has declined by approximately 25% since its peak in 2016.

In part prompted by the RBA’s suggestion to changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More the initially proposed open-ended nature of the merger agreement, the ACCC believes that the now three-year undertaking will allow time to consider whether any Government responses are needed to regulate the industry further and maintain adequate access to cash.

Likely, market forces alone will not fully address these challenges and while the newly created RBA-led industry forum established to support proposed changes to the country’s wholesale banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More distribution arrangements will no doubt play a part in determining the future shape of the industry, time remains of the essence in ensuring cash remains an available and reliable payments choice. Referencing the merger, the Government, in their Strategic Plan for Australia’s Payments System, have committed to work with relevant agencies across the public sector and industry to ensure that Australia has a sustainable cash distribution network that maintains adequate access to cash. How that takes shape remains to be seen.