Cash and Payments in Northern Spain

Blast from the Past

I had only been to Spain once, in May 2008. My first job out of university was as a host for Expedición 1808, a public history TV series on the bicentennial of the Spanish-American wars of independence, which began after Napoleon invaded Spain and forced the abdication of the Spanish king in favor of his brother, Joseph Bonaparte. Then, my friend Alejandra Carbajal, a talented photographer, and I interviewed Latin American workers in Lavapiés, a migrant neighborhood in Madrid.

Most immigrant workers were undocumented: their bosses paid them with cashMoney in physical form such as banknotes and coins. More off the table, always used cash as they had no bank accounts or paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More cards, and sent remittancesMoney sent home from emigrants working abroad. More to their families from conversatorios (internet cafés and phone cabins). Conversatorios were immigrants’ main contact points to their native countries before mobile phones, and WhatsApp made it easier to stay in touch with relatives and friends.

Digital Payments in Spain Now

During a trip to Santander and Bilbao last June for archival research and a conference, I attested to how Spanish consumers and retailers have adopted digital payments widely. Between 2019 and 2022, cash use in Spain declined 18% by volume of transactions and 14% by value, per the latest European Central Bank’s SPACE study.

In 2008, my colleagues and I carried Santander Bank debit cards, but we barely used them in Madrid. We always paid with cash whenever we had dinner or tapas and drinks. During the conference, my younger Spanish colleagues (doctoral students and early-career researchers) used Bizum to make instant transfers and pay for cañas (beers).

Bizum is a mobile payment solution allowing instant transfers between users’ bank accounts. Launched by a consortium of banks in 2016, Bizum has 24.3 million active users from 37 banking entities at the time of writing. Having no Spanish bank account, I carried cash to settle my part, and when I lacked moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More, I paid my debt in specie, that is, with a caña in a different place.

“¡No hay señal!” (There Is No Signal!)

I went to Santander to do research at the Santander Bank historical archive, located in the Cantabria Technological Center, the bank’s data center in Solares, known to the locals as the Santander bunker. Lack of investment in local railways often delays or disrupts the train service between Santander and Solares.

I had to take cabs three times to get to the archive. I had no problems paying with my Apple wallet the first time. However, the second time I had to take a cab, my taxi driver said she could not get a signal for her Santander Bank-issued payments terminal to work within the bunker‘s parking lot. I carried enough cash to settle the transaction. Naturally, I made sure to bring cash for the third time. What can we expect elsewhere if a bank’s terminal service is unreliable within its facilities?

Plenty of Ticket Machines

I took ALSA buses to travel between Santander and Bilbao. I purchased my tickets using the app, except for one day when it was down. When I got to Santander’s bus terminal, I noticed a long line of seniors waiting to buy tickets, as only one ALSA clerk was staffing the ticket desk. On their side, several ticket machines only took card payments.

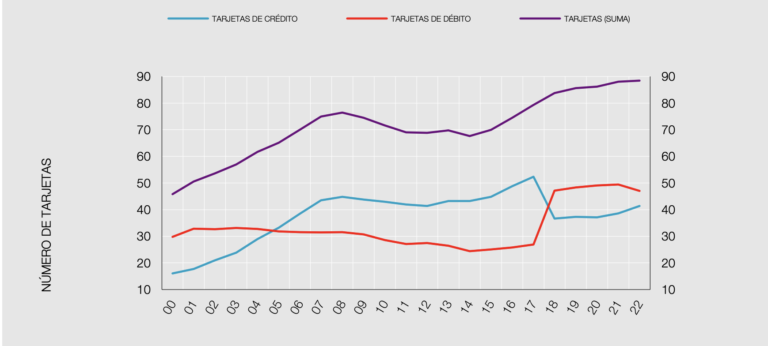

Per the Spanish card scheme Sistemapay, there are 89 million cards in Spain (1.9 payment cards per person) and 2 million payment terminals in Spain (see Graph 1). Slightly half (53%) are debit cards, and the average value of card payments is €33.

Graph 1. Spain: Payment Cards (millions of cards)

Note: Credit cards are in blue, debit cards are in red, and total cards are in purple.

Source: Banco de España (2023).

While I bought my ticket at the machine, I thought it was unfair that seniors must wait in line to pay using cash while others do not. Digital payments might be fast and convenient, but their promoters rarely discuss their exclusionary nature towards vulnerable groups, particularly seniors. The experience was a stark reminder of a viral petition by Carlos San Juan, a retiree in his late seventies from Valencia, requesting better treatment from banks.

Access to cash in Spain has worsened in the past decade.

- Bank desertification is acute in less populated areas. By the end of 2020, nearly 2 million Spaniards lived in municipalities with no cash access points (Posada Restrepo 2021: 7-8), and at least 2% of the Spanish population lived 5 km away from a cash access point.

- Per the latest SPACE study, the share of respondents perceiving access to cash withdrawals to be difficult increased by 4% between 2019 and 2022. Most Spaniards (82%) prefer to obtain cash through ATM withdrawals.

Perché vi serve il numero della mia carta di credito? (Why do you need my credit card number?)

In Bilbao, I stayed at Iralo by Pillow, a hotel I found online. As I left the hotel and waited for the cab to take me to the airport, two Italian motorbikers were irate while attempting to check-in. The woman had also booked online. Still, she did not expect to have to give a credit card number for a temporary €100 hold to cover incidentals.

The friendly clerk at the frontFacade, face. See Obverse. More desk was at a loss for words. The booking site does not share credit card information with its affiliates. I tried explaining that I also had to give my credit card for incidentals. The woman was afraid her number would be misused and wanted to guarantee €100 in cash. That was against the hotel’s policies. In the end, she consented.