Cash Usage and Infrastructure in Spain

Cash Dominates Retail Payments in Spain

According to the European Central Bank’s Study on the PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More Attitudes of Consumers in the EuroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More Area (SPACE), Spaniards used cashMoney in physical form such as banknotes and coins. More in 83% of all point-of-sale transactions and 66% of peer-to-peer transactions as of 2019. In the Banco de España (BdE)‘s 2020 cash use survey, only 2.5% of respondents said they no longer used cash due to the (mistaken) fear of infection.

Although cash remains the most widely used and accepted payment instrument in Spain, the Covid-19 pandemic has threatened cash and its users in the country. The accelerated adoption of digital payments has reduced consumers’ willingness to tip, greatly diminishing the earnings of restaurant and hospitality workers. The Spanish government has reduced the limit on cash payments believing it will increase fiscal revenue. The closing of bank branches and ATMs during the pandemic has worsened the country’s already acute bank desertification, with some communities (Valencia, Galicia) offering subsidies to install and operate ATMs.

Cash Advocacy in Spain: Plataforma Denaria

Plataforma Denaria is a new cash advocacy group in Spain. According to its president, Javier Rupérez, it aims “to safeguard the interests of those who see cash as a tool for financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More, to promote consumers’ freedom of choice in payments, and raise awareness of the importance of cash as a critical infrastructure in the economy, especially in crises situations.”

Cash is a “public good that empowers people and groups that would otherwise be excluded. […] Cash must be protected legally,” said Luis Cayo Pérez Bueno, president of the Spanish Committee of Representatives of People with Disabilities (CERMI).

Spanish retailers “defend the absolute freedom of citizens to choose their payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More;” which is why they oppose the recently approved “cash restrictions as they limit the growth in consumption [demand given that] citizens massively use [cash] as a payment instrument,” said Javier Millán Astray, general director of the National Association of Large Distribution Firms (ANGED).

Cash Usage during the Covid-19 Pandemic

During its September 2021 launch, Plataforma Denaria published the results of a survey on the need to preserve cash. According to it,

- Most Spanish consumers (68.6%) consider access to cash is critical in their lives.

- Most respondents (58%) said there are more barriers against cash now than before the Covid-19 pandemic. Consumers aged 45 years and older thought there were more barriers than younger consumers.

- Some respondents (7%) said they had trouble paying with cash at least once since the Covid-19 pandemic started. Interestingly, this problem was more common in urban areas, with 13.6% of consumers living in towns with more than 500,000 inhabitants saying they had trouble using cash in retail shops and restaurants.

Protecting Free Choice in Payments and the Right to Use Cash

During the Covid-19 pandemic, banks, payment processors, digital platforms, fintech firms, even some governments and central banks have encouraged the accelerated adoption of cashless payments. Nonetheless, these incumbents have not been very successful in dispelling social perceptions regarding the exclusionary nature of digital payments.

Per the Denaria survey, large majorities of Spaniards:

- oppose the advent of an economy without cash (88%),

- support an explicit government guarantee to cash usage (88%),

- think digital payments exclude vulnerable groups, such as the elderly, the homeless, people with disabilities, children and teenagers, and people living in rural and less populated zones (87.7%).

- stand against excluding cash in daily transactions (83%),

- think big tech firms stand to gain the most from the widespread adoption of digital payments (81.8%)

The Spanish Cash Infrastructure

A significant share of respondents to the Denaria survey (41.6%) thought people living in less populated zones had fewer digital payment options than consumers in more populated areas. However, the digital gap shies against the uneven access to the country’s cash infrastructure. Between 2001 and 2018, 63% of Spanish municipalities lost population. Since 2008, bank branches have declined nearly 50% in Spain; ATMs have diminished by 20%.

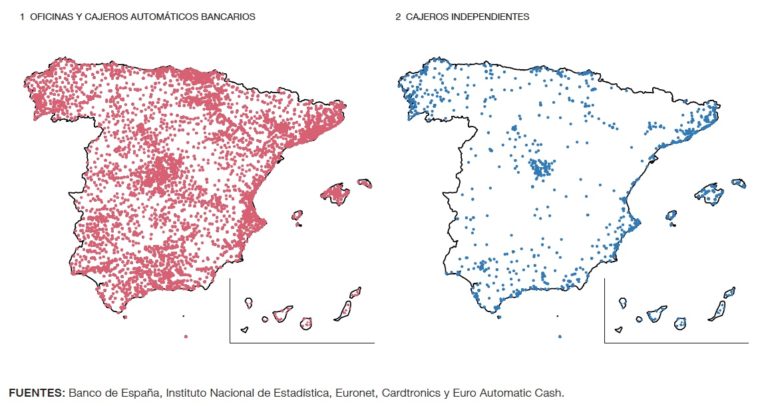

Bank desertification is acute in less populated areas. A recent study by Diana Posada Restrepo (BdE) explores the geographic distribution of cashActivity consisting of the delivery of cash throughout the territory in the amount and modality required to adequately cover the needs. It is one of the central bank’s core functions, for which the necessary logistics, materials and human resources are used, either in-house or outsourced. More infrastructure in Spain. The study employs a database with 68,692 cash access points (bank branches, bank-owned ATMs, and ATMs run by independent operators) active in all Spanish municipalities as of the end of 2020 (see Map 1).

Map 1. Spain: Bank branches and ATMs (red) and independently owned ATMs (blue), 2020

Source: Posada Restrepo (2021): 5.

Map 2. Spain: Percentages of the population living within 5 km (left) and 10 km (right) of a cash access point, 2020

Source: Posada Restrepo (2021): 9.

Posada Restrepo found that by the end of 2020, nearly 1.2 million Spaniards lived in municipalities with no cash access points (Posada Restrepo 2021: 7-8), and at least 2% of the Spanish population lived 5 km away from a cash access point. The provinces of Zamora and Ávila (both in the autonomous community of Castilla y León) have the smallest percentages of the population living within 5 km of a cash access point, with 81% and 85%, respectively (see Map 2).