Spanish Congress Imposes Lower Limit on Cash Payments

When most countries try to boost their economies and encourage consumer spending, the Spanish Congress has approved an act reducing the existing limit from €2,500 to €1,000. The act extends the cashMoney in physical form such as banknotes and coins. More paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More limitation from business-to-business (B2B) transactions to business-to-consumer (B2C), point of sale (POSAbbreviation for “point of sale”. See Point-of-Sale terminal. More), and peer-to-peer (P2P) transactions, such as retail purchases of goods and professional services.

The Spanish government has argued that this lower limit “will facilitate traceabilityThe tracking of a product through its industrial or commercial life, by monitoring its location at all times. More of transactions, and will make it more difficult to incur in fraudulent practices.” As a telling sign of how cash is not the only instrument used by tax evaders, the act also set higher requirements for taxpayers’ cryptocurrency holdings. The act mandates that Spanish taxpayers declare their crypto holdings in Spain and abroad and any transaction involving them.

The Use of Cash in Spain

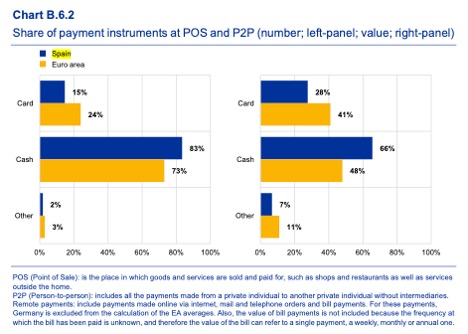

Spanish consumers conspicuously prefer to use cash in retail payments. According to the European Central Bank (ECB) Study on the Payment Attitudes of Consumers in the Euro Area (SPACE), in 2019, 83% of all transactions (66% in value) in Spain were settled with cash, compared to 73% (48% in value) in the eurozone.

Graph 1. Spain: Share of Payment Instruments at point-of-sale (POS) and peer-to-peer (P2P), 2019 (left panel: number of transactions; right panel, value in euros).

Source: SPACE 2020.

Widespread Opposition from Retailers

Trade groups including the National Association of Large Distribution Firms (ANGED), the Spanish Trade Federation (CEC), the Association of Textile Trades (ACOTEX), the Spanish Federation of Home Appliance Merchants (FECE), and the Professional Association of Private Security Services Companies (APROSER) warned that limits to cash payments would have a detrimental impact on the consumption demand and the economic recovery of sectors such as retail and tourism.

“We cannot understand why the government adopts measures that are clearly not supporting the consumption [demand] in a moment when we need to dynamize both consumption and economic activity to recover from the Covid-19 pandemic,” Javier Millán Astray, ANGED’s general director, said. Eduardo Zamácola, ACOTEX’s president, mentioned that even though France adopted a lower limitation to cash payments the country “has not stopped fiscal fraud. We are outraged.”

CEC spokesman Carlos Moreno Figueroa said, “we cannot force people to have credit cards. That means to favour private means [of payment], with costs to consumers. To solve fiscal fraud and the undercover economy, [authorities] should go to its origin, and not to final consumption.” Moreno Figueroa also warned that countries that have adopted limits to cash payments in the past have found they are relatively ineffective in the fight against fiscal fraud.

European Regulators and Limits to Cash Payments

In 2018, the central bank of Spain requested the ECB a technical opinion on a similar initiative to the one just approved. In February 2019, the regulator said cash payments were critical “for several social sectors that prefer to use cash instead of other means of payment for diverse and legitimate reasons” (European Central Bank 2019: 3). Reducing the cash payments limitation from €2,500 to €1,000 would be “disproportionate if one considers its possible adverse repercussions in the cash payments system” (European Central Bank 2019: 4). Months later, in November 2019, the ECB issued a technical opinion to Greece in very similar language, arguing that a bill seeking to expand tax restrictions on the use of cash would be “disproportionate in light of the potentially adverse impact on the cash payment system.

In June 2018, the European Commission decided not to impose EU-wide limitations on cash payments to combat money launderingThe operation of attempting to disguise a set of fraudulently or criminally obtained funds as legal, in operations undeclared to tax authorities, and therefore not subjected to taxation. Money laundering activities are strongly pursued by authorities and in most countries, there are strict rules for credit institutions to cooperate in the fight against money laundering operations, to declare and report any transactions that could be considered suspicious. More and tax evasion. A report demonstrated that the relationship between “tax fraud and the use of cash […] is not always clear-cut”.

However, in May 2021, E.U. Financial Services Commissioner Mairead McGuinness said the Commission planned to introduce a cash payments limitation of €10,000. Deutsche Bundesbank’s board member Johannes Beermann criticized the Commission’s plans last month in harsh terms. Beerman said, “so far there has been no scientifically sound evidence that the goal of combating moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More laundering is achieved with upper limits for cash payments.”