The Resilience of Cash Usage in Spain during the Covid-19 Pandemic

In 2014, nearly 80% of Spanish consumers preferred cashMoney in physical form such as banknotes and coins. More as their primary payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More, according to the Banco de España (BdE). Since then, debit cards have displaced cash in consumers’ paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More preferences. In 2020, 54.1% of consumers said they preferred paying with debit cards, according to the most recent BdE cash use survey.

Although the share of consumers favouring cash is smaller (35.9%), it is worth remembering that surveys on consumers’ payment preferences do not necessarily reflect effective payment behaviour. It is worth reminding that 83% of all point-of-sale transactions in Spain were settled with cash in 2019, according to the European Central Bank’s Study on the Payment Attitudes of Consumers in the Euro Area (SPACE).

Cash Usage in Spain during the Covid-19 Pandemic

Most Spanish consumers continued to shop in person (and pay with cash) even during the country’s lockdowns. In March 2020, the Mercadona supermarket chain stopped taking online orders as customers overwhelmingly shopped in person. Only 2.5% of respondents to the BdE survey said they no longer used cash due to the (mistaken) fear of getting Covid-19.

Like many other countries, Spain experienced a cash paradox during the Covid-19 pandemic: the Spanish public increased their precautionary demand for cash, which more than compensated for a fall in the transactional demand. Per the BdE survey, 89.4% of Spanish consumers said they did not use a €200 or €500 note in 2020; however, nearly half (47.9%) said they had saved at least €500 or more in cash outside their bank accounts.

“Aceptamos Efectivo y (Tal Vez) Tarjetas” (We Take Cash and (Maybe) Cards)

Nearly all businesses surveyed (99.3%) reported they accept and use cash for daily payments. Other payment solutions are not as widely accepted: 93% of retailers take debit cards, 82% accept credit cards, and only 50% accept mobile wallet payments. Businesses said cash payments are cheaper, given the high commissions and fees with card payments.

Most small businesses (80.9%) reported they got cash from a bank every week. A slight majority of the Spanish public (52.5%) refuses to accept 1 and 2 centFraction of a currency representing the hundredth of the unit of account. More coins as changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More: these coins are usually left behind as tips to restaurant and hospitality workers. However, 65.9% of consumers oppose their elimination, as they fear rounding prices to fives and zeros will lead to inflation.

Younger and Older Consumers Prefer Cash

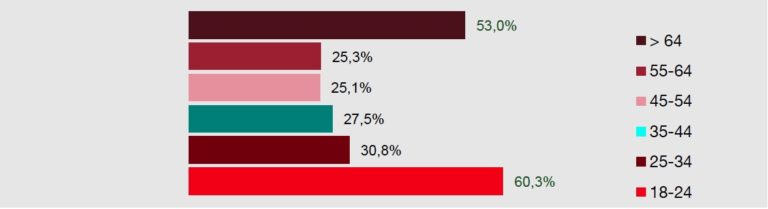

The BdE survey revealed significant differences in cash usage by age and location. Cash is the leading payment instrument of 60.3% of Spanish consumers between 18 and 24, and 53% of Spaniards 64 years and older (see Graph 1). Card usage in Spain correlates to income levels as in other European countries.

Graph 1. Spain: Preference for cash by age group, 2020

Source: Banco de España (2021).

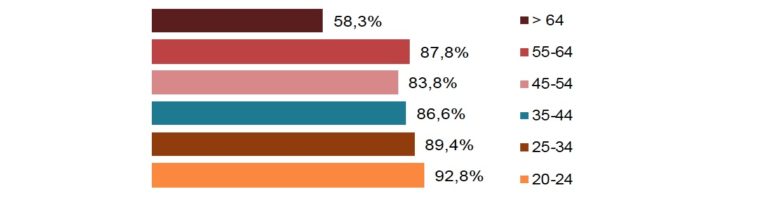

Most Spaniards get their cash from ATM withdrawals (84%) and seldom from bank tellers (80.5%); 60% said they usually withdraw €50-€200 from ATMs, and 42.4% reported using ATMs at least once a week. Although a small fraction of the Spanish public got cash from bank tellers rather than from ATMs (13.3%), the habit is more prevalent among consumers aged 64 and older, with 41.7% getting cash in this manner (see Graph 2).

Graph 2. Spain: Population not getting cash from a bank teller by age group, 2020

Source: Banco de España (2021).

Access to Cash in Less Populated Areas and Financial Exclusion

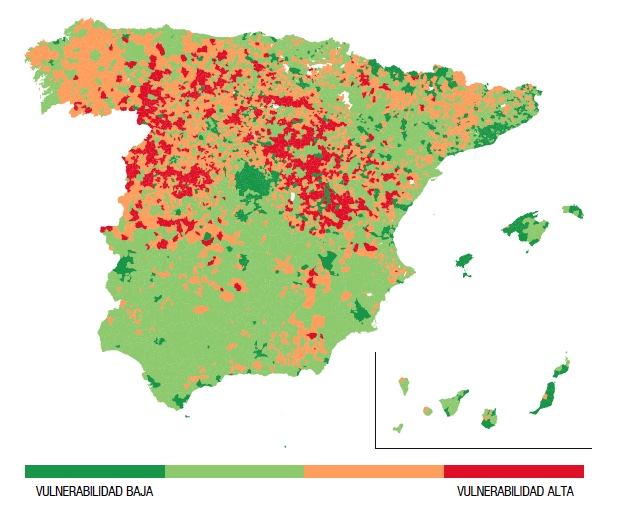

More Spanish consumers living in rural and less populated areas prefer cash than consumers in more populated areas. However, after banks closed branches and shut down ATMs due to the Covid-19 pandemic, more consumers in less populated areas (5.9%) reported their closest bank branch is 10 km (or more) away from where they live. In a recent BdE study, Diana Posada Restrepo estimated the vulnerability of Spanish municipalities to financial exclusion resulting from diminished access to cash (see Map 1).

Map 1. Spain: Vulnerability to Financial Exclusion Resulting from Diminished Access to Cash, 2020

Notes: Municipalities with low vulnerability are in green; those with high vulnerability are in red.

Source: Posada Restrepo (2021): 12.

The study found that municipalities with less access to cash have higher shares of older inhabitants, lower income, and lower educational levels (Posada Restrepo 2021: 13). Nearly 340,000 people (0.7% of the country’s population) live in municipalities with a high risk of financial exclusion. These municipalities have 400 inhabitants, and their closest cash access point is 9.4 km away; their share of adults aged 60 years and older is more than 40%, and their income level is lower than the national average.

Nearly One Million People in Less Populated Areas Struggle to Access Cash

In addition, nearly 1 million people in Spain have a medium vulnerability in their access to cash. They live in municipalities with an average of 1,700 inhabitants. Cash access points are 3 km away from these localities. The share of adults aged 60 years and older in these municipalities is 35% and more, and their income levels are lower than the Spanish national average.