ECB: Cash is “Safe to Use,” Despite the SARS-CoV-2 Virus

A July 2021 paper by Barbora Tamele, Alejandro Zamora-Perez et al. for the European Central Bank (ECB) assessed changes in cash circulation during the Covid-19 pandemic. The authors also examined the role of cashMoney in physical form such as banknotes and coins. More as a possible transmission vector of the SARS-CoV-2 virus.

This post summarizes the findings relating to the second part of the paperSee Banknote paper. More, which conclusively asserts that “the risk of transmission [of Covid-19] via banknotes and coins is very low, and that cash is safeSecure container for storing money and valuables, with high resistance to breaking and entering. More to use” (Tamele, Zamora-Pérez et al. 2021: 27).

Assessing Cash’s Role in Covid-19 Transmission

Researchers studying the likelihood of Covid-19 transmission through cash often cited a paper by Thomas et al. (2008) that found that the influenza virus could survive on banknotes for up to three days in high concentrations, under ideal laboratory conditions. The study considered that “although viruses have not been found on moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More, the potential for their transmission via money is possible.”

Angelakis et al. (2014) had found that the efficiency of viral transmission through cash depended on the “viral strain, the nature of the host cells and surfaces, and atmospheric conditions.” ECB-commissioned research on other viruses, such as the avian flu (2006) and swine flu (2009), had already concluded that cash did not pose a significant risk of viral transmission to its users.

The ECB conducted ad hoc research into whether cash played a role in the transmission of Covid-19 to ensure the integrity of euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More banknotes as means of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More.

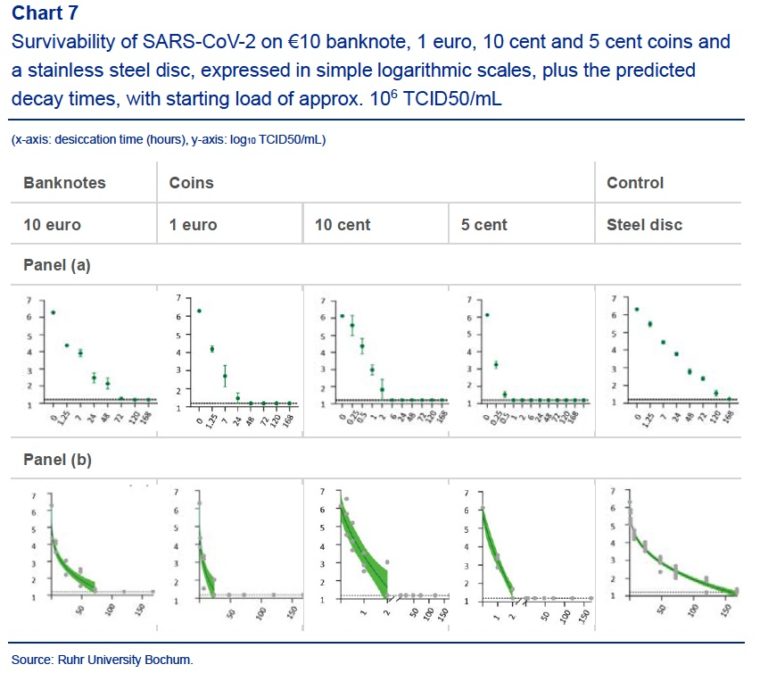

ECB: The SARS-CoV-2 Virus Lasts Longer in Stainless Steel than in €10 Notes

The ECB, with researchers from the Department of Molecular and Medical Virology at the Ruhr University Bochum in Germany, Dr. Brill + Partner GmBH in Hamburg, and BluTest Laboratories Ltd. in Glasgow, found that the SARS-CoV-2 virus could survive on cash for 30 minutes to 72 hours, but only in limited quantities (Tamele, Zamora-Pérez et al. 2021: 15). ECB research found that the SARS-CoV-2 virus “was more stable and therefore survived longer on stainless steel than on the €10 banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More and all the coinA coin is a small, flat, round piece of metal alloy (or combination of metals) used primarily as legal tender. Issued by government, they are standardised in weight and composition and are produced at ‘mints’. More types [€1, 10 and 5 cents]” (Tamele, Zamora-Pérez et al. 2021: 17).

The ECB results coincide with the bottom range of results reported for banknotes in the literature. Tamele et al. said the results could “depend greatly on experiment conditions: humidity, temperature, mode of virus application to the surface, dosing and finally interpretation of the results” (Tamele, Zamora-Pérez et al. 2021: 18).

Graph 1. Survivability of the SARS-CoV-2 virus on €10 Banknotes; €1, 10 and 5 CentFraction of a currency representing the hundredth of the unit of account. More Coins; and Stainless Steel

PVC and Stainless Steel are Likelier to Transfer the SARS-CoV-2 Virus than Cash

ECB research also tested for the likelihood of transferring the SARS-CoV-2 virus from contaminated cash to humans via fingers. The ECB developed new protocols for transferability testing. Researchers used two viral loads (a high load of 106 TCID50/mL and a lower load of 104 TCID50mL). They also employed “wet” inoculum, i.e., immediately after virus droplets were applied to tested surfaces, and “dry” inoculum, i.e., after visible drying of inoculum on tested surfaces).

According to the ECB, “the transferability of the virus from cash is almost non-existent and also lower than for the reference surfaces (PVC and stainless steel). This could be attributed to its porosityThis is a measure of empty volumes in a material in relation to the total volume or surface. Property of certain materials that allow the transfer of air or water through its surface. It is related to the absorption capacity. Depending on the needs and purposes, higher levels of porosity will make material more or less desirable and appropriate. More in the case of the €10 banknote, and to the presence of copper in the coin alloy in the case of the 10-cent coin.” (Tamele, Zamora-Pérez et al. 2021: 18).

Figure 1. Transferability testing of BCoV (bovine coronavirus) and the SARS-CoV-2 Virus from €10 Banknotes; 10 Cent Coins; PVC; and Stainless Steel

For high viral loads, transfers of the SARS-CoV-2 virus reduce the viral load by several hundreds of TCID50/mL for the €10 banknote and by a thousand TCID50/mL for the 10-cent coin.

According to the authors, the most realistic scenario resembling the daily use of cash in retail payments corresponds to the low viral load with a “dry” inoculum. In this case, the remaining SARS-CoV-2 virus on the surface of the €10 banknote and 10 cent coin is below the detection limit; its transferability is also below the detection limit.

Graph 2. Transferability test of the SARS-CoV-2 Virus from €10 Banknotes; 10 Cent Coins; PVC; and Stainless Steel

The scientific literature has barely assessed the transferability of the SARS-CoV-2 virus from surfaces to skin. Lopez et al. (2013) found that porous surfaces (or fomites) such as cotton, polyester, and paper currencyThis is often used as a generic expression to refer to banknotes, versus the “metal currency” expression, which refers to coins. More had lower transfer rates than non-porous materials, such as stainless steel.

The ECB Study Belatedly Confirms that Cash is Safe Despite the SARS-CoV-2 Virus

“[In the euro area, c]ash payments were reduced partly due to fears of contagion via cash, which were probably magnified by media statements and recommendations by public authorities.” – Tamele, Zamora-Pérez et al. 2021: 26.

The SARS-CoV-2 virus spreads primarily through airborne transmission by inhaling respiratory secretions infected with the coronavirus. Transmission via fomites plays a relatively minor role, with the risk estimated to be between 1:10,000 and 1:1,000,000.

This ECB study authoritatively asserts that the risk of transmission of Covid-19 when handling banknotes and coins is very low and “very limited in everyday life conditions, and therefore cash does not contribute to the spread of Covid-19” (Tamele, Zamora-Pérez et al. 2021: 21). The SARS-CoV-2 virus “does not survive on the surface of inanimate objects any longer than many other similar viruses (SARS-CoV-1, influenza), neither can it be transferred efficiently to the human hand finger[s]” (Tamele, Zamora-Pérez et al. 2021: 26).

The report confirms statements made and procedures adopted by several central banks during the Covid-19 pandemic indicating that cash was safe (see the U.S. Federal Reserve, the Banco de México, and the South African Reserve Bank).

Although the study and its authors deserve all praise and amplification, the publication of the results comes at a very late stage. Governments (such as the Johnson administration in the United Kingdom) and the financial industry used the mistaken belief that cash could play a role in Covid-19 transmission to advance their war on cash. The idea has also posed a serious communication challenge to the global cash community.

This post is also available in:

![]()