Mexico: Cash is Alive and Well

According to Bank of International Settlements’ (BIS) data, Mexico’s cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More grew by 42.5% between 2015 and 2019. Anticipating a sustained growth in the demand for cashMoney in physical form such as banknotes and coins. More, Banco de México (the country’s central bank) opened a second banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More printing facility in El Salto, Jalisco, in 2018. That same year, Mexico’s ratio of cash in circulation to GDP was 6.9%, equal to the median and slightly lower than the 8% average in the most recent BIS comparison available.

The Mexican Central Bank Did Not Recommend Using Cash Less During the Covid-19 Pandemic

As SARS-CoV-2 spread throughout the world, Banco de México advised cash holders to “wash their hands correctly and frequently, and to avoid touching their nose, eyes and mouth after touching any surface or object, including banknotes and coins.” In June 2020, the Mexico City local government, in alliance with the Asociación de Bancos de México (ABM, Mexican Banking Association) promoted alternatives to cash, such as the Sistema de Pagos Electrónicos Bancarios (SPEI, Interbanking Electronic Payments System) and Cobro Digital (CoDi, Digital Charging).

Cash in Circulation Grows, Driven by Large-Denomination Banknotes

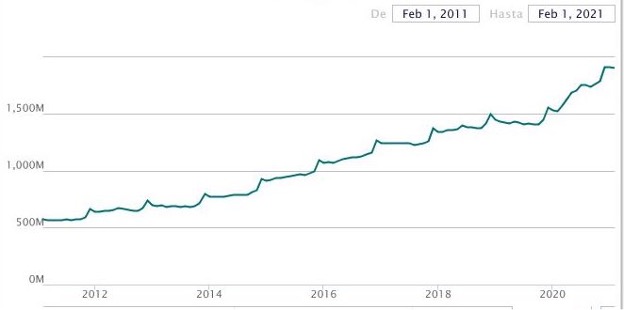

By the end of 2020, Mexico’s cash in circulation to GDP ratio increased to 8.5%. Banco de México data shows that during the Covid-19 pandemic, cash in the hands of the public has risen by a staggering 30.33%, going from MX$1.67 trillion (US$84 billion) on March 11, 2020, the day when the WHO declared Covid-19 a pandemic, to MX$2.18 trillion (US$110 billion) on March 31, 2021. The last amount would result in MX$17,277.35 (US$872.05) in cash per capita, based on population data from the 2020 census.

Graph 1. Mexico: Banknotes and coins in circulation, February 2011-February 2021 (thousands of Mexican pesos)

Source: Banco de México.

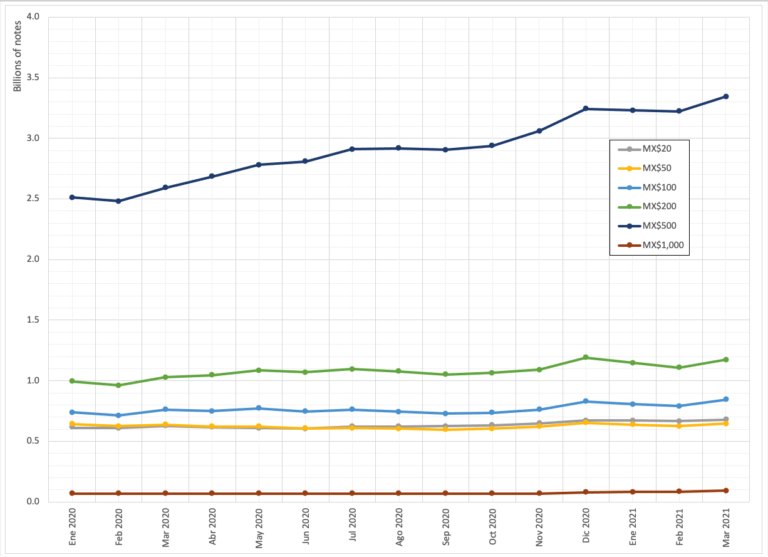

The increase of cash in circulation in Mexico has been driven by large-denomination banknotes, as in other countries during the pandemic. The volume of MX$1,000 notes (US$50.47) grew 34.7%, followed by MX$500 notes (US$25.24), with 33.1%; MX$200 notes (US$10.09), with 18.2%, and MX$100 notes (US$5.05), with an increase of 14.21%. Other small-denomination notes have grown a bitIn computers, the basic unit of digital information; contraction of BInary digiT. More less or stayed the same throughout the pandemic: notes of MX$20 (US$1.01) rose 10.9%, and MX$50 notes (US$2.52) grew 0.84%.

Graph 2. Mexico: Banknotes by denominationEach individual value in a series of banknotes or coins. More, January 2020-March 2021 (billions of notes)

Source: own elaboration with Banco de México data.

Cash Infrastructure Expands Slightly; ATM Transactions Decline in Volume But Increase in Value

Despite sensational media coverage announcing the premature death of cash and the advent of cashless payments in Mexico, the country’s cash infrastructure has expanded during the pandemic. The number of ATMs grew 1.3%, going from 56.63 thousand ATMs in the first quarter of 2020 to 57.4 thousand in the last quarter of 2020. ATMs in bank branches grew 2.1%, from 27.7 thousand in January-March 2020 to 28.3 thousand ATMs in October-December 2020. ATMs outside of bank branches increased by 0.58%, from 28.93 thousand in 2020:Q1 to 29.1 thousand ATMs in 2020:Q4.

Although the volume of ATM transactions declined by 2.9% during the first year of the Covid-19 pandemic, their value increased by an impressive 15.9%. Average ATM withdrawals increased 19.5%, going from MX$2,057 (US$103.82) in the first quarter of 2020 to MX$2,458 (US$124.06) in the last quarter.

Despite the Covid-19 Pandemic and the Economic Collapse, Cash is Alive and Well in Mexico

In 2020, the Mexican economy contracted 8.5% in seasonally adjusted terms, its largest fall since 1932, during the Great Depression. As we can see with the most recent data, cash is alive and well in Mexico, despite the economic collapse.

There are several explanations for the significant growth in the demand for cash during the Covid-19 pandemic:

- According to Banco de México Governor Alejandro Díaz de León, a substantial increase in average ATM withdrawals stimulated the demand for cash.

- Enrique Quintana, the editor of the economic newspaper El Financiero, says that “the cash economy [in Mexico] is still very vast and it is also growing” due to 1) the strict policies of fiscal authorities during the López Obrador administration (which have enlarged the shadow economy), and 2) an expansion of the informal economy absorbing the recently unemployed.

- Jorge Sánchez Tello, head of applied research at the Fundación de Estudios Financieros (Fundef, Financial Studies Foundation), said that the demand for cash increased due to people “hoardingThe term refers to the use of cash as a store of value. However, the term has a negative connotation of concealment, and is often used in the context of the war on cash. See Precautionary Holdings. More cash to make purchases, including people who were let go during the pandemic. [… Also,] the informal economy is going to grow, and there everything is [paid] in cash to avoid being audited.”

- Lindsay Lehr, associate managing director and payments practice leader at Americas Market Intelligence, said that “we are seeing a quantitative reduction in the use of cash. This is a trend that has been growing in the region, but we know that in Latin America and the Caribbean, cash is truly rooted in culture, in the mentality of people, and in the behavior of businesses and consumers, so [reducing its use] has been a really difficult battle.”

- Javier Tejado Dondé, an opinion columnist with El Universal, says four factors are stimulating the demand for cash in Mexico: 1) the federal government is paying some welfare beneficiaries in cash, rather than through debit cards, 2) families and small businessowners are hoarding cash given the economic decline, 3) Mexican workers in the United States have increased their US dollarMonetary unit of the United States of America, and a number of other countries e.g. Australia, Canada and New Zealand. More remittancesMoney sent home from emigrants working abroad. More to the country, 4) drug cartels and other criminal organizations are donating cash to impoverished communities to gain their support.

The demand for cash as a store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More and reserve amid crises can explain the vigorous growth in cash in circulation in Mexico. This phenomenon has occurred in many countries worldwide during the Covid-19 pandemic, such as Argentina, Australia, the European Union, the United States, the United Kingdom, Japan, Singapore, India, and Colombia.