Efforts to Preserve Access to Cash Step Up in the U.K.

With the Economy at a Standstill, ATM and CashMoney in physical form such as banknotes and coins. More Use Declined

During the pandemic, the number of ATM transactions in the LINK network (the largest ATM network in the United Kingdom) dropped a staggering 43%, going from 2.61 billion in 2019 to 1.64 billion in 2020. Early in the pandemic, ATM transactions declined 41%, but then partly recovered in summer 2020 as authorities lifted restrictions and dropped again in the winter as authorities imposed a new lockdown (see Graph 1).

Graph 1. LINK Weekly ATM Transactions, 2019-20 (in millions)

Source: LINK Monthly Report January 2021: 3.

According to LINK surveys, 74% of U.K. consumers reported using less cash during the Covid-19 pandemic than before. Nearly a fifth of those surveyed said they had been discouraged by other people to use cash, and 10% reported that some of the businesses they shopped at had gone entirely cashless. A Bank of England survey from July 2020 showed that 42% of people had visited a cashless store in the previous six months. Another poll showed that 34% of respondents said they could not pay using cash at least once since the pandemic started, particularly in grocery stores, pubs, and restaurants.

But the U.K. Public Still Demanded Banknotes, Pandemic Notwithstanding

In value, ATM withdrawals declined less than in volume with a 36% drop, going from £116 billion in 2019 to £81 billion in 2020 (LINK 2021: 2). People might be spending less, but they store more cash: the average withdrawal value grew from £67 in 2019 to over £85 in 2020. This data point reflects an increase in banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More demand as a reliable store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More and reserve amid crises, as has happened in other countries during the Covid-19 pandemic, such as Argentina, Australia, the European Union, the United States, Japan, and Colombia, among others.

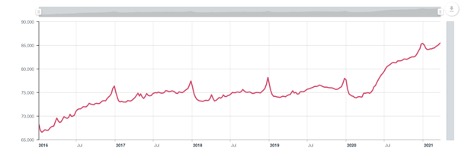

Bank of England data shows that cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More increased by £5 billion in 2020 or 6.7% (see Graph 2). Interestingly, Northern Ireland consumers had the highest withdrawals in the United Kingdom (£2,124 per adult in 2020), arising from heightened uncertainty relating to the Covid-19 pandemic and the region’s fate after Brexit.

Graph 2. Outstanding SterlingPound sterling, British currency. More Notes in Circulation, 2016-21 (in £ million)

Source: Bank of England RPWB55A statistics.

The Pandemic Reduced the ATM Network

The number of ATMs in operation contracted nearly 9.9%, from 60,600 in January 2020 to 54,574 ATMs in December of last year. The number of pay-to-use ATMs declined 16%, going from 15,323 in January to 12,847 in December 2020. Most worryingly, free-to-use ATMs went from 54,500 in January 2018 to 41,500 in January 2021, a fall of 24%.

The reduction resulted from offline ATMs in closed premises (such as high streets, city and shopping centres, airports, pubs, cinemas, convenience stores) and shutdown ATMs in bank branches and supermarkets to comply with public health guidelines.

It is an open question as to how many ATMs will come back online as lockdown measures ease and economic activities return to normalcy. The Covid-19 pandemic threatens the ATM network’s economic viability, already weakened by the closure of nearly half of British bank branches since 2000.

Preserving Community Access to Cash

The situation has prompted several experiments to preserve the sustainability of cash for users and small businesses, such as the Community Access to Cash Pilots and LINK’s Community Access to Cash Delivery Fund. Natalie Ceeney, lead author of the Access to Cash Review, says, “These pilots are designed to find sustainable ways to keep cash viable locally, which, if successful, can then be rolled out more widely.” Even Visa has enacted a program to pay shops to offer cashbackA service whereby the customer pays electronically a higher amount to a retailer than the value of the purchase for goods and/or services and receives the difference in cash. It is also a reward system associated with credit card usage, whereby the consumer receives a percentage of the amount spent on the credit card. More in rural locations in the United Kingdom.

Cash access in rural and remote areas is critical for retail payments. According to Enryo, over 11.6 million adults frequently use cash for day-to-day spending, representing 22% of the U.K. adult population (Cash in the U.K. 2020: 12-13). It is estimated that over 8 million adults (17% of the U.K. population) would be unable to cope or are unsure of how they would cope with a cashless society (Access to Cash Review 2019: 6, 45).

Pilots include “bank hubs” offered through the U.K. Post Office, white-label branches such as the OneBanks initiative, and other CashTechThe expression was first coined by CashEssentials and is the encounter of cash and technology. It brings together innovative companies who leverage software and modern communications technology to improve cash services: access to cash; acceptance of cash; and the efficiency of the cash cycle for all stakeholders. More solutions. In autumn 2020, LINK and PayPoint (a paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More services and ATM provider) launched a Cash-in-ShopService allowing a customer to withdraw cash from a payment account using a mobile application on a smartphone at a participating shop supporting the application. Also referred to as a “virtual ATM”. Unlike cashback, a cash-in-shop transaction does not require the consumer to make a purchase. More pilot allowing consumers to obtain cash in small shops without making a purchase. Traditional cashback is the second most used method for withdrawing cash in the United Kingdom, just behind ATMs.

In Denny, Scotland, a convenience store owner told the BBC that his town “used to have a TSB [Trustee Savings Bank], a Royal Bank of Scotland, a Bank of Scotland, a Clydesdale Bank. They’ve all shut.” He has seen an increase in sales from people picking “up a juice, or a pack of cigarettes” when they withdraw cash. However, his top priority is to help the elderly and the vulnerable members of his small town. “ I think it’s just a community thing where we try to help and give back something. [People] who are on benefits here want access to their cash. […] If someone on benefits has only got £3.50 left in their bank account and they want that £3.50, I can give them that £3.50, and it is not going to cost them anything,” he said.