Bank of England Publishes Review of Cash in the Time of Covid

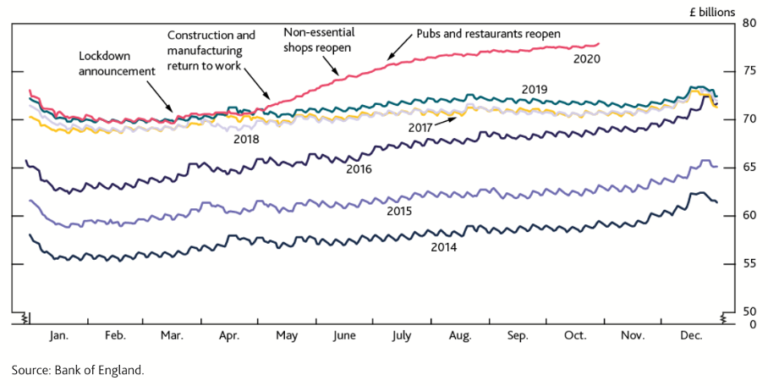

The report provides a comprehensive analysis of changing consumer paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More behaviour during the pandemic. As in many other countries, the UK has experienced a sharp drop in the use of cashMoney in physical form such as banknotes and coins. More for payments and a rise in banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More demand as a store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More. The trend predates the pandemic but has been magnified as economies went under lockdown. The gap between declining cash payments and increasing banknotes has widened as illustrated by the chart below.

Value of Banknotes in Circulation

The authors put forward several factors to explain the cash paradox.

A massive decline in consumer spending

The first most important factor is a massive decline in consumer spending as entire sectors of the economy were shut down – restaurants, cafés, travel… – while others were impacted by social distancing policies. Total household spending dropped by almost 30%. This has impacted cash and non-cash payments: the value and volume of contactless card transactions fell in April in value and volume by 40% and 44% respectively.

A Boom in Online Shopping

Secondly, the pandemic has led to a boom in online shopping which jumped from 19% of retail spend in September 2019 to 28% in September 2020. This results in fewer cash payments.

Minimising Contacts

Thirdly, consumers have been advised by retailers, payment service providers but also the government to minimise contacts around transactions and prefer contactless payments. A Bank of England survey in July revealed that 42% of people had visited a store in the previous six months that did not accept cash.

Contingency Role of Cash

The fourth – and well-known – factor is the contingency role of cash which leads consumers to increase their cash holdings in times of crisis. A Link survey in April showed that 14% of people held more cash at home during the pandemic.

The Reduced Velocity of Cash

The fifth factor is the reduced velocity of cash during the pandemic. As bank branches and ATMs were closed or unavailable during the lockdown, retailers and consumers were unable to deposit their excess cash into their bank account and therefore increase their cash holdings.

The report also presents the results of a laboratory study commissioned by the BoE, analysing the survival of the Covid-19 virus on banknotes.Interestingly, the test was done using a dose of virus equivalent to someone coughing or sneezing directly onto a banknote in what is considered a worse-case scenario. The study found that the level of virus found on a banknote remained stable for an hour after exposure and then declined rapidly. The survival of virus is lower on banknotes, whether paperSee Banknote paper. More or polymerA substrate used in the printing of banknotes, made of biaxially oriented polypropylene (BOPP) polymer. Polymer banknotes were first introduced in Australia and are widely used around the world. More, than on other frequently touched surfaces.

The Bank concludes “In a retail environment, the major infection risk would be directly from breathing in exhaled droplets or aerosols when in close proximity to an infected person within the shop, or potentially from touching a ‘high touch’ object such as the handles of shopping baskets or shopping trolleys, PIN keypads, products on open shelves or the touchscreens of self-checkout terminals.”

The Risk of Covid Transmission by Banknotes is Low

Source: Bank of England

This post is also available in:

![]()