India: During the Pandemic, Household Borrowing has shifted from the Formal to the Informal Sector

The economic impact of the lockdown has taken dramatic proportions in India. The country has recently posted the largest economic contraction among major economies as GDP shrank by 23.9 between June 2020 and June 2019. It is expected to further contract by 5% in 2021. The World Bank estimates that the pandemic risks reversing years of economic gain in India and that it could push millions back into poverty. Between April and August 2020, 18.9 million salaried people lost their jobs. The situation is even worse for migrant labourers and poor workers.

Nobel Laureates Abhijit Banerjee and Esther Duflo have recommended immediate cashMoney in physical form such as banknotes and coins. More transfers of Rs 1,000 per person every month as universal basic income (UBI) to bypass the economic crisis caused by the pandemic. In April, the government of Tamil Nadu has distributed cash along with essential food items to assist the poor during the 21-day nationwide lockdown. The beneficiaries include pavement vendors, construction workers and other workers in the informal sector.

In their blog, Get by with a little help from my friends (and shopkeepers): Household borrowing in response to Covid, Renuka Sane and Ajay Shah analyse whether households have increased borrowing in order to mitigate the drop in revenue as had been observed during the demonetisation of 2016. To test this assumption, they use data from the Consumer Pyramids Household Survey (CPHS) and measure, on the one hand, the evolution of the number of householdswith debt outstanding and on the other hand, the sources from whom households have outstanding borrowings.

The number of households with debt outstanding has declined during the pandemic

The number of households with debt outstanding has been constantly increasing since 2016 till 2019 from 35 million or 12.3% of the total number of householdfs to 155 million or 50.5%. However, in 2020, the number has dropped to 142 million households or 45% of the toatal. The decline has been more important in urban regions than in rural areas.

Less households borrow from banks

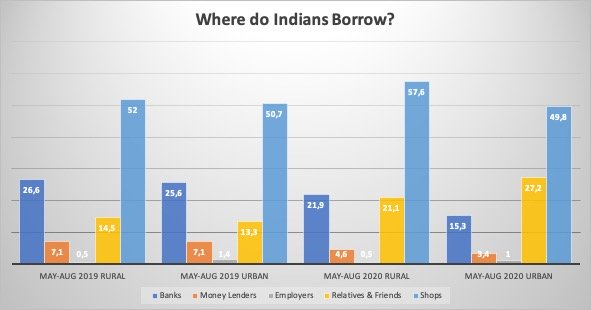

Looking at the sources of household borrowing, Sane and Shah find that the biggest drop in borrowing is from banks: in 2019, 26% of borrower households had borrowed from banks; this has dropped to 20% in 2020. The proportion of households borrowing from moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More lenders has also dropped, from 7% in 2019 to 4% in 2020. The drop in households borrowing from banks and money lenders was higher in urban regions than rural regions.

More borrow from friends and family

The decline in bank lending has been compensated however by a concurrent rise in the number of households borrowing from friends and family, from 14% in 2019 to 21% in rural regions, and from 13% to 27% in urban regions. “The sharp increase in the borrowing from friends and family suggests that some smoothing of consumption expenditure is likely to have occurred using informal social networks that play an important role in the economic lives of those in developing countries.” concludes Sane

Shops are the most frequent source of borrowing

The most frequent source of borrowing are shops. In rural India, their share increased, from 52% to 57.6%, whereas it fell slightly in urban India. Chakraborty and Sane (2019) had found that between the years 2016 and 2018 (i.e. after demonetisationSee Demonetised banknote. More), the biggest rise in borrowing was from shops, especially by those with lower incomes. This seems to apply in the current situation as well, especially in rural regions.

Source: Consumer Pyramids Household Survey (CPHS)

In difficult times, it was not banks, money lenders, and employers that mattered. It was friends and family, and the neighbourhood shops. The study does not actually look at the respective share of cash and digital money in the informal sector but one can assume that it is prominent. According to the recently published Annual Report of the Reserve Bank of India, cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More grew by 14.7% in value and 6.6% in volume between March 2020 and March 2019.