Japanese government incentivises electronic payments

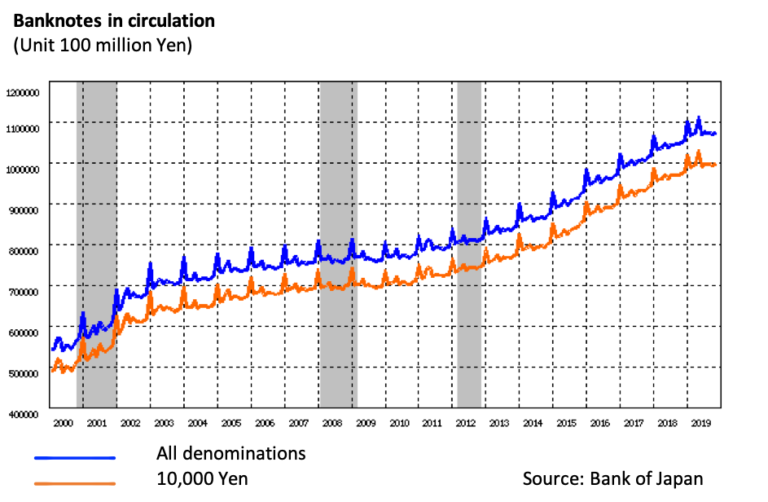

Japan is one of the countries with the highest levels of cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More in relation to GDP in the world, with a ratio exceeding 20%, compared to 8% in the United States or 11% in the euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More area. In value terms, banknotes in circulation have doubled between 2000 and 2019; however, the highest denominationEach individual value in a series of banknotes or coins. More, the 10,000 Yen note, represents 90% of cashMoney in physical form such as banknotes and coins. More in circulation indicating that cash is an important store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More. According to Reuters, Japanese households hold over half of their assets in cash and deposits.

A ¥280 billion program to incentivise digital payments

In 2017, the Ministry of Economy, Trade and Industry (METI) published a policy document titled “Cashless Vision” which set a target to double the share of digital payments from 18% in 2017 to 40% in 2027. In October 2019, the Japanese government raised the sales tax from 8 to 10% and saw this as an opportunity to promote the adoption of digital payments. To offset the impact of the tax hike and promote digital payments, the government has launched a 9-month reward programme whereby consumers receive a 2 to 5% rebate if they use one of 40 approved digital paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More methods. It does not apply to foreign cards. This represents a massive subsidy of ¥280 billion ($2.5 billion). According to a survey conducted at the end of October, only 20% of respondents said they had either started using or are considering using digital payments following the campaign.

The incentive has represented a huge boost for both traditional electronic payment service providers and fintechs which have aggressively promoted their products. Too aggressively maybe for some. In July 2019, 7Pay, the payment system owned by the Seven-Eleven convenience store chain experienced a major hack leading the company to close the service. Another provider PayPay experienced glitches when it offered one-day incentives of up to 20%, leading to complaints on social media.

A challenge for the elderly and small shops

It is still too early to assess the impact of the government campaign. However, it clearly faces two challenges.

The first is to convince consumers and particularly the elderly. Low interest rates, a dense and efficient ATM network, very low levels of counterfeitThe reproduction or alteration of a document or security element with the intent to deceive the public. A counterfeit banknote looks authentic and has been manufactured or altered fraudulently. In most countries, currency counterfeiting is a criminal offence under the criminal code. More notes, al low crime rate and high levels of automation have made cash convenient and appealing. This is particularly true for the elderly who make up almost a third of the population and have little interest in using payment apps or electronic moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More.

The second is to increase the acceptance of digital payments by small merchants. According to Reuters, “Less than half of some 2 million small firms deemed eligible for subsidies on cashless payments have been registered with the government campaign, due to the cost of introducing machines and high transaction fees.”