Over half of US mobile-payment users hate the idea of life without cash

A research study conducted by market research company Origin, reveals that consumers prefer not to choose between cashMoney in physical form such as banknotes and coins. More and digital payments, but carry both hand-in-hand. The study, Cashless Culture: The Marketer’s Guide to the Emerging Cashless Consumer, is based on the views of 1,018 qualified smartphone users across the United States varying in age (18 and above), gender and relationship status.

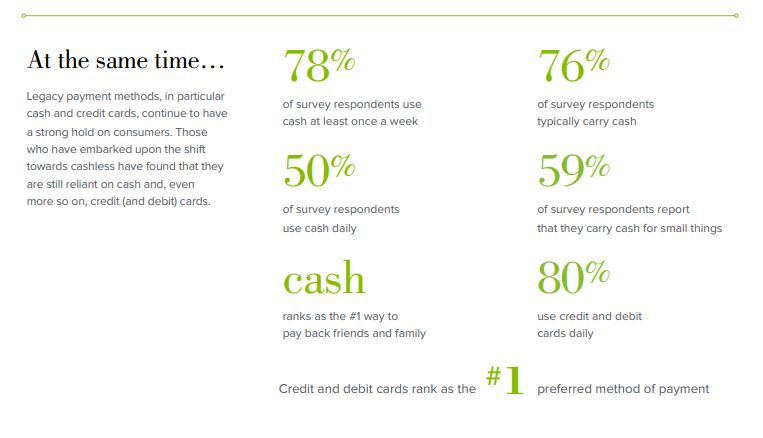

Key insights include:

- 76% of consumers still carry cash daily

- 55% hate the idea of life without cash

- 45% of consumers have never used any mobile paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More app

- 58% of mobile payment users report that they only started using mobile payments within the last year

- 94% consumers can’t be caught leaving the house with just their mobile phones, making sure to bring along cash to make purchases

Compared with other countries such as China where almost 80% of smartphone users made mobile payments in 2018, only about 20% of US customers made a mobile payment. The US has been relatively slow in transitioning to the more digital side of things when it comes to payment methods, largely because many US consumers are more comfortable paying by card or cash, reports eMarketer.

Credit and debit cards ranked as the most preferred method of payment amongst US consumers. But results from the survey show how cash is still very much embedded in everyday life, ranking as the preferred way to pay back friends and family. Meanwhile, 63% of the survey’s respondents report that clear and consistent visual cues around mobile payment options and how they work would increase their willingness to let go of cash and credit/debit cards.

Part of the research consisted of a deprivation study with 10 adults, who agreed to “go cashless” for a week and record their experiences. The results were surprising, shining light on the social pressure aspect of mobile and app-based payments: “I asked if the restaurant accepted mobile payments and the waitress looked at me disapprovingly,” said one participant. Spoiler alert: every participant cheated.

(Cashless Culture: The Marketer’s Guide to the Emerging Cashless Consumer, Hill Holliday, 2019)

As the payment ecosystem expands, so do consumer payment habits but as we observed, not as one would assume. Cash, like other forms of payment instruments, continues to play an important role in US society.

Sign up and download the full publication here