ECB: Cash is Dominant in Euro-Area Payments

In December 2022, the European Central Bank (ECB) published its latest Study on the PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More Attitudes of Consumers in the EuroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More Area (SPACE). SPACE 2022 sheds light on how consumers’ payment habits have changed since the start of the Covid-19 pandemic. This is the third ECB study following SPACE 2020 and the 2016 Study on the Use of CashMoney in physical form such as banknotes and coins. More by Households in the euro area (SUCH). The following SPACE study will be published in 2024.

Methods and Main Findings

The SPACE 2022 results are based on data from 50,000 euro area consumers over online and telephone interviews in two rounds (October-December 2021 and March-June 2022).

Per the study factsheet, cash is still the most frequently used payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More in retail transactions in the euro area, albeit its share has declined. Online payments have become more frequent.

Cash v. Cards

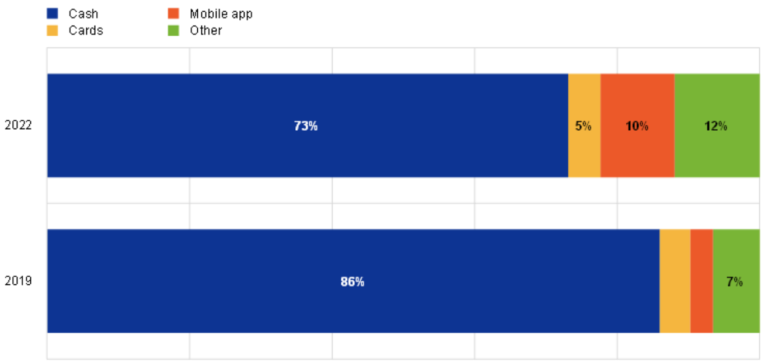

Cash remained the most frequently used payment instrument by the number of transactions (see Graph 1A). By value of payments, cards had a higher share of transactions (46%) than cash payments (42%) in 2022 (see Graph 1B).

- In 2022, cash was used for 59% of point-of-sale (POSAbbreviation for “point of sale”. See Point-of-Sale terminal. More) transactions, down from 72% in 2019.

- Card payments increased from 25% of POS transactions in 2019 to 34% in 2022.

- Contactless card payments increased from 41% of all card payments in 2019 to 62% in 2022.

Graph 1. Euro Area: Share of Payment Instruments Used at the POS In Terms o Number and Value of Transactions, 2016-2022

A. By Number of Transactions B. By Value of Transactions

B. By Value of Transactions

Source: ECB (2022).

Cash is most frequently used for small-value payments. Cards are most commonly used for payments over €50.

Cash Use

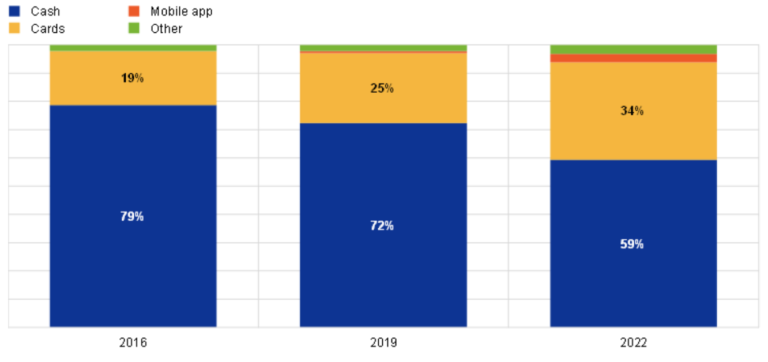

Most consumers (54%) said they paid with cash at physical POS as before the Covid-19 pandemic (see Graph 2). While 31% of consumers said they used less cash, 14% used cash more often.

Graph 2. Euro Area: Share of Consumers Using Cash at Physical POS More Often, Less Often or Equally Often Compared to Before the Covid-19 Pandemic, 2022

Source: ECB (2022).

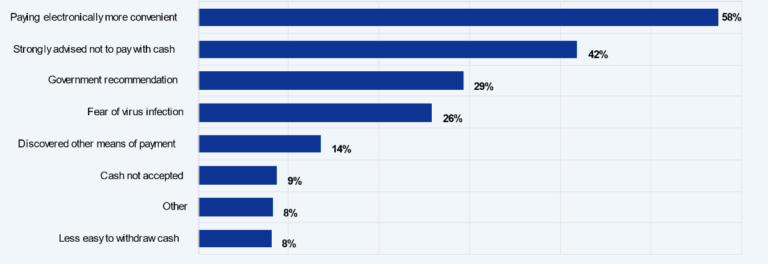

As Graph 3 shows, most consumers who used less cash during the pandemic did so out of convenience (58%), followed by advice not to pay with cash (42%) and government recommendations (29%).

Graph 3. Euro Area: Reasons for Using Less Cash During the Covid-19 Pandemic, 2022

Source: ECB (2022).

People’s perceived advantages of cash are budgeting, privacy, and immediate settlementThe discharge of an obligation in accordance with the terms of the underlying contract. In e-transfers the settlement may take days, whereas cash settlements are instantaneous and irreversible. More; consumers’ perceived benefits of cards are carrying no or less cash, speed, and easiness.

Online payments increased significantly from 6% of day-to-day transactions in the euro area in 2019 to 17% in 2022. Consumers pay online, especially for food and essential goods, from supermarkets and restaurants.

Access to Cash and Cash Acceptance

Most cash withdrawals came from ATMs (74%), followed by consumers’ cash reserves (11%) and bank counters (6%).

The share of consumers keeping cash reserves at home (outside their wallets or bank accounts) increased from 34% in 2019 to 37% in 2022.

Most people (90%) reported having fairly or very easy access to an ATM or a bank to withdraw cash (up from 89% in 2019). The remainder (10%) said it was fairly or very difficult to reach a cash access point (see Graph 4).

Graph 4. Euro Area: Ease of Access to Cash Access Points, 2022

Source: ECB (2022).

Most physical locations accept cash, although their share diminished from 98% in 2019 to 95% in 2022. Consumers could pay with non-cash payment instruments in 81% of transactions in 2022.

Person-to-Person (P2P) Payments

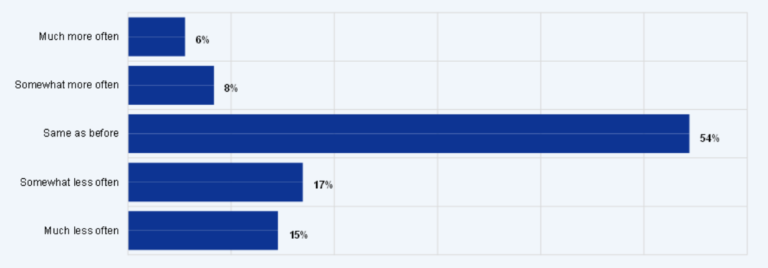

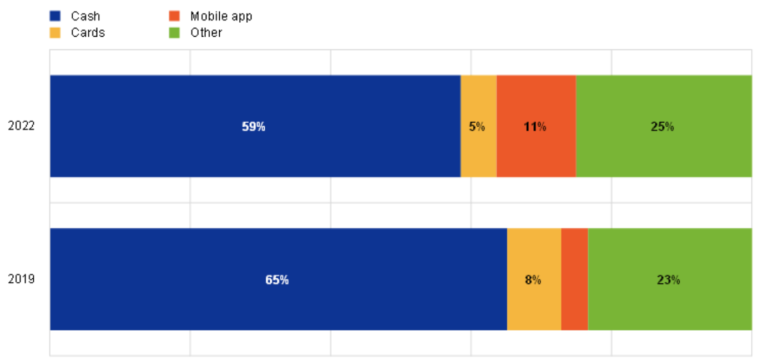

Although cash dominates payments between individuals, its share has lowered from 86% in 2019 to 73% in 2022 in terms of the total number of payments and from 65% to 59% in terms of value (see Graph 5). Mobile payments are rising, from 3% in 2019 to 10% in terms of person-to-person payments (P2P) and from 4% to 11% in value.

Graph 5. Euro Area: Breakdown of Number and Value of P2P Payments by Payment Instrument, 2019-2022

A. By Number of Transactions

B. By Value of Transactions

Source: ECB (2022).

Payment Preferences

“The ECB is committed to ensuring that consumers remain free to choose how to pay, both now and in the future. We are seeing confirmation of strong demand for both cash and digital payments. Our commitment to cash and our ongoing work on a digital euro aims to ensure that paying with public moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More is always an option.” –Fabio Panetta, ECB Executive Board member.

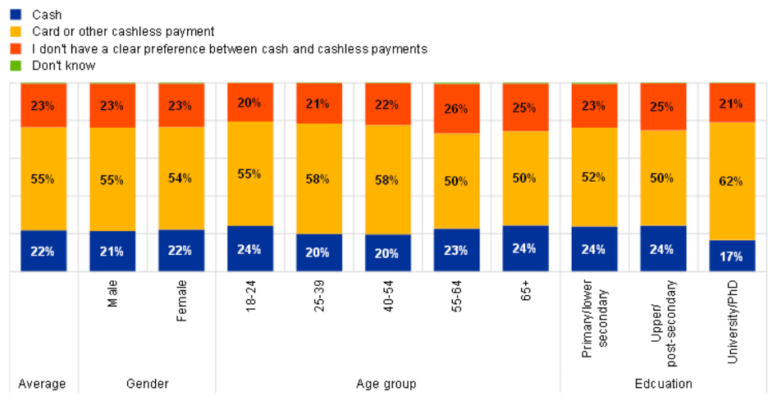

Most consumers (55%) preferred cards and other digital payments, 22% preferred cash, and 23% had no clear preference. However, most consumers (60%) considered it essential to have cash as a payment option. Paying in cash was more important to consumers older than 55 and those with upper and post-secondary education (see Graph 6).

Graph 6. Euro Area: Importance of Having the Option to Pay in Cash by Demographic, 2022

Source: ECB (2022).

Graph 7 breaks down payment preferences by demographic.

- There was no significant difference in payment preferences by gender.

- By age, 24% of consumers in the age groups 18-24 and 65+ stated they preferred cash, against 20% of those in age groups 25-39 and 40-54; 23% of respondents aged 55-64 expressed a cash preference.

- By education, 24% of people with primary/lower secondary education levels preferred using cash, compared to 17% with undergraduate/postgraduate education.

Graph 7. Euro Area: Preferences for Cash or Cashless Payments By Demographic, 2022

Source: ECB (2022).

This post is also available in:

![]()