Uncertainty, Politics, and Crises: The Case for Cash

The paperSee Banknote paper. More by Gerhard Rösl and Franz Seitz is based on a comprehensive literature survey and theoretical considerations and is complemented by case studies; it proposes a classification scheme of how cashMoney in physical form such as banknotes and coins. More holdings typically evolve when confronted with different types of uncertainty, by separating between demand for domestic and international cash as well as between transaction and store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More balances. The authors focus on the stabilizing macroeconomic properties of cash and recommend guidelines for cash supply by central banks and the banking system. The analysis is complemented by five case studies from the developing world: Venezuela, Zimbabwe, Afghanistan, Iraq, and Libya.

The Case of Domestic Cash

Over the past 30 years, global cash demand has consistently increased in times of crisis-related uncertainty, regardless of the nature of the crisis. International surveys on the paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More behaviour of domestic residents unambiguously demonstrate that low banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More denominations and coins are mainly used for payments. In contrast, larger banknote denominations are typically earmarked for non-transactional purposes. Therefore, an analysis of denominational groups of currencies (small versus large banknote denominations) can shed some light on the motives behind the increase in cash demand in times of uncertainty.

Table 1 below summarises how domestic demand for domestic cash tends to different types of uncertainty, both as a means of payment and as a store of value. It shows that in case of a natural disaster, transactional demand for cash experiences a substantial increase and store of value demand a perceptible one; in the case of a financial shock, the trend is reversed with a significant increase in store of value demand and a modest one for transactional demand. In an inflationary environment, a distinction has to be made between the initial phase of considerably increasing inflation and the move towards hyperinflation. While cash demand first increases with rising inflation for daily purchases, the need for cash for transactional purposes and a store of value typically erodes quickly, and moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More holders turn to stable foreign currencies, if available (see Table 2).

Table 1. Domestic demand for domestic cash in times of uncertainty.

The Case of Foreign Cash

There is evidence that foreign cash (mainly USD, EUR, CHF in Africa and the SAR) also faces high demand in some crises. For instance, foreign demand for euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More banknotes increased considerably after US-based Lehman Brothers went bankrupt in the autumn of 2008.

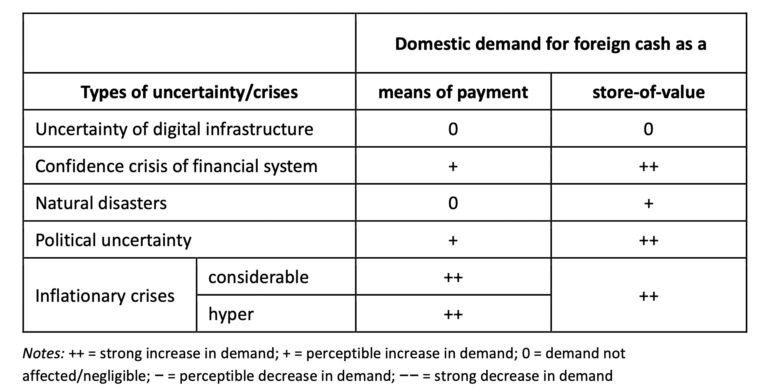

Table 2 summarizes how several types of uncertainty affect domestic demand for foreign cash over the past 30 years. Foreign currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More always serves as a vehicle for domestic money holders to import stability abroad. This can either be a more stable means of payment which stabilizes domestic demand and production in the local (regional, national) goods and services markets or helps to safeguard domestic savings by providing a foreign store of value.

Table 2. Domestic demand for foreign cash in times of uncertainty.

The authors recommend that central banks should – besides maintaining price stability – always be able and willing to provide cash in a perfectly elastic way, i.e., meet the demand for both transactional and store-of-value motives. Since people tend to increase their cash holdings, especially in times of uncertainty, both as a means of payment and as a store of value, central banks should not restrict their banknote denominations only to lower ones. In addition, a conscientious central bank should stockpile sufficient cash in its vaults to meet unexpected demand during crises. However, cash production and storage costs might seem unnecessarily high at first glance, but the social benefits in uncertain and unstable times unambiguously outweigh the costs. Therefore, those costs might be interpreted as an insurance premium the society pays for unanticipated events.

In uncertain times, cash permanently stabilizes the overall situation. It leads to a more resilient economy, but the type of crisis determines if this stabilizing role is exerted by domestic or foreign cash. Therefore, central banks need to regularly guarantee the proper functioning of the domestic cash cycleRepresents the various stages of the lifecycle of cash, from issuance by the central bank, circulation in the economy, to destruction by the central bank. More, including access and acceptance of cash and sufficient production and storage capacities. In addition, central banks of internationally accepted currencies such as the US dollarMonetary unit of the United States of America, and a number of other countries e.g. Australia, Canada and New Zealand. More and the euro should be willing to meet foreign demand for their currencies in a fully elastic way. This stabilizes foreign economies in times of turmoil, and the associated seigniorage income of the cash exporting country is well-earned.

Global Uncertainty Is Increasing

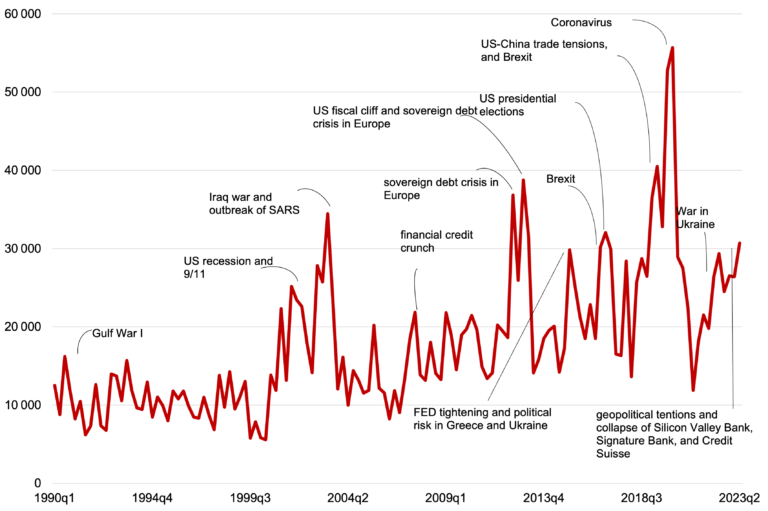

As the world is facing a complex multi-crisis situation, with extreme weather events aggravated by climate changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More, increasing geopolitical conflicts with global consequences, and natural disasters, can this new classification shed light on future demand for cash? Uncertainty is inherently difficult to measure, but researchers have found ways to gauge its level. One example is the World Uncertainty Index, computed by counting the use of the word ‘uncertainty’ (or its variant) in the quarterly Economist Intelligence Unit country reports published for 143 individual countries (see Graph 1). The index spikes around major events such as the Persian Gulf War, the European debt crisis or the Iraq war. As the chart below shows, the index reached a historical high in 2020 at the height of the pandemic and then dropped to its lowest level since 2006. It has been trending upwards since, and the figure for the second quarter of 2023 is more than twice the average between 1990 and 2023.

Graph 1. World Uncertainty Index, 1990-2023

Consequently, now more than ever, it is essential to protect and reinvent cash to ensure it remains viable and sustainable in an uncertain future.

This post is also available in:

![]()