South Korea: Cash Infrastructure and Innovation

South Korea: CashMoney in physical form such as banknotes and coins. More and Banking Infrastructure

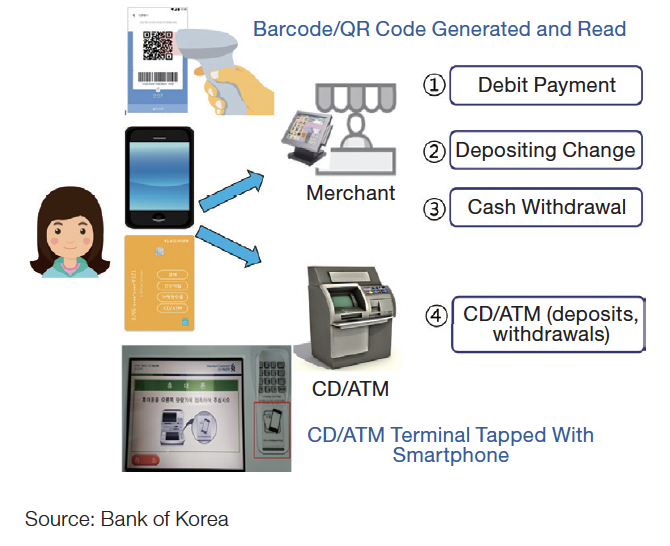

Per the World Bank (2023), the number of ATMs per 100,000 adults in South Korea peaked at 288.59 in 2013 and declined to 259.46 in 2020, a 10% fall (see Graph 1). There were 117,623 bank-owned and independent ATMs in 2020, down from 119,392 in 2019, per a report from the Bank of Korea (BOK) to Rep. Youn Kwan-suk. Seoul, Busan, and Gyeonggi have lost the most ATMs.

The ATM density remains very high compared to other countries: it is over four times higher than in the euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More area (62.72 ATMS per 100,000 adults in 2021), more than twice as high as in Japan (116.94 per 100,000 adults in 2021), and 50% higher than in the United States (173.96 ATMs per 100,000 adults in 2009).

Graph 1. South Korea: ATMs per 100,000 adults (units)

Source: World Bank (2023).

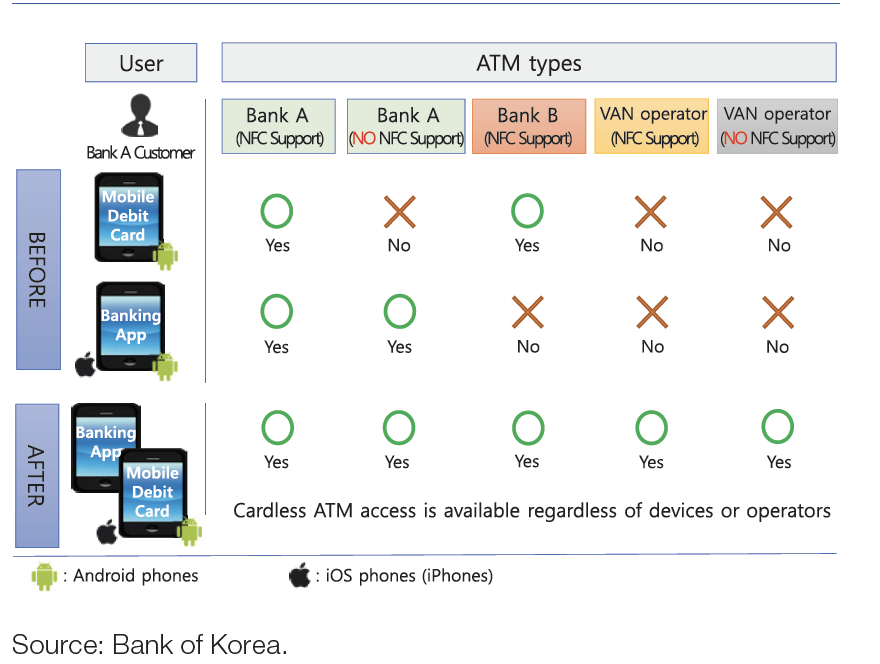

Domestic banks have downsized their branch network from a peak of 7,811 branches in March 2013 to 5,974 in March 2023, a 23.5% decline (see Graph 2). Bank-owned ATMs have declined 31.3%, from a maximum of 49,766 ATMs in June 2016 to 34,169 in 2022.

Graph 2. South Korea: Domestic Banks’ Branches and ATMs, 2003-2023

Note: Bank branches as of the end of March; ATMs as of the end of June.

Source: Financial Services Commission (2023).

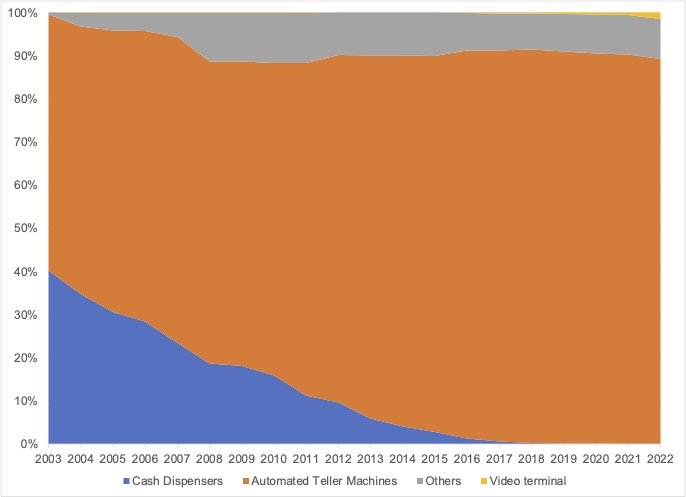

Graph 3 shows the composition of bank-owned ATMs. In 2003, most cash terminals were ATMs (59.3%), followed by cash dispensers (40.2%). Cash dispensers fell in disuse and have nearly disappeared. As of 2022, most cash terminals are ATMs (89.3%), followed by other device types such as smart ATMs and kiosks (9.3%) and video terminals (1.4%).

Graph 3. South Korea: Types of Bank-Owned ATMs, 2004-2022

Note: ATMs as of the end of June.

Source: Financial Services Commission (2023).

The decline in banking infrastructure and the proliferation of digital payments make it even more pressing to protect cash access for vulnerable social groups, especially seniors.

“Financial authorities need to come up with policies to prevent the alienation of the elderly in the finance sector. They could advise local lenders to build specialized bank branches for the elderly or slow down the pace of closing down ATMs, while increasing educational opportunities in the public sector for older adults to improve their digital capabilities” – Representative Yoo Dong-soo (Democratic Party).

Banks Modernize ATMs

Several Korean banks operate self-teller machines (STMs), advanced ATMs that can handle 80% of bank tellers’ daily tasks, such as creating bank accounts, issuing paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More cards, and applying for loans. The STMs allowed customers to get new debit cards without face-to-face contact during the Covid-19 pandemic. As of August 2020, KB Kookmin Bank had 102 STMs, followed by Woori Bank (43), Shinhan Bank (22), and NH Nonghyup Bank (19).

- “I needed this debit card for some time after losing the same one a while ago, but haven’t been able to visit bank windows as coronavirus cases started to peak […] Then I found out that I could get a new card at this machine even without having to go near the bank staff. I tried it doubtfully and was kind of surprised to find out it really worked,” said Jung, a woman in her late 30s.

- “There are tasks that are more convenient with the machine such as issuing a debit card, changing the password of an account that’s been locked and printing various sorts of financial certificates. These are also available through the mobile app, but you would have to wait a couple of days to get your hands on the product. Here, you get it done right away,” said Kim Kyung-mee, an employee of Woori Bank’s Smart Kiosk in Gangnam district, southern Seoul.

Last June, Shinhan Bank partnered with the startup Alchera to launch facial recognition at 900 ATMs. Customers can withdraw cash without bank cards or passbooks using a biometric facial recognition service, Shinhan Face Pay. The solution will also help clients withdraw foreign currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More at branches and ATMs at Incheon Airport and Samseong subway station.

Central Bank’s CashTechThe expression was first coined by CashEssentials and is the encounter of cash and technology. It brings together innovative companies who leverage software and modern communications technology to improve cash services: access to cash; acceptance of cash; and the efficiency of the cash cycle for all stakeholders. More Initiatives Improve Access to Cash

“To prevent the increasingly widespread use of digital payment instruments from causing any undue inconvenience to population segments whose preferred means of payment remains cash, the Bank of Korea plans to work with government and banks to improve the services and usability of ATMs, which are the primary infrastructure item that provides access to cash.” – Bank of Korea (BOK 2021: vii)

In December 2016, the BOK announced it would aim to eliminate small denominationEach individual value in a series of banknotes or coins. More coins due to high minting costs by 2020. In September 2020, the BOK launched a pilot service that deposits leftover cash from retail purchases into a customer’s bank account or mobile cash cards. However, in 2022, the BOK issued coins for 28.5 billion won while withdrawing coins for 29.6 billion won (BOK 2023: 52). Consequently, as of year-end 2022, the value of coins in circulation amounted to 24.7 trillion won ($1.9 billion).

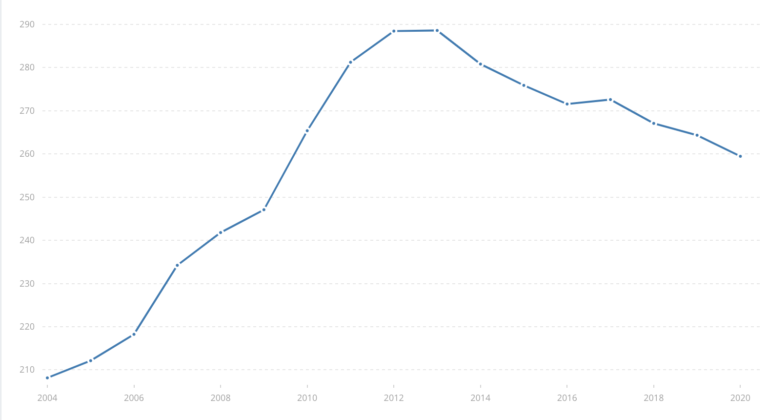

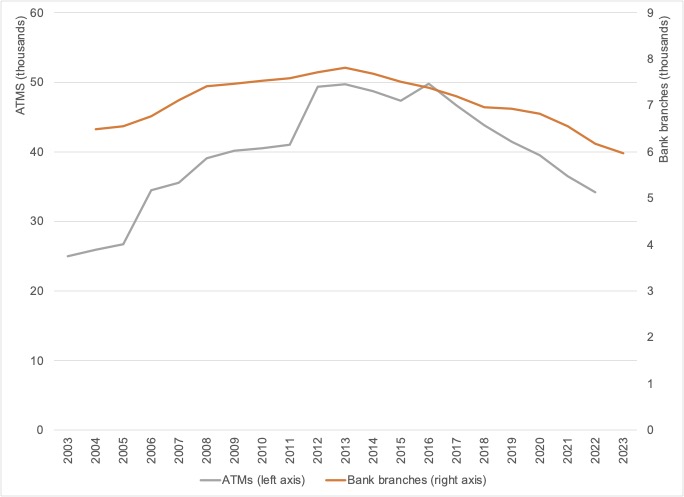

In June 2020, the BOK launched a mobile cash card service that allowed Android users to withdraw cash from ATMs using their mobile wallet (BOK 2021: ii, 15). However, adoption was slow, as only 43.1% of ATMs supported near-field communication (NFC) technology. To address this issue, the BOK’s Committee of Financial Informatization Promotion (CFIP) launched a QR solution in December 2022 that works on all mobile phones and ATMs nationwide (BOK 2023: 18).

Image 1. South Korea: Cardless ATM Services

Source: BOK (2021: 50; 2023: 18)

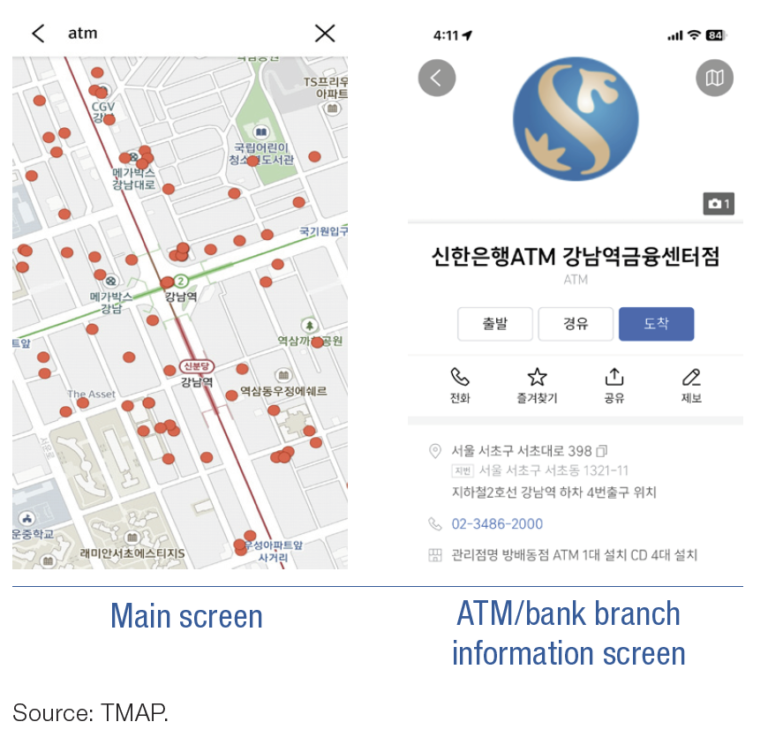

In November 2021, the BOK launched a “mobile financial map service” locating all operating bank branches and ATMs in an app that updates daily (BOK 2022: iii, 8). The app shows ATM locations, hours, services (deposits and withdrawals, banking operations, etc.), fees, supported languages, and accessibility features.

Image 2. South Korea: Financial Map Service

Source: BOK (2023: 18)

In November 2021, the BOK delegated the app’s operation to the Korea Financial Telecommunications & Clearings Service (KFTC). Since December 2022, the public can also look at this information from map platforms such as Naver Map, TMAP, and the navigation apps of Hyundai and Kia (BOK 2023: 17).