U.S.: Phone Thieves and Payment Apps

It is often argued that cash’s anonymous and untraceable nature fuels the criminal economy. Kenneth Rogoff argued in his 2016 book The Curse of CashMoney in physical form such as banknotes and coins. More that “paper currencyThis is often used as a generic expression to refer to banknotes, versus the “metal currency” expression, which refers to coins. More, especially large notes such as the U.S. $100 bill, facilitates crime.” Björn Ulvaeus, a former member of the Swedish pop group ABBA, is also adamantly against cash and claims it is a tool of preference for criminals.

However, criminals have adapted very well to the digital economy. Bands of thieves are stealing funds via digital paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More apps using their victims’ iPhone passcodes or drugging them to use their phone’s facial recognition technology. Such crimes have been reported in cities such as Boston, London, New York, and Mexico City.

- “Once you get into the phone, it’s like a treasure box. This is growing. It is such an opportunistic crime. Everyone has financial apps,” said Alex Argiro, a retired New York Police Department detective.

- “It was only a matter of time before an attacker would use shoulder surfing or social engineering,” said Adam Aviv, an associate professor of computer science at George Washington University.

Targeting iPhones’ Passcodes

“It’s just as simple as watching this person repeatedly punch their passcode into the phone. There’s a lot of tricks to get the person to enter the code.” – Sgt. Robert Illetschko of the Minneapolis Police Department.

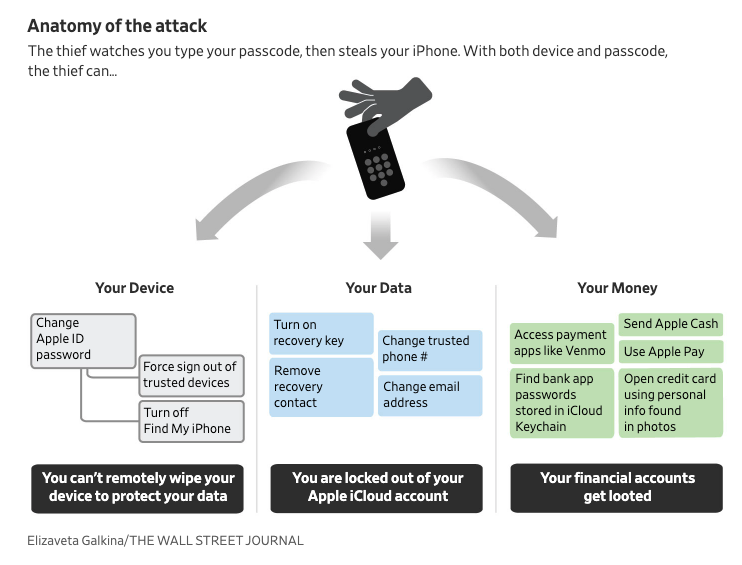

Thieves are exploiting an iPhone vulnerability: the passcode, a string of numbers that grant access to a device (see Illustration 1). Criminals befriend victims at bars, ask them to take a photo or open up Snapchat or other social media apps, and observe while the owners unlock their iPhones with the passcode.

Illustration 1. iPhone Passcode Robberies.

Source: Wall Street Journal.

After thieves learn a user’s passcode and steal the device, they can changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More their victim’s Apple ID, lock the user out of their account, unlock the phone’s stored passwords, and commit thefts through Apple Pay charges, banking and mobile payment apps.

Keys to the VaultSafe; strong room. A place reinforced with special security measures where high-value objects and documents are safeguarded. In central banks, banknotes and other objects are safeguarded in vaults. More: Passcode Breaches

- In November 2022, a man stole Reyhan Ahas’s iPhone in Midtown Manhattan. Within minutes, the 31-year economist could no longer get into her Apple account, and $10,000 vanished from her bank account.

- In January 2022, Reece Thompson’s iPhone went missing from a bar in Minneapolis. The following day, Thompson was locked out of his Apple account. Thieves charged thousands of dollars to his credit cards via Apple Pay and stole $1,500 from his Venmo account. Thompson was the victim of a theft ring that had stolen nearly $300,000 from at least 40 victims.

- In October 2023, David Vigilante had his phone stolen at a pizza shop on Manhattan’s Lower East Side. Vigilante found out someone had attempted to charge $15,000 to his credit card via Apple Pay and had opened a new Apple credit card, using photos he had taken of sensitive documents saved in the Photos app and stored on iCloud.

Criminals Target Gay Men’s Phones in New York City Bars

The New York Police Department (NYPD) is investigating the deaths of two gay men, first regarded as drug overdoses but now considered robberies. The victims’ relatives found the men’s bank accounts were drained using banking apps, PayPal and Venmo accounts, and their credit cards were maxed.

Thieves target New York bar-goers, launder moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More via apps, and then resell the phones. The perpetrators unlock users’ phones with facial recognition technology by holding the devices in frontFacade, face. See Obverse. More of their faces while the victims are unconscious.

An NYPD grand larceny task force is investigating at least a dozen similar non-fatal cases. New York Times reporters spoke to five men drugged in gay bars and awoke to find their bank accounts had been emptied, and their credit cards were maxed out.

- In March 2020, Oscar Alarcon, 33, was drugged at a gay bar in Hell’s Kitchen. When he woke up in a Midtown hotel, he found that $2,000 had been transferred from his bank account using PayPal and Zelle. “I don’t remember what happened there. I don’t remember how I left,” said Alarcon.

- In December 2021, New York sales executive Taylor Ashy was drugged and woke up to find the thieves had transferred $10,000 out of his bank account, enrolled his debit card in Apple Pay, and opened Venmo and Apple credit cards in his name.

- In December 2022, Tyler Burt, 27, was robbed of over $25,000 after being drugged. Police officers treated him skeptically. “It seemed like they thought being drugged wasn’t even a possibility. They said, ‘Maybe you were but that isn’t relevant to the robbery,’” said Burt.

What Should Users Do?

“The most important thing is awareness. People forget that what they’re holding in their hand is their entire life. If someone has access to it, they can do a lot of damage.” – Sgt. Robert Illetschko of the Minneapolis Police Department.

Wall Street Journal reporters put together a list of recommendations to protect data from thieves.

- Cover your phone’s screen in public. Treat your passcode like an ATM PIN. Do not type the code in front of strangers.

- Strengthen your passcode. Use at least six digits and make the combination complex.

- Enable additional protection in financial apps. Add a passcode but don’t use the same one as your phone.

- Use a third-party password manager such as 1Password or Dashlane.

- Delete photos and scans of documents with sensitive information.

- Act quickly if your phone is stolen. Use iCloud.com to remotely wipe your phone and deactivate its SIM so thieves cannot receive verificationChecking the authenticity. More codes.