U.S.: Unbanked Households and Cashless Bans

How the 4.5% Lives: The Unbanked in the United States

The U.S. Federal Deposit Insurance Corporation (FDIC) has been conducting the National Survey of Unbanked and Underbanked Households with the U.S. Census Bureau since 2009. Per the latest FDIC survey published in November 2022:

- 5.9 million U.S. households (4.5% of the total) were unbanked in 2021, meaning no one in the household had a checking or savings account at a bank or a credit union. The rate of unbanked households was 8.2% in 2011 (see Graph 1).

- 18.7 million U.S. households (14.1%) were “underbanked” in 2021, meaning that the household was banked and used nonbank transactions (moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More orders, check cashing, or international remittancesMoney sent home from emigrants working abroad. More) or nonbank credit (rent-to-own services or payday, pawn shop, tax refund anticipation, or auto title loans).

- 107.9 million (81.5%) were “fully banked” in 2021, meaning the household was banked and did not use nonbank transactions and credit products or services.

Graph 1. United States: Estimated Household Unbanked Rates, 2009-2021 (Percent)

Source: FDIC (2022: 1).

The Unbanked: Sociodemographic and Geographic Characteristics

“Moving to cashless transactions would be quite exclusionary to already economically vulnerable populations. We see exactly who would be excluded by any move to go cashless.” – Diane Standaert, senior vice president for policy and advocacy at HOPE, a Mississippi credit union and development organization.

By sociodemographic characteristics (FDIC 2022: 14, 16), unbanked rates were higher among lower-income households (19.8%), less educated households (19.2%), single-mother households (15.9%), households headed by a person with disabilities (14.8%), and Black and Hispanic households (11.3% and 9.3% respectively).

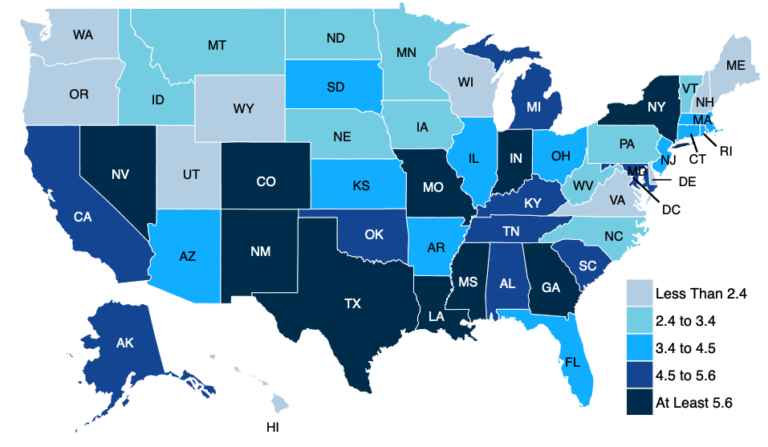

By region (FDIC 2022: 16 and Map 1 below), the South had the highest unbanked rate (4.9%), followed by the Midwest and West (4.2% each) and the Northeast (4.1%).

Map 1. United States: Unbanked Household Rates by State, 2021

Source: FDIC (2022: 17).

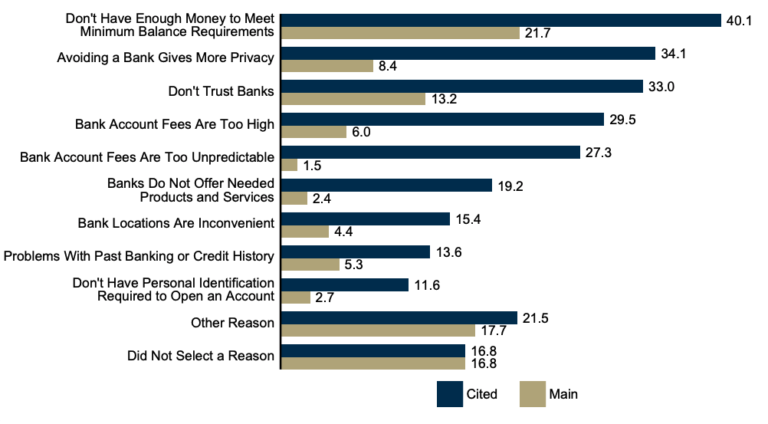

The most cited reasons for not having an account (FDIC 2022: 19 and Graph 2) were: don’t have enough money to meet minimum balance requirements (21.7%), don’t trust banks (13.2%), and avoiding a bank gives more privacy (8.4%).

Graph 2. United States: Unbanked Households’ Reasons for Not Having a Bank Account, 2009-2021 (Percent)

Source: FDIC (2022: 19).

Financial InclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More: The Racial Gap

Although the United States is a highly-developed economy, it still has persistent financial inclusion gaps. According to the World Bank’s Global Financial Inclusion Database, in 2021,

- 94.95% of Americans (age 15 and older) had a financial institution account.

- 82.8% owned a debit card, and 66.7% had a credit card,

- 92.97% had made or received a digital paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More,

- 73.74% used a mobile phone or the internet to make payments, buy things, or send or receive money using a financial institution account.

Black households are unbanked at more than five times the rate of white ones.

- Mississippi has the highest unbanked rate in the country, with 11.1%. More than 1 in 5 Black Mississippians lack a bank account.

- “We was taught like, you keep your money at home. It was like, don’t deal with banks. You try to, like, apply for different things, always getting turned down, due to, like, bank accounts, credit scores, all these,” said Paula Jones, a warehouse clerk.

- “I wasn’t making enough money to deal with a bank. If you’re getting your check on a card, what you going to deal with a bank for? I mean, you just want your check. If you get a Social Security check, they go to the liquor store or to the furniture store, and they had to cashMoney in physical form such as banknotes and coins. More their check,” said Elizabeth Johnson, a Clarksdale, Mississippi resident.

U.S. Legal TenderMoney that is legally valid for the payment of debts and must be accepted for that purpose when offered. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered (“tendered”) in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. More: Federal State and Local Regulations

The Coinage Act of 1965 (Section 31 U.S.C 5103) states that “United States coins and currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More (including Federal Reserve notes and circulating notes of Federal reserve banks and national banks) are legal tender for all debts, public charges, taxes and dues.” The statute means that all U.S. money identified above is a valid and legal offer of payment to discharge debts when given to a creditor.

However, no U.S. federal statute mandates that a private business, a person, or an organization must accept banknotes or coins as payment for goods and services, per the Board of Governors of the Federal Reserve System and the U.S. Treasury Department.

Private businesses can develop policies on whether to accept cash unless a state or local law says otherwise. Massachusetts has mandated cash acceptance since 1978. New Jersey (2019) and Colorado (2021) have approved cashless bans, too.

Some cities, including San Francisco, Philadelphia (2019), New York City, and Washington, D.C. (2020), have prohibited retailers from going cashless. Similar legislation has failed in the right-leaning states of Idaho, Mississippi, and North Dakota, with Republicans siding with trade groups arguing retailers, should have payment choices to serve their customers best.

The New Jersey Cashless Ban

First introduced in 2017, the New Jersey cashless ban bill began advancing in June 2019 but stalled due to opposition from Amazon and Walmart. At the time, Amazon had a bookstore in Paramus that did not accept cash.

- “Many people don’t have access to consumer credit and any effort by retail establishments to ban the use of cash is discriminatory,” said Assemblyman Paul Moriarty (D-Gloucester), a bill sponsor.

- In 2021, New Jersey’s rate of unbanked households was 3.5%. However, the New York-Newark-Jersey City, NJ-New Jersey-Pennsylvania metropolitan area rate was 5.6%.

The New Jersey legislature approved the cashless ban in March 2019. The law, N.J.S.A. 56:8-1 et seq. states:

“A person selling or offering for sale goods or services at retail shall not require a buyer to pay using credit or to prohibit cash as payment in order to purchase the goods or services. A person selling or offering for sale goods or services at retail shall accept legal tender when offered by the buyer as payment.”

The law sets up civil penalties of up to $2,500 for a first offense and up to $5,000 for a second offense and provides some exemptions for

- Airport retailers (if at least two food sellers at each terminal accept cash).

- Municipal parking lots and parking facilities accepting only mobile payments.

- Car rental businesses (if they accept cashier’s checks and certified checks).

A Coffee Chain Breaks the Law (and Pays for It)

In April 2022, the New Jersey Division of Consumer Affairs received a complaint that Hidden Grounds Coffee (a chain with cafés in Hoboken, Jersey City, and New Brunswick) refused cash payments. In June, a Hoboken employee told a state investigator the shop “was robbed on several occasions, and that was one reason why they were not accepting cash.”

In July 2022, the New Jersey Office of the Attorney General notified Hidden Grounds Coffee that it would have to pay $2,000 for violating the state’s Consumer Fraud Act and its prohibition of discrimination against cash-paying customers.

Towards Mandatory Acceptance of Cash

The Payment Choice Act is a bill that would require applicable retail businesses to accept cash for transactions of less than $2,000 and prohibit them from charging cash-paying customers a higher price relative to customers not paying with cash. Retail businesses would retain the flexibility to accept payments through any other means. The bill passed the House Financial Services Committee passed 32-17 on May 18, 2022.

The Consumer Choice in Payment Coalition (CCPC) applauded the vote. The CCPC is a broad-based group of consumer advocates, businesses, and nonprofit organizations that joined forces more than two years ago to promote and advocate for maintaining the continued availability of cash as a payment option for the nation’s consumers.