U.K.: Can Bank Hubs Solve the Access to Cash Conundrum?

In March 2019, the Access to Cash Review commissioned by Link, the UK’s ATM network concluded that “Sleepwalking into a cashless society will leave millions behind. Action is needed now.” Bank of England data shows that cashMoney in physical form such as banknotes and coins. More in circulation increased by £5 billion in 2020 or 6.7% as many consumers have increased their cash holdings in times of crisis.

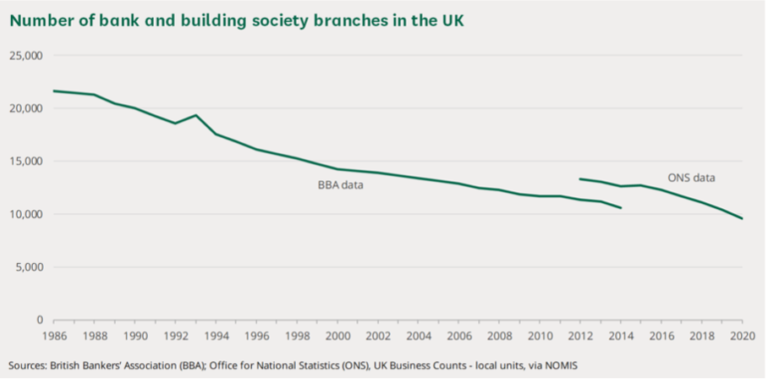

Bank branches have declined by 28% since 2012

Maintaining an infrastructure to access cash has been identified as a critical issue. According to data published by the House of Commons, the number of bank branches has been falling steadily. In March 2020, there were 9,560 bank branches or building society branches in the U.K., a 28% decline since 2012 (see Graph 1). In addition, there were 11,638 Post Offices, which often act as an alternative to bank branches.

Graph 1. United Kingdom: Number of Bank and Building Society Branches, 1986-2020.

Sources: British Bankers’ Association (BBA); Office of National Statistics (ONS); UK Business Counts – local units, via NOMIS

According to Link, who operates the vast majority of cash machines in the U.K., the total number of ATMs peaked at 70,588 in 2015 and has dropped to 54,574 at the end of 2020, a 29% decline (see Graph 2). The numbers for 2020 do not include ATMs that were temporarily closed due to the coronavirus crisis.

Graph 2. United Kingdom: Free to use ATMs (blue) and pay to use ATMs (red), 1998-2020.

Eight bank hubs are being trialled

The five leading British banks (Barclays, Natwest, Lloyds, Santander, and HSBC) and the Post Office are trialing bank hubs across eight communities to ensure residents and businesses have access to cash. The hubs include an ATM, a cash deposit machine (CDM), and the banks each provide a staff member one day per week to assist with more complex transactions.

The range of services available depends on each of the banks but it currently includes recovering lost passwords and usernames, reporting lost bank cards, and setting up standing orders. Natalie Ceeney, who launched the Community Access to Cash Pilots scheme, says more services are likely to be added as the banks find out what the customers want through the pilot.

The BBC quoted the postmaster of one hub: “One lady came in to say ‘thank you, you have changed my life’, and that’s not an understatement.” “It is hard to find anyone – young or old – who is not relieved to have the new hub in town” adds journalist Kevin Peachey.

This is not the first time British banks attempt to open bank hubs. In March 2019, Lloyds Banking Group, Royal Bank of Scotland, and Barclays launched a jointly-run mini bank branches for its business customers. Bank hubs are popular in Latin America and enable banks to offer services in areas where they lack the critical mass to operate a branch in a profitable way.

In a separate initiative, startup Onebanks is launching kiosks that provide bank-agnostic services in convenient locations such as supermarkets. The kiosks operate as white-label branches for every bank. The kiosk offers everyday banking from cash withdrawals, deposits, bill payments, transfers, to support and face-to-face conversation with human beings. Services to customers are free of charge.

Regulators have also been urging banks to reconsider branch closures. The Financial Conduct Authority has called on banks to reconsider branch closures amid fears that vulnerable customers could be left without access to services. The new Financial Services Bill which received Royal Assent on 29 April also aims to improve access to cash by making it easier for retailers of all sizes to offer cash back without a purchase.