Use of Cash by Companies in the Euro Area

The first ECB survey on cash usage among companies aims to understand companies’ strategic views on the current and future use and acceptance of cashMoney in physical form such as banknotes and coins. More.

It covers:

- The acceptance of and satisfaction with cash and cash services, compared with other means of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More and the perceived advantages of the former, satisfaction with the cash services of banks and cash-in-transit companies, and offers of additional cash services such as cashbackA service whereby the customer pays electronically a higher amount to a retailer than the value of the purchase for goods and/or services and receives the difference in cash. It is also a reward system associated with credit card usage, whereby the consumer receives a percentage of the amount spent on the credit card. More and cash-in-shopService allowing a customer to withdraw cash from a payment account using a mobile application on a smartphone at a participating shop supporting the application. Also referred to as a “virtual ATM”. Unlike cashback, a cash-in-shop transaction does not require the consumer to make a purchase. More;

- Companies’ views on the future of cash, their plans to automate cash operations/tills and their plans to accept cash in the future;

- Cash withdrawals and deposits behaviour.

The paperSee Banknote paper. More focuses on four sectors of interest – retail trade; hotels; restaurants and cafes; arts, entertainment and recreation – as these are the most individual customers.

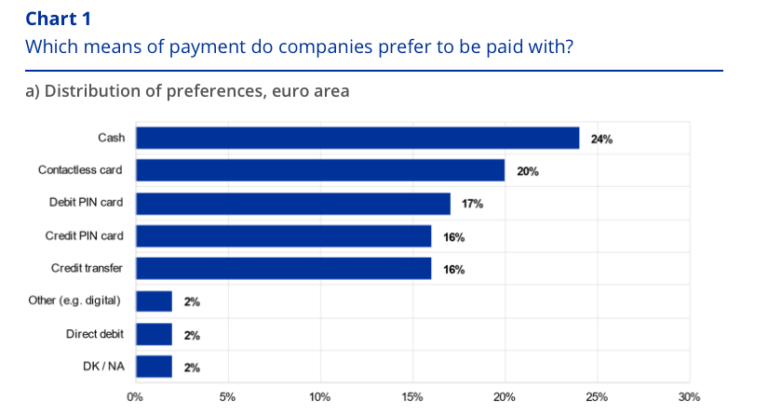

24% of Companies Prefer to be Paid in Cash

Companies have differing preferences. 24% 24% of companies prefer consumers to pay with cash, followed by contactless cards with 20% of choices, debit PIN cards with 17% and credit PIN cards with 16%. Overall, cards as a whole (including contactless cards) account for 53% of preferences.

96% of Companies Accept Cash

Cash is accepted by 96% of surveyed companies, well ahead of other means of payment. Of the companies that accept cash, only 5% expect to stop taking cash in the future.

Cash is Cheaper, Faster and More Reliable

When firms decide whether to accept a means of payment, security of payment (94%) and reliability of payment methods (92%) are the most important criteria. Overall, companies generally consider cash to be better in terms of overall costs, transaction speed and reliability than other payment methods.

85% of Companies Deposit Cash

A large majority of companies deposit cash (85%), while withdrawals are used by around a quarter of companies. The majority of deposits are done using cash-in devices (53%), followed by bank counters (49%), night safes (20%) and cash-in-transit companies (17%). Over-the-counter is the most commonly used method (64%) for cash withdrawals, followed by ATM (45%) and via a cash-in-transit company (20%). 63% of firms said they had not automated their cash operations, with 23% saying that they have cashierInitially, the person who is responsible for the safe, its opening and closing, and the contents that are safeguarded inside it. Nowadays, at a central bank, the person who is responsible for matters related to the treasury and cash. Their signature would usually appear alongside others on the banknotes issued by the bank. More desks with smart cash tills and 9% have self-check-out devices.

Cashback and Cash-in-Shop Services Are Limited

11% of companies offer cashback and 6% cash-in-shop services at present. Likewise, when asked, a few companies said they were planning to introduce these services in the future. The benefits are widespread, however, in Belgium and Finland. In Belgium, 59% of companies offer cashback, and 35% provide cash-in shops. In Finland, the respective figures are 55% and 36%. The main reasons merchants are not offering these services are a lack of knowledge and expected low customer demand.