Ghana: Cash in Circulation Grows by 42%

CashMoney in physical form such as banknotes and coins. More in Ghana during the Covid-19 Pandemic

Ghana registered its first two Covid-19 cases on March 12, 2020. On March 16, the Bank of Ghana (BoG) directed financial institutions in the country to “ensure that banking halls, automated teller machines (ATMs), counting machines and other relevant equipment are sanitized on a regular basis” and “ensure all electronic channels are fully functional at all times and ATMs do not run out of cash.”

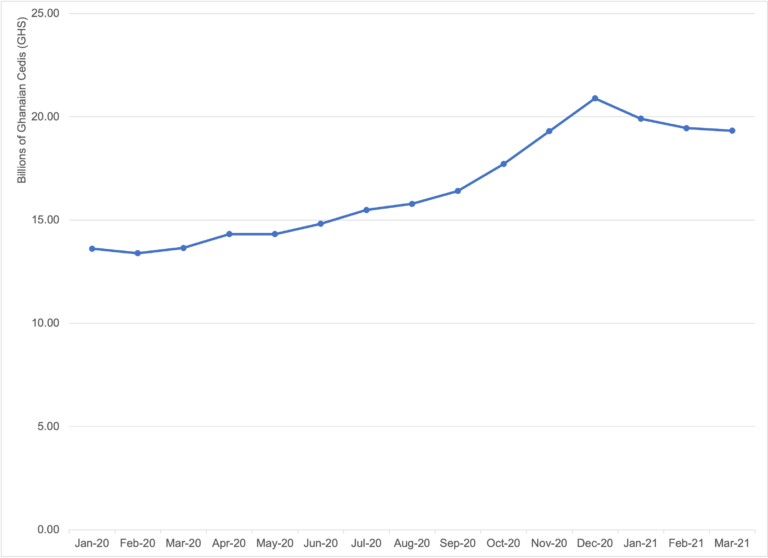

BoG data shows that currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation grew from 13.64 billion Ghanaian cedis (GHS, equivalent to USD2.26 billion) in March 2020 to GHS19.32 billion (USD3.2 billion) in March 2021, an impressive 41.6% yearly increase (see Graph 1).

Graph 1. Ghana: Currency in Circulation, January 2020-March 2021

Source: BoG Monthly Monetary Survey series (2021), CashEssentials.

Digitalisation and its Challenges

In 2017, the country adopted a “Digital Ghana Agenda” to promote inclusion through digitalisation. Before the Covid-19 pandemic, the strategy had helped improve Ghanaian’s access to mobile phones and the internet, slightly less so for bank accounts (see Graph 2). Geta Striggner-Quartey, Vodafone Ghana’s Legal and External Affairs Director, has called the government to expand the initiative by collaborating with “smartphone manufacturers and operators, as to make more smartphones reach nearly every adult.”

Graph 2. Ghana: Access to Mobile Phones, Internet, and Bank Accounts, 2017-2019

Source: Financial Times (2019).

Ebow Anamoah-Mensah, chief technology officer of IT Consortium, has recognized the role of the government as a prime mover towards digital payments in the country. “Now that the government has joined the cashless society, there will be […] fewer situations that one may need cash. I am sure in the next 20 years, cash will be scarce in a lot of countries including Ghana.”

The digital agenda has left structural shortages in the cash and financial infrastructure unaddressed. According to the World Bank, Ghana had only 11.51 automated teller machines per 100,000 adults in 2018, and less than 60% of adults had access to financial services.

Digitalising Ghanaian Payments

In May 2007, the BoG incorporated a subsidiary, Ghana Interbank PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More and SettlementThe discharge of an obligation in accordance with the terms of the underlying contract. In e-transfers the settlement may take days, whereas cash settlements are instantaneous and irreversible. More Systems, Ltd. (GhIPSS), to implement and manage interoperable payment infrastructures for banks and non-banks. Through GhIPSS, the BOG has consolidated ATM networks and advanced mobile moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More interoperability, instant pay platforms, and universal QR code services.

In 2020, GhIPSS processed 77 million transactions across its platforms, a 103% yearly increase compared to 33 million transactions in 2019 (GhiPSS Annual Media Engagement 2021). By value, however, GhIPSS transactions went from GHC219 billion (USD36.35 billion) to GHC254 billion (USD42.16 billion) in the same period, a much more modest 16% increase. This growth rate is lower than the 29.7% increase in Ghana’s currency in circulation between May 2019 and May 2020.

Mobile Money and Mobile Fraudsters

Since its introduction in 2009, mobile money (electronic wallets linked to mobile phone numbers) has made considerable inroads in Ghana, particularly in person-to-person (P2P) payments (GhiPSS Survey on Choice of Payment Channels 2021). Mobile money interoperability transactions amounted to 43.9 million in 2020, a 367% increase from 9 million transactions in 2019 (GhiPSS Annual Media Engagement 2021), but represent merely 1.4 transactions per person per year.

As mobile money use and digital payments increase, so have fraud cases. MTN (Ghana’s largest mobile money operator with 94% of market share) started requiring valid identity cards to withdraw cash from its agents in April 2021. However, only half the population holds one. According to P.K. Senyo, senior lecturer of Information Systems at the University of Southampton, the “no ID, no cashout” friction “will only derail the financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More gains and Ghana’s cashless agenda.”

BoG’s QR Code Solution and Visions of a Cash-Lite Society

In May 2020, the BoG launched GhiPSS Instant Pay, making Ghana the first African country to implement a universal QR code payment system that works with smartphones and “yam” phones (non-smartphones).

“At this time, our quest towards a modern, cashless society is more important than ever and we are proud to be the first African country to implement this universal QR code solution,” said Archie Hesse, GhIPSS’ CEO. According to Hesse, “customers are becoming more aware of the various cashless services and are beginning to incorporate them into their payment lifestyles.”

“Do we have the necessary infrastructure to turn Ghana into a cash-lite society? The answer is yes, yes, yes.” Hesse has said.

The BoG’s CBDC Pilot and its Stance against Cryptocurrencies

The BoG is currently exploring the digital currency space, joining other African central banks (such as the Reserve Bank of South Africa and the Central Bank of Nigeria). Earlier in August, the BoG announced a CBDC pilot later this year.

According to Maxwell Opoku-Afari, the BoG’s first Deputy Governor, the digital cedi “is part of the central bank acknowledging the need for digital payment and digital delivery of financial services […] The mobile monies transaction are not backed by cash and hence limiting the value addition. The central bank’s digital currency is fiat money, it is cash on its own so that financial institutions like the banks and fintechs will be able to create value addition on the digital cash.”

Similar to its enthusiasm for CBDCs, the BoG shares its peers’ harsh assessments on crypto assets. BoG’s Governor Ernest Addison has said that “cryptocurrencies […are] not [a] regulated activity by the Bank of Ghana, so we warn the public about engaging in cryptocurrency trade. […] The basic function of currencies is they are meant to be used effectively as a medium of exchangeThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More, even as a unit of account. […] These private forms of money are not good to perform the functions of money effectively.”