Online Merchants Increasingly Accept Cash

The 2023 Global E-commerce Payments and Fraud report is based on a global survey of more than 1,000 small and large merchants across the globe conducted in November and December of 2022.

CashMoney in physical form such as banknotes and coins. More is Increasingly Accepted Online

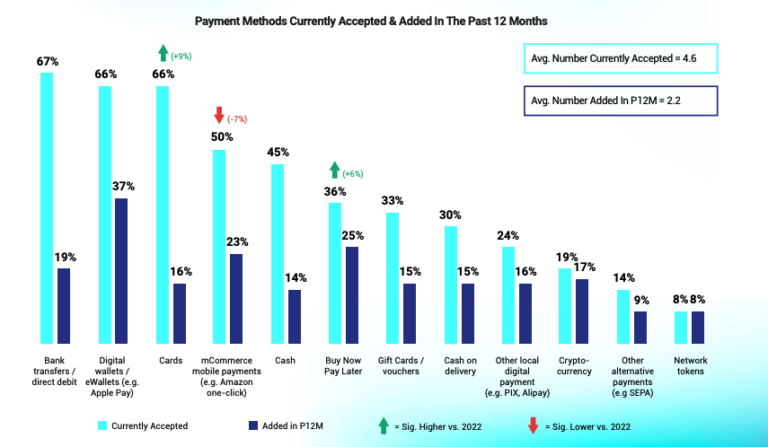

According to the survey, e-commerce merchants currently accept payments via four primary methods: digital wallets, direct debit transfers, traditional cards and eCommerce mobile apps (such as PayPal mobile or Amazon one-click). Cash is the 5th most accepted payment methodSee Payment instrument. More and is taken by nearly half (45%) merchants. Cash on delivery is reported as a separate category and is accepted by 30% of merchants. Gift cards and vouchers, third-party payments, and buy-now-pay-later (BNPL) payments are each accepted by around 3 in 10.

Even more counterintuitive, over the past 12 months, the number of merchants accepting cash has increased by 14%, whereas those taking cash on delivery have increased by 15%.

Customers Would make More Online Purchases if Cash were an Option.

According to another report commissioned by paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More service provider Paysafe in April 2022, surveying 11,000 people in 10 countries across the Americas and Europe, 47% would prefer to pay online with cash, and 44% of respondents said they would make more online purchases if paying in cash were an option.

Paysafecash – which acquired German CashTechThe expression was first coined by CashEssentials and is the encounter of cash and technology. It brings together innovative companies who leverage software and modern communications technology to improve cash services: access to cash; acceptance of cash; and the efficiency of the cash cycle for all stakeholders. More Viafintech in 2021 – offers merchants an online cash payments option whereby the customers select the option at the checkout and receive a unique barcodeMethod for encoding information, which can be read by machines. Barcodes store information using a combination of printed parallel lines (bars) and in the spaces that are left between them. Reading stored data is performed using optical readers. More they can scan at one million points of sale in 55+ countries to complete the purchase. This guarantees the transaction is secure and private.

Cash on Delivery Remains Popular in Asia

Cash on delivery remains hugely popular across many Asian countries.

According to the payments gateway provider Adyen, cash-on-delivery accounts for 60% of online payments in India; it is the most popular payment method in Indonesia and Japan.

BigTech has adopted Cash.

Tech giants have understood the importance and business opportunity of enabling their customers to pay in cash.

For a select group of countries (at the time of writing, Japan, Indonesia, Malaysia and Mexico), Google customers can purchase apps with cash. Customers who pay with cash receive a payment code that lets them pay at a nearby store equipped to handle transactions. They then receive their purchase within 10 minutes, along with a receipt sent by email.

Amazon Cash lets customers add cash to their account by presenting a barcode or phone number at a participating store. Amazon says, “We created Amazon Cash to serve all customers, including those who prefer not to use debit or credit cards to shop. At Ama,zon we strive to give customers choice and are proud to allow customers to shop with the payment of their choice.”

Uber allows customers to pay drivers in cash directly via the app in select countries. The option originated in Hyderabad, India, in 2015 as a pilot. The number of locations was expanded to 150 cities the following year and now includes 51 countries.

Measuring Cash Usage Online

One challenge is to measure the value and volume of online transactions made in cash. The ECB Study on the Payments Attitudes of Consumers of December 2020 (SPACE) measured this and found that 4% of volume and 3% of online transactions were settled in cash. In the following 2022 SPACE survey, cash on delivery was reported as a point-of-sale transaction.

This is undoubtedly an area that warrants further research.