Spain: Cash Use, Acceptance, and Access

The Banco de España (BdE) has just released the results of its second survey on paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More habits and the use of cashMoney in physical form such as banknotes and coins. More. The study sheds light on the use of and access to cash, adoption of cash alternatives, and awareness of other methods to get cash and the digital euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More (BdE 2023: 3). Ipsos conducted 1,600 interviews with consumers and retailers: 1,350 to a representative sample and 250 to people and merchants in municipalities without a bank branch.

SPACE Insights on Cash in Spain

Per the European Central Bank’s (ECB) latest Study on the Payment Attitudes of Consumers in the Euro Area (SPACE) of December 2022,

- Spain experienced the second-largest decline (-18%) in cash usage by transaction volume in the euro area and the third-largest by value (-14%).

- Spain is among the euro area countries where a significant share of the population (7%) report receiving up to a quarter of their income in cash.

- Most people in Spain (82%) prefer to obtain cash from ATMs. Access to ATM withdrawals worsened by 4% in Spain between 2019 and 2022.

Cash Use and Acceptance are High

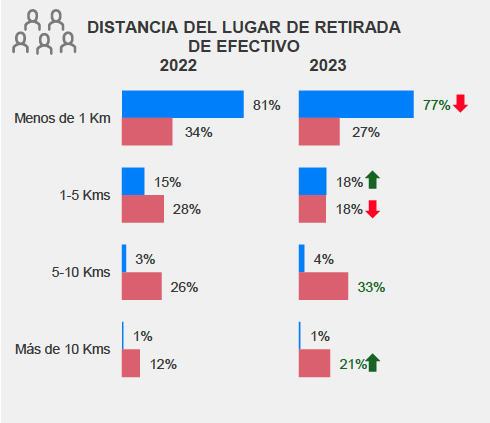

Cash is consumers’ most used payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More, with 99% of those surveyed using it frequently, compared to 88% using cards and 23% using mobile devices such as smartphones and smartwatches (see Graph 1). Most (65%) use cash in everyday transactions, only 32% use cards, and 10% pay with mobile devices daily (BdE 2023: 8).

Graph 1. Spain: Use of Payment Instruments, 2022-2023

Notes: Dinero efectivo – cash, tarjetas – cards, dispositivos moviles – mobile devices, plataformas internet – internet platforms, transferencias – transfers, posee – owns, utiliza – uses, utiliza diariamente – uses daily, pagos realizados – made payments.

Source: BdE (2023: 8).

Cash is the payment instrument most accepted by retailers, followed by cards and mobile devices. All retailers reported receiving cash, while only 89% accept cards and 78% accept mobile devices (BdE 2023: 12). Fewer retailers in underbanked municipalities accept electronic payments, as 82% reported receiving cards, and 65% get mobile devices.

Consumers said they used cash due to ease of use (29.3%), habit (23.3%), budget management (17.3%), and security (8.1%); they valued cards as payment methods due to ease of use (71.8%), speed (11.6%), and security (7.9%). Mobile device users prefer them due to ease of use (73%) and speed (17.1%, BdE 2023: 9).

The perceived advantages of cash over its alternatives are protection against fraud and outages, budget management, privacy, and financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More. Its main disadvantages are a sense of insecurity, difficulty or impossibility in making certain payments, and problems in obtaining them (BdE 2023: 34).

- Most Spaniards (67%) believe that the use of cash will be the same in a year, 3% higher than in 2022 (BdE 2023: 15). A plurality of adults under 35 years (39%) believe that case use will diminish, while only 16% of seniors (65 years and older) think that will be the case.

- Most consumers (62%) reported having enough cash for daily transactions, 23% said they have cash for unexpected expenses, and 7% kept cash as savings out of their bank accounts (BdE 2023: 16). Adults between 55 and 64 years held more cash for daily expenses.

- On average, consumers carry €43 in banknotes and €6 in coins: 47% carry between €21-€50 in banknotes, and 50% carry €3-€5 in coins (BdE 2023: 17).

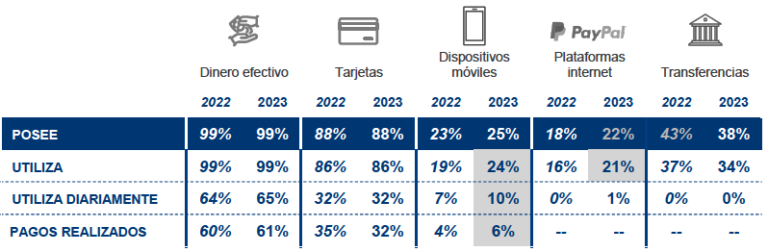

Graph 2. Spain: Daily Use of Payment Methods, 2022-2023

Notes: Dinero efectivo – cash, tarjetas – cards, dispositivos moviles – mobile devices, hombres – men, mujeres – women, años – years, est. básicos – primary education, est. medios – medium education, est. superiores – higher education.

Source: BdE (2023: 11).

Age and educational achievement are essential variables driving payment methodSee Payment instrument. More use (BdE 2023: 11, see Graph 2):

- More men (67%) reported using cash than women (63%). Men and women use cards and mobile devices at similar rates (32% and 10%, respectively).

- Over 74% of people over 55 reported using cash more frequently than other age groups. Card use prevails among adults between 25 and 44 years, with at least 43% preferring them in daily payments. Mobile devices are popular among adults under 35.

- Most people with primary education (75%) use cash as their primary payment method. People with medium and higher education levels reported using cards more (36% and 41%, respectively).

Cash Access is Deteriorating

Most people obtain their cash from ATMs (74.5%), followed by bank counters (9.1%), their job, and personal transfers from relatives, friends, or colleagues (BdE 2023: 19). People in underbanked municipalities reported getting cash from ATMs at a lower rate (69.5%) while they go more often to bank branches (14.9%).

Nearly half of the retailers (45%) get cash at bank branches. The rest (54%) obtain cash mostly from their earnings or other retailers (BdE 2023: 21). Most retailers said €1 coins and €5 banknotes are the most difficult to find.

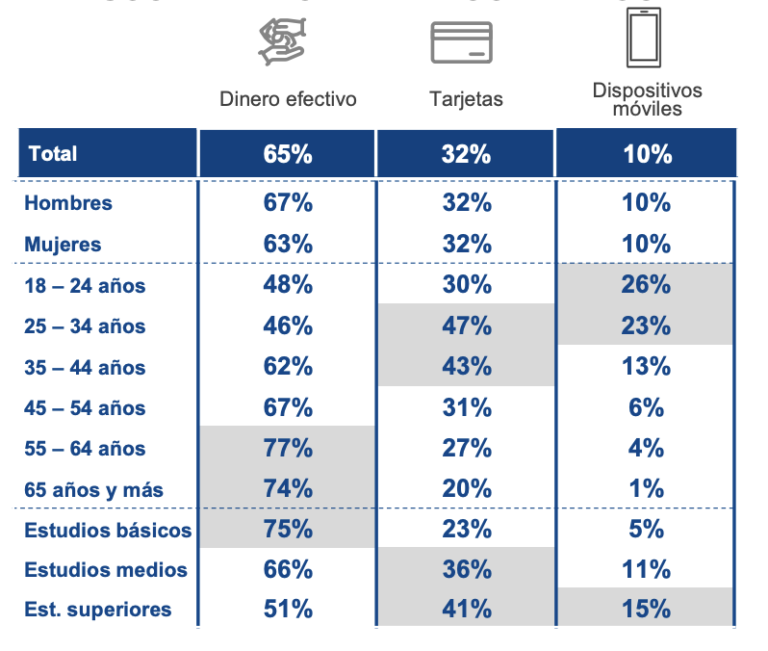

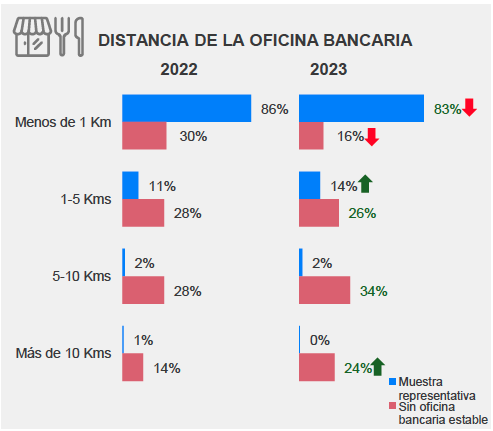

More people think cash withdrawal points are farther away than in 2022, especially in municipalities without bank branches (BdE 2023: 20). Most people have a cash withdrawal point (77%) and a bank branch (83%) within a kilometer (see Graph 3, panels A and B). The shares are lower for underbanked municipalities, where only 27% of people live within 1 km from a cash withdrawal point and 16% from a bank branch.

Graph 3. Spain: Distance from Cash Withdrawal Point and Bank Branches, 2022-2023

A) Cash Withdrawal Points

B) Bank Branches

Note: Blue – representative sample, red – underbanked municipalities.

Source: BdE (2023: 20).

A minority of consumers (22%) know about Correos Cash (a service enabling cash deposits and withdrawals from a bank account at postal offices as well as cash deliveries at home or to a third-party address), and even less (14% cashbackA service whereby the customer pays electronically a higher amount to a retailer than the value of the purchase for goods and/or services and receives the difference in cash. It is also a reward system associated with credit card usage, whereby the consumer receives a percentage of the amount spent on the credit card. More and cash-in-shopService allowing a customer to withdraw cash from a payment account using a mobile application on a smartphone at a participating shop supporting the application. Also referred to as a “virtual ATM”. Unlike cashback, a cash-in-shop transaction does not require the consumer to make a purchase. More (BdE 2023: 24-25). Less than a quarter of retailers (24%) knew about Correos Cash, and a few (2%) offer cashback and cash-in shop services, although that share increases in underbanked municipalities (5%).

Half of the consumers (50%) and more than half of retailers (59%) said they had no difficulties obtaining cash from ATMs. The main problems reported concern service outages and lack of cash. Pluralities of citizens (45%) and retailers (45%) said there were no difficulties regarding cash services at bank branches. The main problems concern limited hours and high waiting times (BdE 2023: 28-29).

The Digital Euro

Awareness of the digital euro in Spain is still tiny. Only 20% of people and 23% of retailers know about the ECB’s digital euro project. A minority of those surveyed (20%) would use the digital euro as a complement to current means of payment. Most seniors (82%) said they would not use digital euros.